- Home

- »

- Advanced Interior Materials

- »

-

Coated Glass Market Size & Share Report, 2030GVR Report cover

![Coated Glass Market Size, Share & Trends Report]()

Coated Glass Market Size, Share & Trends Analysis Report, By Application (Architectural, Automotive, Optical), By Coating (Hard, Soft), By Region, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-3-68038-144-3

- Number of Pages: 110

- Format: Electronic (PDF)

- Historical Range: 2017 - 2020

- Industry: Advanced Materials

Report Overview

The global coated glass market size was valued at USD 32.32 billion in 2021 and is expected to grow at a compound annual growth rate (CAGR) of 9.3% from 2022 to 2030. The rising penetration of green buildings and the need to improve energy efficiency and rising awareness associated with it are projected to benefit the market growth over the coming years. Coated glass is used in residential and commercial buildings to keep the inside rooms cool and allow maximum visible light. By reflecting the infrared energy, the temperature inside the building is cooler and therefore it reduces the dependence on air conditioning systems. The product is also used in colder regions, to maintain the warm temperature of the room. In the building & construction industry, coated glass is generally used in the form of insulated glazing units in façades and windows. As a result, the growth of the construction industry in the U.S. is predicted to benefit the market.

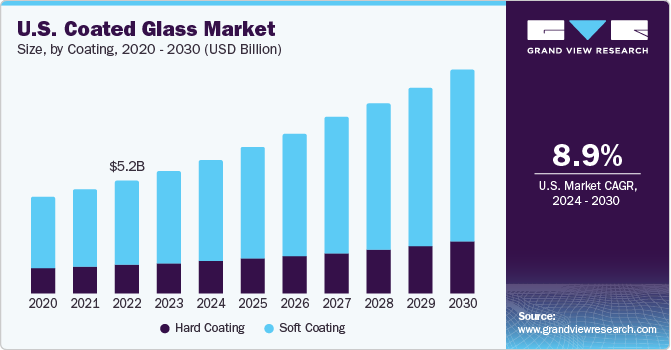

The growth of the U.S. market is likely to be supported by the USD 1.2 trillion Bipartisan Infrastructure Bill in the country, which is projected to drive the put-in-place construction value for transport infrastructure at an average rate of 8.9% from 2020 to 2025. This is anticipated to benefit the expansion of bridges, rails, ports, water transport, telecommunications, broadband, EVs, and energy. The construction industry has recovered well since the beginning of 2021, as the COVID-19 cases have reduced significantly, benefiting the resumption of industrial activities. The residential sector in the U.S. is likely to benefit from low mortgage rates and strong demand for bigger homes. However, lack of skilled labor and rising costs for building materials remain short-term challenges for market players.

Jumbo-coated architectural glass is the major trend in the U.S. market. As a result, companies are establishing jumbo coaters to serve their demand. For instance, in 2021, Guardian Glass started production of super jumbo coated glass with the dimension of 130” x 240”. The production has started at the company’s Carleton, Michigan facility.

Coating Insights

Soft coating segment held the largest revenue share of over 68.0% in 2021 and is also projected to grow at the fastest rate over the forecast period. The significant factor driving the growth of the soft coating segment is its ultra-low emissivity, which enables it to reflect considerably more heat than hard coated products. Furthermore, the soft-coated product is characterized by more visible light transmission and higher optical clarity as compared to hard-coated products.

In colder regions, to retain the heat inside the room, sputtered coating is applied to the outside face to re-radiate the heat inside the room. This type of glass is typically employed in double-glazed units and can be used in all climates. Also, since the soft-coated product is typically used in a double-glazed unit, the air gap in the unit facilitates better heat insulation properties as compared to single hard-coated single-pane windows.

For hard coated glass, special handling procedures and equipment are not required. This type of product is shipped and handled using the same equipment as that for non-value-added float glass. The significant factor contributing to the growth of this segment is the durability of hard coated products. This glass can be tempered, laminated, and heat-strengthened and can be used in glazing applications without the fear of losing the coating.

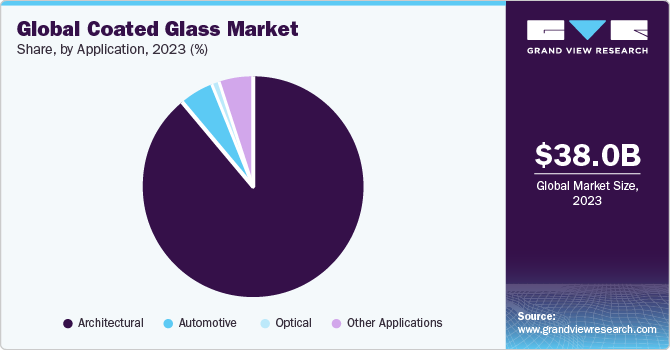

Application Insights

The architectural application segment held the largest volume share of over 92.0% in 2021 and is expected to continue its dominance over the forecast period. Coated glass facilitates very low energy utilization and reduces air conditioning (AC) costs in architecture. This is done by reflecting heat coming from outside the building in warmer climates. Therefore, it is perceived as an innovative product that enhances the energy efficiency of the building by reducing AC costs and lowering CO2 emissions.

