- Home

- »

- Advanced Interior Materials

- »

-

Central & South America Iron Casting Market Report, 2030GVR Report cover

![Central & South America Iron Casting Market Size, Share & Trends Report]()

Central & South America Iron Casting Market Size, Share & Trends Analysis Report By Product (Gray Iron, Ductile Iron, Malleable Iron), By Application (Automotive, Pipes & Fittings), And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-126-2

- Number of Pages: 86

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Advanced Materials

Report Overview

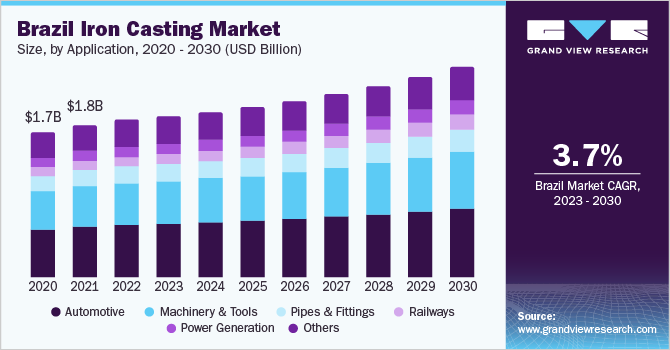

The Central & South America iron casting market size was estimated at USD 2.26 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 3.8% from 2023 to 2030. Developments in the end-use industries, such as railways and power generation, along with the increasing demand from the automotive sector, are anticipated to contribute to market growth. Rising investments in railways and increasing demand for power that results in the requirement for large-scale power generation are anticipated to fuel the growth of the market in the region in the coming years. For instance, in September 2022, Shell PLC launched its Shell Energy brand in Brazil. The company is expected to invest USD 570 million in renewables in the country by the end of 2025.

It is expected to generate clean energy from wind and solar power plants. Brazil's rising demand for iron castings can be attributed to increasing infrastructure development projects, the rapidly growing energy generation sector, and surging investments by automobile manufacturers. For instance, in August 2023, the Brazilian government announced its plans to invest USD 200 billion in infrastructure, energy, and transportation projects in the next four years as a part of an initiative to enhance economic growth and employment opportunities in the country. Iron castings are extensively utilized in pipes & fittings used in residential and industrial applications.

The increasing number of projects related to sanitization, sewage, and wastewater treatment being carried out in Brazil are expected to fuel the market growth. For instance, the dearth of sewerage and sanitation systems in Brazil has compelled the country to secure a loan worth USD 128 billion from IDB for improving the water, sewerage, and sanitation services for Joinville, one of its municipalities. Furthermore, the demand for iron castings is expected to rise in Central & South America due to an increase in the production of vehicles owing to the rising population and increase in the per capita income of the younger generation.

Iron castings are utilized for manufacturing engine blocks, cylinder heads, brake rotors, and steering knuckles. According to OICA, in 2022, automotive production rose by around 5%, 24%, and 25% in Brazil, Argentina, and Colombia respectively, as compared to 2021. The increase in automotive production marks as a growth driver for the market, however, the regulatory pressure to improve the efficiency of vehicles and reduce the environmental impacts of greenhouse gas emissions, obstructs this driver. Aluminum is considered a sustainable material, and its use over iron & steel prevents around 70 million tons of unwanted CO2 from mixing into the air. The various advantages of aluminum in the automotive industry are likely to be a restraining factor for the use of iron castings in the region over the forecast period.

Application Insights

The automotive application segment held the largest revenue share of over 31.0% in 2022. Iron castings are widely used for manufacturing automotive components, such as engine blocks, gear housings, elbows, manifolds, crankshafts, flywheels, differential cases, front axle supports, lift arms, knuckles, and gear carrier assemblies. The automotive industry has been receiving impetus in the form of government funding and policies across Central & South America. For instance, in September 2022, the Argentine Congress enacted Law 27.686 to promote investments in the automotive industry in the country. With the introduction of this new law, the industry has been designated as a strategic sector in the country.

The Argentine Congress aims to promote new investments in the industry and strengthen its supply chain while reinforcing the export-oriented profile of the industry. Thus, such initiatives toward the development of the auto industry are expected to prove fruitful for segment growth. The railway segment is expected to register the fastest CAGR from 2023 to 2030 due to high investments to meet the rising demand for mass mobility. For instance, in January 2023, Marcopolo Rail, a Brazilian manufacturer, signed a USD 15 million contract with the Chilean State Railways to supply three two-car Diesel Multiple Units (DMU). Such projects are anticipated to augment the demand for iron castings in the region over the coming years.

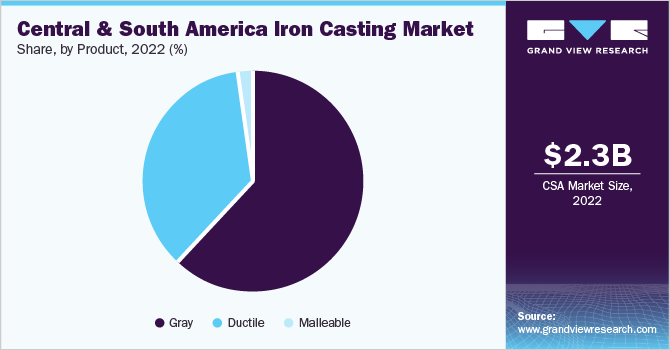

Product Insights

The gray iron segment held the largest revenue share of over 61.0% of the overall market in 2022, and this trend is anticipated to continue over the forecast period. In this type of casting, the carbon and silicon content of gray cast iron ranges from 2.5–4% and 1-3%, respectively, and possesses a graphitic microstructure. Gray iron castings are widely used in machinery & tools due to their high compressive strength, good machinability and damping capacity, high thermal conductivity, low-cost production, and excellent wear resistance.

