- Home

- »

- Biotechnology

- »

-

Circulating Tumor Cells Market Size & Share Report, 2030GVR Report cover

![Circulating Tumor Cells Market Size, Share & Trends Report]()

Circulating Tumor Cells Market Size, Share & Trends Analysis Report By Application (Clinical/Liquid Biopsy, Research), By Specimen (Bone Marrow, Blood), By Product, By Technology, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: 978-1-68038-287-7

- Number of Pages: 120

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Healthcare

Report Overview

The global circulating tumor cells market size was valued at USD 10.32 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 13.34% from 2023 to 2030. Owing to the non-invasiveness and advantages offered by circulating tumor cells (CTC), it is considered a promising tool in cancer diagnosis. In addition, technological advancements in chip technology are another key factor driving the market growth. Since the last several decades, extensive translational and clinical cancer research programs in the field of CTCs are being conducted. The ongoing research on CTC technology by several government bodies, such as the American Association of Cancer Research and the American Society of Clinical Oncology, to utilize it as a surrogate marker for the determination of cancer progression is expected to aid the growth of the market.

Several tumor markers that have been introduced in recent years can be used with companion diagnostics to monitor or diagnose a variety of cancers. The high adoption of companion diagnostics in monitoring tumor eradication characteristics of cytotoxic drugs is among the few factors propelling the demand in this market. Key stakeholders are constantly engaged in endeavors aimed at developing CTC-based tests, which can prove helpful in cancer diagnosis. The development of medical imaging technologies, the rising demand for preventative healthcare and companion diagnostics, and the rising incidence of metastatic cancers are some of the key factors driving the market growth.

Concerns related to the reliability and consistency of isolation as well as the relationship between quantitation of this biomarkerand cancer prognosis are limiting factors affecting the clinical utility of this biomarker. Although there is a wide availability of several benchtop instruments for analysis and delineating circulating tumor cells from other blood cells, it is difficult to characterize these cells due to phenotypes exhibited by cells.

Furthermore, this biomarker has long been a subject of academic research, but the difficulty of centralizing the know-how and technologies has obscured the path to commercialization as many universities and private companies have developed their own expertise. However, recent years have seen a drive toward practical application, majorly due to a wave of acquisitions by large players centralizing the technology and numerous tie-ups with pharmaceutical companies to make progress toward forming a value chain and accelerating market growth.

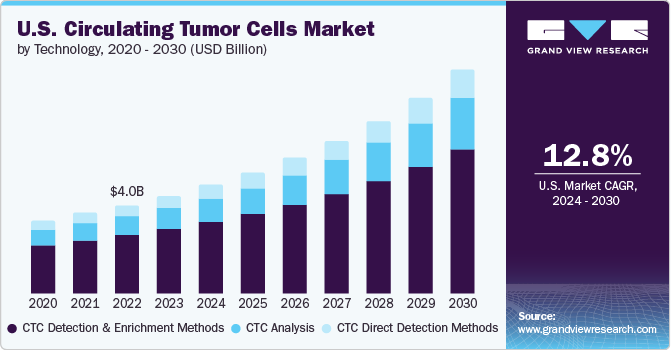

Technology Insights

In 2022, the CTC detection and enrichment methods segment accounted for the largest revenue share of 65.3%. The availability of different methods for the enrichment of circulating tumor cells in cancer detection is expected to significantly impact segment growth over the forecast period. Moreover, positive or negative enrichment of CTCs based on biological properties is expected to hold significant potential for market growth. An effective enrichment process helps in the enhancement of sensitivity, selectivity, and yield, thereby ensuring successful clinical translation of this field.

Different detection techniques include filtration, centrifugal force, magnetic beads-based enrichment, and other physical properties, such as density, size, deformity, and electric charges. According to a research paper published in October 2021 titled “Negative enrichment of circulating tumor cells from unmanipulated whole blood with a 3D printed device”, the negative enrichment approach is beneficial as it results in intact tumor cells free of attached immune agents, thereby removing potential artifacts in the subsequent studies and enabling an impartial detection of CTCs.

Due to these factors, the segment is anticipated to have rapid growth. Advancements in technologies, such as immunofluorescence, NGS, FISH, and qPCR, are anticipated to drive the clinical utility of these cells, thus accelerating revenue growth for CTC analyses. Several companies are investing in the development of products that help in CTC analysis and downstream assays. For instance, Vortex Biosciences offers various CTC analysis products, including immunofluorescence, cytopathology, cytogenetics (FISH), cell culture, and genomics.

Application Insights

The research segment dominated the market and captured the largest revenue share of 73% in 2022. Circulating tumor cells are regarded as a substrate of cancer metastasis. Circulating tumor cells enumeration remains largely a research tool. Recently, the focus has shifted toward circulating tumor cell characterization and isolation, which can provide significant opportunities in predictive testing research.

This arena has significantly improved cancer studies, thus, products offered in the market are primarily designed to be used within research settings. Some key products that have contributed to the large share of research settings are Parsortix Technology, Target Selector Platform, Apostream, Celsee PREP 400, IsoFlux CTC system, DEPArray System, VTX-1, and AdnaTest.

