- Home

- »

- Advanced Interior Materials

- »

-

Chillers Market Size, Share & Trends Analysis Report, 2030GVR Report cover

![Chillers Market Size, Share & Trends Report]()

Chillers Market Size, Share & Trends Analysis Report By Product (Water-Cooled, Air -Cooled), By Application (Commercial, Residential, Industrial), By Compressor Type, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68038-923-4

- Number of Pages: 100

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Advanced Materials

Chillers Market Size & Trends

The global chillers market size was valued at USD 9,554.9 million in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 4.4% over the forecast period. Rising temperatures due to global warming are likely to drive the demand for cooling equipment. Increasing adoption of chillers owing to their ability to remove heat from the building and maintain internal temperature is anticipated to drive the market. The major components of the chillers include compressor, evaporator, condenser, expansion valve, control units, and power panels.

Chillers provide air conditioning by removing unwanted heat from residential, commercial, and industrial buildings. These equipment utilize refrigerants to remove heat from the condenser and evaporators. According to the Joint Center for Housing Studies, baby boomers are anticipated to drive the demand for renovations and new constructions over the next ten years in the U.S. Rising number of construction activities in the country is expected to have a positive impact on the market growth in the country.

Vapor compression chillers use an electrically-driven mechanical compressor to force the refrigerant around the systems and are categorized into air-cooled and water-cooled. However, the vapor absorption coolers implement heat sources, such as hot water or steam, to enable the movement of refrigerant in the system, wherein the refrigerant moves around between areas of different pressure and temperature.

Governments of various developing countries have been investing significantly in public infrastructures, such as offices, hospitals, malls, and housing societies. Growth in construction spending in the emerging economies of the Middle East and the Asia Pacific regions on account of strong industrial and economic development coupled with population expansion is anticipated to have a positive impact on the market growth.

The imposition of lockdowns by various countries to curb the spread of the COVID-19 pandemic in 2020 and 2021 has resulted in restrictions on the movement of goods and people within the country as well as across countries. This, in turn, has impacted the construction contractors’ ability to complete their projects, thereby impacting the chiller market growth negatively.

Product Insights

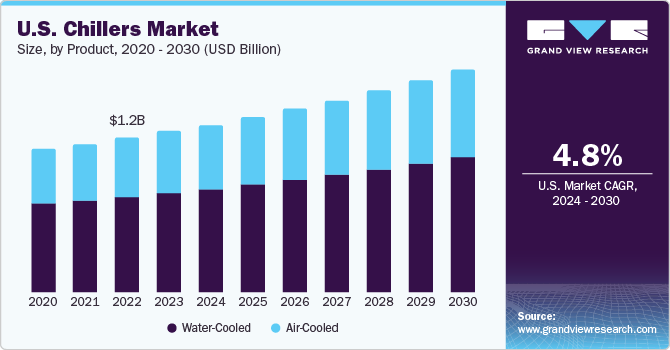

The water-cooled segment accounted for the largest revenue share of 62.4% in 2022 owing to the longer life span and high efficiency of these systems as compared to air-cooled equipment for large cooling loads. Water-cooled equipment is installed inside the buildings, which ensures the slow deterioration of the components.

Water-cooled chillers utilize water from external cooling towers and are usually used for large-capacity applications. These coolers reject heat from the gaseous refrigerant in a condenser before it is transformed into a liquid. The cooling towers are heat exchangers providing cooling water for the removal of heat from the coolant to cool buildings, process fluids, and machinery.

The air-cooled segment is expected to grow at the fastest CAGR of 4.8% during the forecast period on account of the low cost of these equipments attributed to a smaller number of components in the system. These coolers require less space and can be installed on rooftops of buildings, resulting in more space within the structure for other amenities.

However, the loud noise created by the compressors and fans of the air-cooled products is expected to limit their penetration in residential buildings. In addition, the requirement of frequent replacement of the product owing to the deterioration of its material by exposure to the wind, snow, frost, rain, and sun is anticipated to hamper growth.

Compressor Type Insights

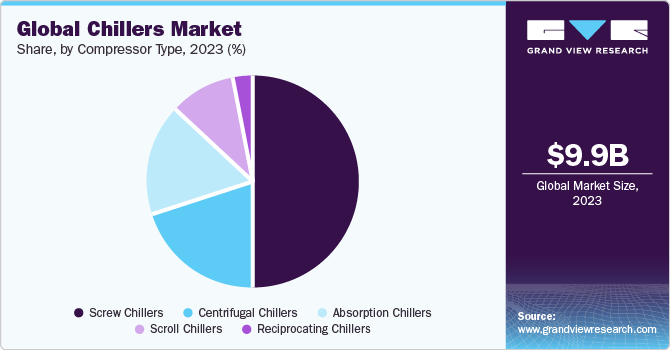

The screw chillers segment accounted for the largest revenue share of 49.7% in 2022. These coolers work on either air-cooled or water-cooled mechanisms, using two interlocking rotating helical rotors for compressing the refrigerant. The capacity of the products is controlled with the help of a slider or speed control.

