- Home

- »

- Clinical Diagnostics

- »

-

Clinical Microbiology Market Size And Share Report, 2030GVR Report cover

![Clinical Microbiology Market Size, Share & Trends Report]()

Clinical Microbiology Market Size, Share & Trends Analysis Report By Product, By Disease (Bloodstream, Respiratory, Gastrointestinal, Periodontal, STD, UTI), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-1-68038-142-9

- Number of Pages: 94

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Healthcare

Report Overview

The global clinical microbiology market size was valued at USD 4.3 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 7.1% from 2023 to 2030. The rising prevalence of infectious diseases, including bacterial, viral, and fungal infections, is a significant driver for the market. According to a fact sheet published by the World Health Organization in April 2023, approximately 10.6 people were diagnosed with tuberculosis worldwide in 2021, whereas 1.6 million people lost their lives.

Technological advances, such as the introduction of automated systems and rapid molecular diagnostic tests, have improved the efficiency and accuracy of microbial detection. Increasing awareness regarding the importance of diagnosis of infectious diseases is anticipated to propel the market growth. In addition, increasing research and development activities in clinical microbiology are driving innovation and the development of new diagnostic techniques and tools. The aging population with weakened immune systems is susceptible to infections. The increasing geriatric population is expected to drive the market's growth during the forecast period.

Clinical microbiology is instrumental in conducting Antimicrobial Susceptibility Testing (AST). It helps to determine the most effective antibiotic treatment for a specific infection. The Kirby-Bauer disk diffusion method is a widely used phenotypic AST method to determine the susceptibility of bacteria to different antibiotics. The rising prevalence of antimicrobial resistance drives the demand for AST to combat drug-resistant pathogens. AST also has applications in point-of-care settings.

The COVID-19 pandemic significantly impacted the market for clinical microbiology as the demand for diagnostic tests increased significantly. The Centers for Disease Control and Prevention (CDC) reported that over 527 million COVID-19 diagnostic tests were conducted in the U.S. by July 2021.

The need for rapid and accurate testing during the pandemic accelerated the development of testing technologies such as reverse transcription polymerase chain reaction (RT-PCR), loop-mediated isothermal amplification (LAMP), and CRISPER-based essays were prominent. Rapid antigen tests such as Abbott BinaxNOW and Quidel Sofia SARS antigen tests obtained Emergency Use Authorization (EUA) from regulatory agencies and were widely used to screen the virus.

Post-pandemic, clinical microbiology remained crucial for ensuring outbreak preparedness and response. It plays an important role in infection control, enabling effective diagnosis, treatment, and prevention of infectious diseases.

Moreover, the need for more trained graduates and training programs is an issue, particularly in developing countries, where the demand for skilled professionals is rapidly increasing. However, the entry of automated systems into the market is expected to replace manually operated conventional platforms in the future, thereby reducing the impact of a lack of skilled professionals.

Product Insights

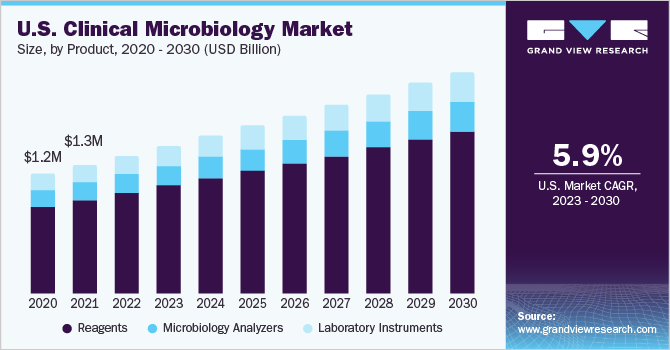

Based on products, the market is segmented into reagents, microbiology analyzers, and laboratory instruments. Reagents accounted for the largest revenue share in the global market in 2022. The segment includes solutions, primers, master mixes, and kits used in various diagnostic assays. The segment is expected to remain dominant throughout the forecast period. Factors such as the higher cost of specialized kits and constant repeat purchases are expected to drive segment growth. The market is witnessing rising investments in research and development (R&D). Almost all analytical and therapeutic research projects demand reagents and chemicals, thereby driving the penetration of reagents.