Currently, CTC-based screening and monitoring methods are at the nascent stage. A substantial number of commercial liquid biopsy tests are based on cell-free DNA (cfDNA), which has hampered the clinical utility of these cell-based tests. The dominance of cfDNA over circulating tumor cells in cancer diagnosis has led to a smaller share of clinical applications in the market. Nonetheless, the presence of circulating tumor cells in the bloodstream indicates a risk of metastatic spread and the existence of a tumor.

Product Insights

The devices or systems segment dominated the market and accounted for the largest revenue share of 43% in 2022. This can be attributed to the availability of a robust product portfolio coupled with advancements in microfluidics technology. The introduction of fabricated glass microchips to overcome the challenges and to increase technical completeness for mass production is expected to propel the segment growth. The development of automated instruments that eliminate the use of additional blood collection tubes reduces the cost of blood collection tubes.

The reduction in costs is also observed as the transportation is free of the additional laboratory consumables and transfer tubes when the reagent-equipped tubes are used. On the other hand, kits and reagents have also contributed significantly to the segment’s revenue due to frequent purchases and high usage rates. For instance, CellSearch Circulating Tumour Cell Kit authorized by the U.S. FDA, is one the most popular products produced in the U.S.

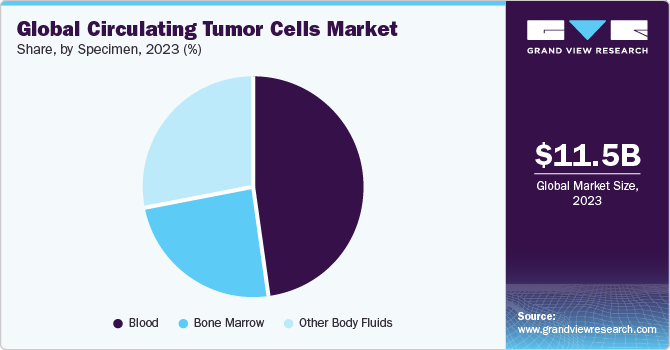

Specimen Insights

The blood specimen segment dominated the market and accounted for the largest revenue share of 46.5% in 2022. A large concentration of these cells in blood samples as compared with other biospecimens is responsible for the largest penetration of this specimen type. Approaches for tumor cell identification in blood samples are considered important in current cancer research, as it aids in the prediction of prognosis and determination of the response to systemic chemotherapy. However, the use of whole blood as a specimen poses a challenge when combined with microfluidic technology.

Membrane clogging as a result of a high concentration of blood cells minimizes the applicability of whole blood samples in microfluidic-based circulating tumor cell enumeration. Devices with various pore shapes and sizes are anticipated to overcome this issue and drive segment growth in the coming years. Moreover, the development of fluid-assisted separation technology by Clinomics, a molecular laboratory based in Bloemfontein, Free State can be employed for efficient detection of these cells.

Over the past few years, a substantial number of research activities have been conducted on Disseminated Tumor Cells (DTCs), circulating tumor cells that reside in permissive target tissues, and the number of such research activities is expected to increase exponentially in the coming years. Moreover, the emergence of high throughput techniques has effectively accelerated the detection of genome variation among these cells, thereby driving segment growth at a significant pace throughout the forecast period.

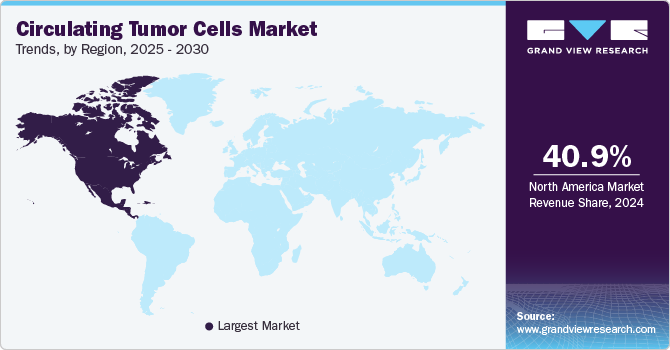

Regional Insights

North America captured the largest market share of 50.8% in 2022. Aviva Biosciences; Apocell, Inc.; Advanced Cell Diagnostics; Biocept, Inc.; Biofluidica, Inc.; and CellTraffix, Inc. are the key players operating in the region. These players are undertaking various strategies to enhance their market hold, which is a key factor responsible for the high share of the U.S. North America is anticipated to significantly contribute to the global market's growth due to factors including the rising incidence of cancer, product approvals, and increased R&D efforts.

For instance, the American Cancer Society projects that there will be around 127,070 lung cancer fatalities nationwide and about 238,340 new instances of lung cancer diagnosis in 2023. Furthermore, the presence of a population with high susceptibility to cancer, an increase in market penetration rates, and technologically advanced cancer care infrastructure are supporting the region’s growth. On the other hand, Asia Pacific is projected to grow at a lucrative rate due to high unmet diagnostic needs coupled with rapidly growing patient awareness with regard to early detection of cancer and risk assessment.