Absorption chillers are used in applications with high-quality waste heat, including building with heated swimming pools and hospitals. Furthermore, buildings having combined heat and power (CHP) engines are paired with absorption coolers. The absence of a compressor in the absorption coolers results in direct or indirect firing and controlling the capacity through the amount of heat entering the system.

The reciprocating chillers segment is expected to grow at a CAGR of 3.0% over the forecast period on account of its installation in small and medium cooling loads with low-cost refrigerators. These coolers use a chamber and piston to compress the refrigerant and control the capacity through speed control, and cylinder unloading or compressor staging.

Centrifugal chillers are available in open and hermetic construction, wherein the latter is widely used. The capacity control of these coolers is achieved by using inlet vanes present of the impellers, which restrict the flow of refrigerants. The compact size and high operational efficiency of the equipment at full load is expected to have a positive impact on its demand.

Application Insights

The commercial segment held the largest revenue share of 44.6% in 2022. Chillers are used in various commercial buildings, such as corporate offices, data centers, public buildings, healthcare facilities, education institutes, and warehouses, to maintain the temperature in the structures during warm weather.

Chillers are used in data centers for cooling the heat generated in high-density enclosed spaces. The requirement of maintaining constant temperature, humidity, air cleanliness, and air movement within the data centers to avoid downtime and equipment failure is expected to augment product adoption in the commercial sector.

The product demand in the food & beverage industry is expected to grow at a CAGR of 3.6% over the forecast period. Glycol chillers are used in wineries and breweries to maintain the temperature of the beverage products. These coolers circulate chilled propylene glycol through the cooling coils to keep the cold temperature of the beverage and food storage units.

The explosion-proof chillers are used by petrochemical companies, such as Chevron, Shell, and Exxon, and in off-shore oil rigs to maintain the facilities' temperature. The low-temperature systems aid in maintaining temperatures as low as -40° F and are used for petrochemical cooling and to create ice for ice skating rinks.

Regional Insights

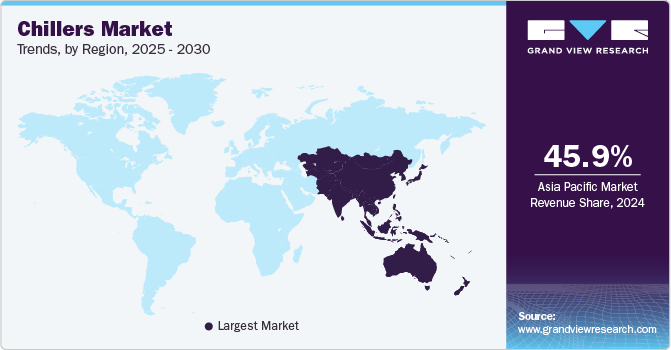

Asia Pacific dominated the market and accounted for the largest revenue share of 45.2% in 2022 due to investments in the commercial and residential construction industries. The rising number of data centers in the region is anticipated to have a positive impact on the chillers market growth over the forecast period.

The construction of commercial buildings, such as retail buildings and offices, has witnessed significant growth in Melbourne and Sydney. Factors, such as the steady population growth, availability of skilled labor, and technological advancements, in Australia, are expected to drive the construction industry, and in turn, boost the market growth over the forecast period.

Middle East & Africa is expected to grow at a CAGR of 4.9% during the forecast period. The rapid growth of transportation facilities in Saudi Arabia is expected to boost residential and commercial development in vicinities, which is expected to have a positive impact on product demand over the forecast period. Factors, such as increasing the tourism sector, population growth, and rapid urbanization, are driving the construction industry, in turn, driving the market growth in the country.

Key Companies & Market Share Insights

The global market is highly competitive on account of the presence of global and local manufacturers. The companies are engaged in expansion through mergers & acquisitions and joint ventures. For instance, in May 2023, Trane acquired MTA, an Italian manufacturer and distributor specializing in industrial refrigeration and air conditioning equipment. This strategic acquisition is expected to enhance Trane's commercial HVAC capabilities, particularly in key markets, by incorporating MTA's process chillers and expanding the rental and services business. With manufacturing sites located in Tribano and Conselve and a workforce of approximately 500 employees, MTA has an annual production capacity of 13,500 systems. In addition, they comply with various energy-efficiency requirements stated by the regulatory authorities. These companies offer a wide range of systems that are sold through multiple channels, including distributors, company-owned websites, retailers & their websites, and e-commerce websites. Some prominent players in the global chillers market include:

-

Trane

-

Cold Shot Chillers

-

Tandem Chillers

-

Drake Refrigeration, Inc.

-

Refra

-

Carrier

-

FRIGEL FIRENZE S.p.A.

-

Midea

-

Rite-Temp

-

Multistack, LLC.

-

DAIKIN INDUSTRIES, Ltd.

-

General Air Products

-

ClimaCool Corp.