Laboratory instruments comprise incubators, gram strainers, bacterial colony counters, autoclave sterilizers, petri dish fillers, and culture systems. Automated culture systems dominated the global laboratory instruments segment in 2022. The microbiology analyzers segment comprises instruments used in molecular diagnostics, mass spectrometry, and microscopes. Microscopes held the largest share owing to wider applicability and rising demand. The molecular diagnostic instruments segment, on the other hand, is expected to exhibit the fastest growth rate over the forecast period. This growth can be attributed to the increasing significance of molecular diagnosis in the early detection of cancer and infectious diseases.

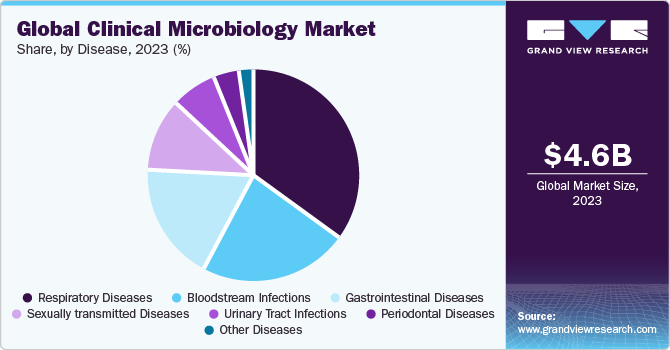

Disease Insights

Based on diseases, the market is segmented into respiratory diseases, bloodstream infections, gastrointestinal diseases, sexually transmitted diseases, urinary tract infections, periodontal diseases, and other diseases. The respiratory diseases segment dominated the market with a market share of 38.7% in 2022 and is expected to maintain its dominance throughout the forecast period growing with the fastest CAGR of 8.1%. Increasing levels of air pollution with growing industrialization are rapidly escalating the prevalence of respiratory diseases. In addition, respiratory diseases spread rapidly among all infections due to the easy transfer of contagious pathogens. Thus, the segment is expected to grow significantly over the forecast period. Furthermore, the prevalence of infectious diseases is high in developed and developing countries.

According to a fact sheet published by the World Health Organization in May 2023, asthma affected approximately 262 million people in 2019 and led to the deaths of 455,000 people worldwide. Biopsy, blood tests, and bronchoscopy are the most commonly used diagnostic tools for respiratory diseases. Therefore, the rising incidence of chronic respiratory diseases is boosting market growth.

The bloodstream infections segment had a significant market share in 2022. The increasing prevalence of antibiotic-resistant bacteria, invasive medical procedures, and increased immunocompromised patients contribute to the rise in bloodstream infections (BSIs). According to the

National Institutes of Health (NIH), in the U.S., an estimated 250,000 bloodstream infections occur annually. Rapid diagnostic technologies such as PCR and mass spectroscopy have helped improve the speed and accuracy of identifying pathogens causing BSIs. In addition, integrating automated systems and data management solutions has enhanced the efficiency of microbiology testing for BSIs, further driving market growth.

Regional Insights

North America dominated the market and accounted for the largest revenue share of 39.0% in 2022. The region has a strong and well-established pharmaceutical industry, which is a key driver of the market. Highly developed industrial and healthcare sectors in the U.S. are fueling the adoption of advanced clinical diagnostic techniques. In addition, stringent regulatory frameworks and the presence of leading players are augmenting regional market growth.

Asia Pacific is expected to grow at the fastest CAGR of 9.2% during the forecast period. The region has witnessed a significant increase in healthcare expenditure, leading to greater investment in research and development activities. Japan is one of the leading countries with strong technological developments and high usage of microbial testing for various applications. China is another significant market contributing to regional growth.