Key Companies & Market Share Insights

The market is consolidated with several emerging as well as established players. The market is witnessing high competition among both public and private firms. The players are adopting several measures to sustain market competition with the changing trends, which exerts a positive impact on the overall market growth. Companies are involved in the development of new kits to maintain a competitive advantage in the market. For instance, in July 2023, Menarini Silicon Biosystems announced the launch of its new CELLSEARCH CTC test with the DLL3 biomarker for small cell lung cancer for the research use only in North America and Europe. Some of the prominent players in the global circulating tumor cells market include:

-

QIAGEN

-

Bio-Techne Corporation

-

Precision for Medicine

-

AVIVA Biosciences

-

BIOCEPT, Inc.

-

BioCEP Ltd.

-

Fluxion Biosciences, Inc.

-

Greiner Bio One International GmbH

-

Ikonisys Inc.

-

Miltenyi Biotec

-

IVDiagnostics

-

BioFluidica

-

Canopus Bioscience Ltd.

-

Biolidics Limited

-

Creativ MicroTech, Inc.

-

LungLife AI, Inc.

-

Epic Sciences

-

Rarecells Diagnostics

-

ScreenCell

-

Menarini Silicon Biosystems

-

LineaRx, Inc. (Vitatex, Inc.)

-

Sysmex Corporation

-

STEMCELL Technologies, Inc.

Circulating Tumor Cells Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 11.47 billion

Revenue forecast in 2030

USD 27.55 billion

Growth rate

CAGR of 13.34% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segment coverage

Technology, application, product, specimen, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Germany; U.K.; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Companies profiled

QIAGEN; Bio-Techne Corp.; Precision for Medicine; AVIVA Biosciences; BIOCEPT, Inc.; BioCEP Ltd.; Fluxion Biosciences, Inc.; Greiner Bio One International GmbH; Ikonisys Inc.; Miltenyi Biotec; IVDiagnostics; BioFluidica; Canopus Bioscience Ltd.; Biolidics Limited; Creativ MicroTech, Inc.; LungLife AI, Inc.; Epic Sciences; Rarecells Diagnostics; ScreenCell; Menarini Silicon Biosystems; LineaRx, Inc. (Vitatex, Inc.); Sysmex Corporation; STEMCELL Technologies, Inc.

Customization scope

If you need specific market information, which is not currently within the scope of the report, we will provide it to you as a part of the customization

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Circulating Tumor Cells MarketReport Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global circulating tumor cells market report on the basis of technology, application, product, specimen, and region:

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

CTC Detection & Enrichment Methods

-

Immunocapture (Label-based)

-

Positive Selection

-

Negative Selection

-

-

Size-based Separation (Label-free)

-

Membrane-based

-

Microfluidic-based

-

-

Density-based Separation (Label-free)

-

Combined Methods (Label-free)

-

-

CTC Direct Detection Methods

-

SERS

-

Microscopy

-

Others

-

-

CTC Analysis

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Clinical/ Liquid Biopsy

-

Risk Assessment

-

Screening and Monitoring

-

-

Research

-

Cancer Stem Cell & Tumorogenesis Research

-

Drug/Therapy Development

-

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Kits & Reagents

-

Blood Collection Tubes

-

Devices or Systems

-

-

Specimen Outlook (Revenue, USD Million, 2018 - 2030)

-

Blood

-

Bone Marrow

-

Other Body Fluids

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Spain

-

Italy

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global CTCs market size was estimated at USD 10.32 billion in 2022 and is expected to reach USD 11.47 billion in 2023.

b. The global CTCs market is expected to grow at a compound annual growth rate of 13.34% from 2023 to 2030 to reach USD 27.55 billion by 2030.

b. CTC detection & enrichment methods dominated the CTCs market. This is attributable to the availability of different methods for the enrichment of circulating tumor cells in cancer detection.

b. Some key players operating in the CTCs market include Greiner Bio One International GmbH; QIAGEN; Bio-Techne Corporation; Menarini Silicon Biosystems; Sysmex Corporation; and Biocept, Inc.

b. Key factors that are driving the CTCs market growth include rising cancer prevalence, increasing preference for non-invasive cancer diagnosis, and technological advancements in CTC isolation and analysis.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."

Important: Covid19 pandemic market impact

Biopharmaceutical innovators are at the forefront of the human response to the coronavirus pandemic. A significant number of major biotech firms are in the midst of a race to investigate the Sars-Cov-2 genome and prepare a viable vaccine for the same. As compared to the speed of response to SARS/MERs etc, the biotech entities are investigating SARs-Cov-2 at an unprecedented rate and a considerable amount of funds are being put into the R&D. With multiple candidates in trial, the public and private sectors are anticipated to work in unison for the foreseeable period, until a vaccine is developed for Covid-19. The report will account for Covid19 as a key market contributor.