-

Johnson Controls

-

Fluid Chillers, Inc.

Recent Developments

-

In December 2022, Trane unveiled its latest offerings, the water-cooled XStream eXcellent GVWF and air-cooled Sintesis eXcellent GVAF chillers. These innovative chillers incorporate magnetic-bearing compressors and utilize the low global warming potential (GWP) refrigerant R1234ze. Equipped with high-speed centrifugal compressor technology, these chillers deliver larger capacities, wider operating maps to meet challenging European climate conditions, and enhanced seasonal efficiencies, all while maintaining a compact size.

-

In October 2022, Trane, a leading provider of indoor comfort solutions and services, introduced CITY Advantage, a new line of compact scroll water-cooled chillers. These models utilize the low global warming potential (GWP) refrigerant R-454B. The CITY Advantage series is an expansion of Trane's existing CITY portfolio and is specifically designed to offer year-round cooling or heating capabilities while occupying minimal space. The compact size makes these units ideal for small commercial buildings, industrial facilities, and various processes.

-

In April 2021, refrigeration equipment manufacturer Refra initiated production operations at its newly established facility in Vievis, located in close proximity to the capital city, Vilnius, Lithuania. Spanning an area of 12,000 square meters, the factory is situated approximately 40 kilometers northwest of Refra's headquarters in Vilnius. The expansion has resulted in the creation of employment opportunities for an additional 100 individuals.

Chillers Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 9,928.3 million

Revenue forecast in 2030

USD 13.45 billion

Growth rate

CAGR of 4.4% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

October 2023

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, compressor type, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Russia; China; Japan; India; Australia; South Korea; Thailand; Indonesia; Malaysia; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

Trane; Cold Shot Chillers; Tandem Chillers; Drake Refrigeration, Inc.; Refra; Carrier; FRIGEL FIRENZE S.p.A.; Midea; Rite-Temp; Multistack, LLC.; DAIKIN INDUSTRIES, Ltd.; General Air Product; ClimaCool Corp.; Johnson Controls; Fluid Chillers, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Chillers Market Report Segmentation

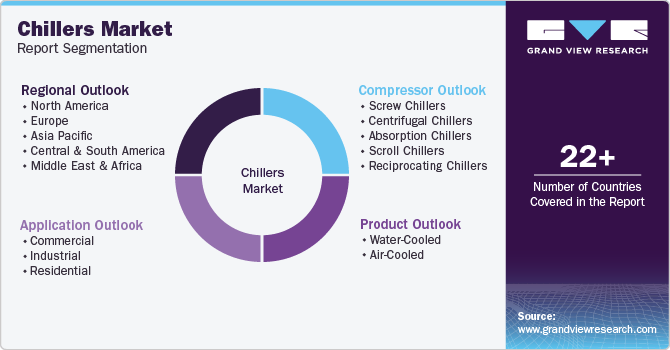

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global chillers market based on product, compressor type, application, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Water-Cooled

-

<50kW

-

51-100kW

-

101-500kW

-

501-1000kW

-

1001-1500kW

-

>1501kW

-

-

Air -Cooled

-

<50kW

-

51-100kW

-

101-500kW

-

501-1000kW

-

1001-1500kW

-

>1501kW

-

-

-

Compressor Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Screw Chillers

-

Centrifugal Chillers

-

Absorption Chillers

-

Scroll Chillers

-

Reciprocating Chillers

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Commercial

-

Corporate Offices

-

Data Centers

-

Public Buildings

-

Mercantile & Service

-

Healthcare

-

Others

-

-

Residential

-

Industrial

-

Chemicals & Pharmaceuticals

-

Food & Beverage

-

Metal Manufacturing & Machining

-

Medical & Pharmaceutical

-

Plastics

-

Others

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Russia

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

Thailand

-

South Korea

-

Indonesia

-

Malaysia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. Some of the key players operating in the chillers market include Trane; Cold Shot Chillers; Tandem Chillers; Drake Refrigeration, Inc.; Refra; Carrier; FRIGEL FIRENZE S.p.A., Midea; Rite-Temp; Multistack, LLC.; DAIKIN INDUSTRIES, Ltd.; General Air Products; ClimaCool Corp.; JOHNSON CONTROLS - HITACHI AIR CONDITIONING COMPANY; and Fluid Chillers, Inc.

b. The key factors driving the chillers market include growth in the construction industry, increasing demand for cooling equipment and process cooling applications in the HVAC & refrigeration industry, and rising atmospheric temperatures attributed to global warming.

b. The global chillers market size was estimated at USD 9,554.9 million in 2022 and is expected to reach USD 9,928.3 million in 2023.

b. The global chillers market is expected to grow at a compound annual growth rate of 4.4% from 2023 to 2030 to reach USD 13.45 billion by 2030.

b. Asia Pacific dominated the chillers market with a revenue share of 45.1% in 2022 on account of the rapid urbanization, coupled with growing populations in several countries, including China and India.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."