Various governments around the world are setting new building codes to minimize the energy utilization in the buildings. This represents a lucrative opportunity for the market players. Low-e glass is a critical technology owing to its ability to minimize the emission of UV and infrared radiation. This helps in cooling the temperature inside the building and different architectures.

The automotive segment is expected to grow at a rate of 3.7% from 2022 to 2030, in terms of volume. Coated products, particularly Low-e coated glass, are used in the windshield of automobiles. The use of such products in automobiles helps minimize the utilization of AC, reduces carbon efficiency, and boosts fuel efficiency. Furthermore, supportive government regulations are expected to play a key role in driving the growth of coated glass in the automotive sector.

Regional Insights

The Asia Pacific held a revenue share of 35.0% in 2021, of the global market. China, Japan, and South Korea are significant markets in the Asia Pacific. Also, developing economies such as India and Southeast countries including Indonesia and Thailand has huge potential. Rising economic growth, disposable income, and subsequent increase in investments in EVs, housing construction, and solar installations in these countries are benefitting market growth.

High-volume production of automobiles in the Asia Pacific is likely to benefit the industry to some extent. Although there is no significant adoption of coated glass products in the automotive industry, automakers are beginning to integrate these products into vehicles, especially luxury vehicles. Asian countries have significant cost advantages, which help to boost the production of vehicles.

Europe coated glass market is expected to grow at a CAGR of 9.2% from 2022 to 2030, in terms of revenue. Special emphasis on green construction in Europe is anticipated to augment the growth of the market. Heating & cooling, insulation, lighting, and self-powered building are the key areas of focus in the green construction industry in the region. Low-E coated solar control glass is used in many high-efficiency buildings where the heat is reflected from the windows leaving cold air for ventilation during the summers.

Key Companies & Market Share Insights

The recent trend in the glass industry depicts that primary manufacturers are targeting their investments in value-added products like coated glass. These players are focused on developing products that boost energy efficiency and as the market expands, those investments are expected to be crucial. For instance, Guardian Industries sees its strongest growth in value-added products in near future.

Also, energy efficiency is now the driving force of innovation for coated glass manufacturers for the past five years. The evolution of energy conservation programs and building codes has proved to be critical in driving a lot of that innovation. Further, there is a legitimate aspiration of building owners for environmental-friendly and energy-saving products. This is expected to rapidly push the demand for energy-saving products like Low-E coated glass. Some of the prominent players in the global coated glass market:

-

China Glass Holding, Ltd.

-

AGC Inc.

-

Euroglas

-

Guardian Industries

-

Central Glass Co. Ltd.

-

Fuyao Glass Industry Group Co., Ltd.

-

CEVITAL GROUP

Coated Glass Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 35.01 billion

Revenue forecast in 2030

USD 71.71 billion

Growth Rate

CAGR of 9.3% from 2022 to 2030

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD billion, volume in kilotons, and CAGR from 2022 to 2030

Report coverage

Revenue & volume forecast, competitive landscape, growth factors, company profiles, and trends

Segments covered

Coating, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Germany; U.K.; France; Russia; China; India; Japan; Brazil

Key companies profiled

AGC Inc.; Central Glass Co. Ltd.; CEVITAL GROUP; China Glass Holding, Ltd.; Euroglas; Fuyao Glass Industry Group Co., Ltd.; Guardian Industries; Nippon Sheet Glass Co., Ltd.; Saint-Gobain; SCHOTT AG

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global coated glass market report based on coating, application, and region:

-

Coating Outlook (Revenue, USD Billion; Volume, Kilotons, 2017 - 2030)

-

Hard

-

Soft

-

-

Application Outlook (Revenue, USD Billion; Volume, Kilotons, 2017 - 2030)

-

Architecture

-

Automotive

-

Optical

-

Others

-

-

Regional Outlook (Revenue, USD Billion; Volume, Kilotons, 2017 - 2030)

-

North America

-

U.S.

-

-

Europe

-

Germany

-

U.K.

-

France

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

- Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global coated glass market was estimated at USD 32.32 billion in 2021 and is expected to reach USD 35.01 billion in 2022.

b. The coated glass market is expected to grow at a compound annual growth rate of 9.3% from 2022 to 2030 to reach USD 71.71 billion by 2030.

b. Architectural was the key application segment of the market with a revenue share of about 89.0% of the market in 2021.

b. Some of the key players operating in the coated glass market are AGC Inc., Central Glass Co. Ltd., CEVITAL GROUP, China Glass Holding, Ltd., Euroglas, Fuyao Glass Industry Group Co., Ltd., Guardian Industries, Nippon Sheet Glass Co., Ltd., Saint-Gobain, and SCHOTT AG.

b. Rising awareness to improve energy efficiency and increasing government expenditure on infrastructure is projected to drive the coated glass market growth over the coming years.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."

Important: Covid19 pandemic market impact

The shortage in supply of raw materials from Chinese manufacturers has resulted in a severe demand-supply gap. The manufacturers are further expected to be stranded on raw material orders owing to the logistics industry being significantly impacted due to lockdown amid COVID-19. However, the producers are expected to move away from China aiming to reduce the future risks that would affect the business and to reduce the manufacturers' cluster in a single country in order to smoothen the supply chain. The report will account for Covid19 as a key market contributor.