- Home

- »

- Biotechnology

- »

-

Cell Culture Media Market Size, Share, Growth Report, 2030GVR Report cover

![Cell Culture Media Market Size, Share & Trends Report]()

Cell Culture Media Market Size, Share & Trends Analysis Report By Product (Serum-free Media, Stem Cell Culture Media), By Type (Liquid Media, Semi-solid And Solid Media), By Application, By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68039-957-8

- Number of Pages: 150

- Format: Electronic (PDF)

- Historical Range: 2018 - 2022

- Industry: Healthcare

Cell Culture Media Market Size & Trends

The global cell culture media market size was estimated at USD 4.73 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 12.54% from 2024 to 2030. Cell culture media is generally a gel or liquid including compounds required to regulate and support the growth of cells or microorganisms used in the manufacturing of biopharmaceuticals. Culture media is a critical ingredient in biopharmaceutical manufacturing, aiding the growth of cells, and is the fastest-growing segment within this market. This growth is mainly driven by growing demand for biopharmaceuticals, favorable governmental policies, and increasing investment in R&D.

The outbreak of COVID-19 has improved demand for well-established cell-based vaccine production technologies. Moreover, it has given rise to a few scientific innovations, particularly in the production and testing of vaccine technology. For instance, Vero cell line originated from the African green monkey kidney and has been extensively used for viral vaccine manufacturing. It has also been used for the development of various SARS-CoV variants. ProVeroTM1 Serum-free Medium manufactured by Lonza Bioscience is a protein-free medium, of non-animal origin designed to support the growth of Vero cells and MDCK.

Furthermore, cell culture-produced AAV vectors have also gained thrust as one of the most effective protein and gene delivery tools in vaccine manufacturing as well as gene therapy. Key market players are expanding their production capabilities. In 2021, Sartorius increased its production in all regions due to elevated demand in its core business and to additional customer needs related to COVID-19 therapeutics and COVID-19 vaccines. The biosimilars market is on the cusp of momentous growth. This growth is due to several mAb biosimilars that are anticipated to be launched in a few years as patents on significant drugs, such as trastuzumab (Herceptin from Roche), infliximab (Remicade from J&J), and Adalimumab (Humira from Abbott) are going to expire.

Additionally, the FDA’s approval of cell-based candidate vaccine viruses (CVVs) for use in cell-based influenza vaccines could advance the efficiency of cell-based flu vaccines. Cell culture technology has been used to develop other U.S.-licensed vaccines, comprising vaccines for smallpox, rotavirus, rubella, hepatitis chickenpox, and polio. Furthermore, for 2021-2022 influenza season, all 4 flu viruses used in the cell-based vaccine are cell-derived. For instance, in October 2021, Seqirus received U.S. FDA approval for FLUCELVAX QUADRIVALENT, the first and the only cell-based influenza vaccine in the U.S.

Market Dynamics

The expansion of clear, regulatory approval paths for biosimilars in emerging markets is generating opportunities for biosimilar monoclonal antibodies. The availability of an approval pathway in the U.S. has led to new opportunities for biosimilar manufacturers to enter major markets around the globe. Biosimilar versions of monoclonal antibodies have a probability to offer cost reductions of 25% to 30%, and many emerging countries are vigorously developing pathways for biosimilar approvals & are swiftly catching up.

Emerging countries such as Venezuela, Brazil, Colombia, India, and Mexico have established regulations for biosimilar approval. Russia is also developing a pathway for approval, as are other countries across Africa and Asia. The China FDA has also begun discussions on the development of a biosimilar approval procedure. In recent years, China’s biosimilar drug industry has established rapidly. By the end of 2019, the country had maximum number of biosimilar drugs in research, with 391 biosimilar drugs in the R&D pipeline.

In recent years, stem cell therapy has become an advanced and promising scientific research topic. The development of treatment methods has induced great opportunities. Stem cells have considerable potential to become one of the most significant aspects of medicine. In addition to the fact that they play a huge role in development of restorative medicine, their study also divulges additional information about complex events that happen during human development.

Moreover, there is growing interest in improving stem cell culture not only because cell culture is extensively used in basic research for studying stem cell biology but also due to the potential therapeutic applications of cultured stem cells. Funding related to stem cell research has augmented in recent years, which has further accelerated the growth of research. In March 2022, the City of Hope received a USD 4.9 million grant from the California Institute for Regenerative Medicine. This funding will help the Research Centre to guide next generation of scientific leaders in stem cell research and its translation into innovative lifesaving treatments. The grants will fund laboratory research and help scientists to learn how to implement cell-based therapies, engineer, and manufacture cells, obtain regulatory approval, and commercialize biomedical products.

Product Insights

Based on product, the serum-free media (SFM) segment held the highest market share of 36.0% in 2023. The use of serum-free media signifies a significant tool, which allows the researchers to perform specific applications or grow a specific cell type without using serum. Advantages of using serum-free media include increased growth and/or productivity, more consistent performance, better control over physiological sensitivity, and diminishing the risk of infection by serum-borne adventitious agents in the culture.

In addition, serum-free alternatives better serve animal welfare which is the major factor driving the adoption of SFM. The field of gene and cell therapy is rapidly growing, and the Food and Drug Administration (FDA) regulatory guidelines are demanding more control of raw materials to sustain the reliable and safe manufacturing of drug products. The use of SFM offers an opportunity to produce additional reproducible formulations and fewer batch-to-batch variability.