The booming medical tourism industry is expected to spur demand for microbial diagnostic and monitoring tests in Asian countries such as India, China, Thailand, and Malaysia. Furthermore, the availability of skilled labor at affordable cost and advanced manufacturing infrastructure is resulting in manufacturing facilities of major pharmaceutical and medical device makers shifting to Asia. This is boosting regional market expansion.

Key Companies & Market Share Insights

The introduction of automated systems and innovative designs is expected to intensify the competition among market players by changing market dynamics over the forecast period. Product launches, approvals, strategic acquisitions, and innovations are just a few of the important business strategies market participants use to maintain and grow their global reach.

For instance, in February 2023, bioMerieux S.A. announced the launch of MAESTRIA™, a next-generation microbiology middleware created by bioMérieux to improve laboratory productivity and patient care.

In September 2017, Bruker announced its acquisition of MERLIN Diagnostika GmbH. MERLIN offers extensive knowledge in antibiotic resistance testing (ART) and antibiotic susceptibility testing (AST) products, services, and consulting. MERLIN's antibiotic resistance, specialized susceptibility testing technology, and product portfolio enhance Bruker's microbiology business. The following are some of the major participants in the global clinical microbiology market:

-

BIOMÉRIEUX

-

Cepheid.

-

Danaher Corporation

-

Bruker Corporation

-

BD

-

Hologic Inc.

-

F. Hoffmann-La Roche Ltd

-

Alere, Inc.

Clinical Microbiology Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 4.7 billion

Revenue forecast in 2030

USD 7.6 billion

Growth rate

CAGR of 7.1% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, disease, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

BIOMÉRIEUX.; Cepheid.; Danaher Corporation; Bruker Corporation; BD; Hologic Inc.; F. Hoffmann-La Roche Ltd; Alere, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Clinical Microbiology Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global clinical microbiology market report based on product, disease, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Laboratory Instruments

-

Incubators

-

Gram Stainers

-

Bacterial colony counters

-

Autoclave sterilizers

-

Petri dish fillers

-

-

Automated Culture Systems

-

Microbiology analyzers

-

Molecular diagnostic instruments

-

Microscopes

-

Mass spectrometers

-

-

Reagents

-

-

Disease Outlook (Revenue, USD Million, 2018 - 2030)

-

Respiratory diseases

-

Bloodstream Infections

-

Gastrointestinal diseases

-

Sexually Transmitted diseases

-

Urinary Tract infections

-

Periodontal diseases

-

Other diseases

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global clinical microbiology market size was estimated at USD 4.3 billion in 2022 and is expected to reach USD 4.6 billion in 2023.

b. The global clinical microbiology market is expected to grow at a compound annual growth rate of 7.0% from 2023 to 2030 to reach USD 7.5 billion by 2030.

b. North America dominated the clinical microbiology market with a share of 39.0% in 2022. This is attributable to highly developed industrial and healthcare sectors in the U.S. that are fueling the adoption of advanced clinical diagnostic techniques.

b. Some key players operating in the clinical microbiology market include bioMerieux S.A.; Cepheid Inc.; Danaher Corporation; Bruker Corporation; Becton Dickinson & Company; Hologic Inc.; Roche Diagnostics; and Alere Inc.

b. Key factors that are driving the market growth include rising demand for automation and increasing the prevalence of infectious and chronic diseases.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."

Important: Covid19 pandemic market impact

The most common concern for the governments of all Covid-19 hit nations is the excruciating need to screen for and test large numbers of patients for possible Sars-Cov-2 infection. As a result, most of them are facing major shortages in the supply for diagnostic kits to test for the virus. Diagnostics virology entities are under immense pressure to provide reliable testing kits, and there is a surge in demand for in-vitro or point-of-care testing capacities by labs across a large number of countries. The report will account for Covid19 as a key market contributor.