Machine tool vibration results in poor part accuracy & surface finish and accelerates the failure of components like bearings. To tackle this problem, grey iron casting is used. The ductile iron segment is anticipated to register the fastest growth rate over the forecast period. Compared to gray iron, it offers higher toughness and strength. It finds applications in various products, such as switch boxes, crankshafts, electrical fittings, cylinder heads, motor frames, flywheels, drive pulleys, work rolls, and circuit breakers. Its ductile nature makes it suitable for pipes as well. Hence, growing investments in the water treatment and sewage industry are anticipated to boost segment growth over the coming years.

Country Insights

Brazil held the largest share of over 83.0% of the overall revenue in 2022. Growing investments in infrastructural development are promoting product demand in the country. For instance, in December 2021, the Government of Brazil announced the development of nine railway stretches across the country. It has authorized six companies to develop 3,506-kilometer stretches with an investment worth USD 9 billion. Argentina is anticipated to register the fastest growth rate, in terms of revenue, over the forecast period. Its motor vehicle production rose by over 23% in December 2022 from December 2021.

Moreover, increasing government focus on the automobile sector and railways is expected to have a positive influence on the growth of the market in the country. Chile is another vital market for iron castings in the Central & South America region. Increasing investments in infrastructure development projects are likely to product demand in the country. The Government of Chile allocated approximately USD 250.0 million (CLP 202 billion) in 2022 to enhance infrastructure developments in Los Rios, including airports, ports, public buildings, roads, and highways. As a result, the requirement of castings, such as pipes and fittings, manhole covers and grates, and bollards are becoming increasingly in demand.

Key Companies & Market Share Insights

The landscape is very competitive. As a result, key players have been devising strategies to enhance their capacities through product development, innovations, and mergers & acquisitions. For instance, in July 2021, Tupy, a structural component manufacturer in Brazil acquired iron casting operations of Teksid SpA, a subsidiary of Stellantis. Consolidated. This acquisition has expanded Tupy’s global footprint and enhanced its ability to competitively produce blocks. Some of the prominent players in the market include:

-

Boherdi Foundry

-

CALMET

-

Castertech (Randon Companies)

-

Fagor Ederlan

-

Fundição Regali Brasil

-

Fundición Callao SA

-

Funvesa

-

Grupo Industrial Saltillo (GIS)

-

Industrias Ascheri & Cia.

-

ISOFUND

-

LEPE

-

Teksid SpA

-

WHB Brasil

Central & South America Iron Casting Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 2.31 billion

Revenue forecast in 2030

USD 3.03 billion

Growth rate

CAGR of 3.8% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion, volume in kilotons, and CAGR from 2023 to 2030

Report coverage

Revenue & volume forecast, competitive landscape, growth factors, company profiles, and trends

Segments covered

Product, application, country

Regional scope

Central & South America

Country scope

Brazil; Argentina; Chile

Key companies profiled

Boherdi Foundry; CALMET; Fundición Callao SA; Funvesa; Industrias Ascheri & Cia; Grupo Industrial Saltillo (GIS); ISOFUND; LEPE; WHB Brasil; Fagor Ederlan; Teksid SpA; Fundição Regali Brasil; Castertech (Randon Companies)

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Central & South America Iron Casting Market Report Segmentation

This report forecasts revenue and volume growth at the country and regional levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Central & South America iron casting market report on the basis of product, application, and country:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Gray Iron

-

Ductile Iron

-

Malleable Cast Iron

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Machinery & Tools

-

Pipes & Fittings

-

Railways

-

Power Generation

-

Others

-

-

Country Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Central & South America

-

Brazil

-

Argentina

-

Chile

-

-

Frequently Asked Questions About This Report

b. The Central & South America iron casting market was estimated at USD 2.26 billion in 2022 and is expected to reach USD 2.31 billion in 2023.

b. The Central & South America iron casting market is expected to grow at a compound annual growth rate of 3.8% from 2023 to 2030 to reach USD 3.03 billion by 2030.

b. Based on application segment, automotive held the largest revenue share of more than 31.0% in 2022 owing to increasing production of vehicles in the region.

b. Some of the key players are Boherdi Foundry, CALMET, Fundición Callao SA, Funvesa, Industrias Ascheri & Cia., Grupo Industrial Saltillo (GIS), ISOFUND, LEPE, WHB Brasil, Fagor Ederlan, Teksid SpA, Fundição Regali Brasil, Castertech (Randon Companies), among others.

b. The growing demand for pipes & fittings in sewage projects, and in the oil & distribution network, along with increasing investment in railway infrastructure is anticipated to drive the Central & South America iron casting market.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."