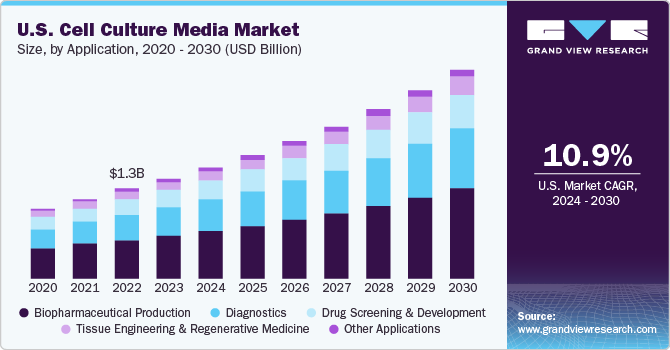

Application Insights

Based on application, the biopharmaceutical production segment dominated the market with a revenue share of 42.71% in 2023. The biopharmaceutical industry’s demand for more reproducible and better-defined media to meet the expanding production levels while reducing the risk of contamination in the downstream processes is significantly increasing the demand for this market.

Moreover, strategic activities by key biopharmaceutical companies also drive the segment growth. For instance, in July 2021 Cytiva and Pall Corporation invested USD 1.5 billion over two years to meet the rising demand for biotechnology solutions. The two companies plan to invest USD 400+ million for culture media in powder or liquid along with expanding their operations in the U.S., Austria, and UK.

Type Insights

Based on type, the liquid media segment captured the highest revenue share of 62.9% in 2023. An increasing number of biologics and biosimilars manufacturers, both downstream and upstream, are switching from premixed powders to liquid media owing to factors such as rapid mycobacterial growth and high rate of isolation. Moreover, it eradicates a few process steps, and also reduces the probability of hazardous exposure, and makes manufacturing and development more flexible and simpler than powdered media. In addition, ready-to-use liquid media also eliminates the need for mixing containers, balances, and installation of water for injection (WFI) loop which is needed for mixing powder media.

The segment is also being driven by the strategic activities of the manufacturers. For instance, in June 2021, Sartorius opened its new site in Israel, which focuses on customized and specialty cell culture mainly for the advanced therapies market. This site will serve as a significant production site for buffers and liquid cell culture.

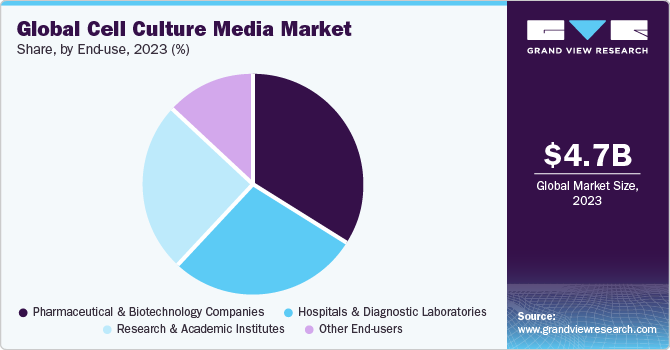

End-use Insights

The pharmaceutical and biotechnology companies segment captured the highest revenue share of 34.25% in 2023. The expansion of the current manufacturing capacities for biopharmaceuticals drives the demand for cell culture products. For instance, in September 2020, Cytiva announced the expansion of its manufacturing capacity and hiring personnel in significant areas to support the growth of the biotechnology industry. The company has planned investment of around USD 500 million for five years to increase the manufacturing capacity.

In addition, the increasing clinical trials will further offer lucrative opportunities in the review period. For instance, in 2021, the number of industry-sponsored trials in progress for regenerative medicine augmented by 100 as compared to 2020, bringing the total to 1,320. There were 1,328 regenerative medicine trials in progress worldwide supported by non-industry groups such as government entities and academic centers.

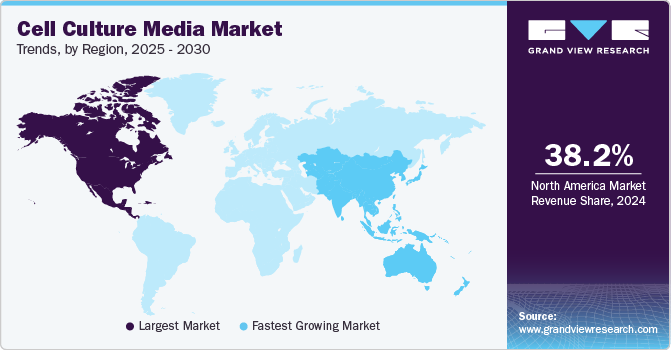

Regional Insights

North America dominated the regional market with a revenue share of 37.58% in 2023. This major share can be attributed to the growth in the pharmaceutical and biotechnology industries, mounting approvals for cell culture-based vaccines, and rising incidence of diseases such as cancer coupled with investments and funding in cell-based research.

Asia Pacific is estimated to grow at the fastest CAGR of 14.92% during the forecast period owing to the increase in awareness associated with the use of the cell culture technique. Furthermore, strategic activities by key market players to expand their presence in the Asia Pacific countries to capture high market share are expected to offer lucrative opportunities. For instance, In December 2021, Fujifilm Irvine Scientific, Inc. started the construction of its new bioprocessing center in China, with the aim to ensure cell culture media optimization support for biotherapeutic drug development, vaccines, and advanced therapies.

Key Companies & Market Share Insights

Key players in this market are implementing various strategies including partnership, merger and acquisition, geographical expansion, and strategic collaboration to expand their market presence. In July 2023, Merck KGaA invested USD 24.38 million to boost cell culture media production in the U.S. This development expanded the production capacity of the Lenexa facility to manufacture cell culture media.

In September 2023, Celltrion invested USD 94.5 million to construct a facility with an annual production capacity of 8 million vials in Songdo, Incheon. The new development is expected to increase the bioreactor capacity to 600,000 L and will be operational in 2027. In March 2023, Samsung Biologics announced that it would commence the construction of a fifth plant holding a capacity of 180,000 liters. Post completion, Samsung Biologics will maintain its global biomanufacturing capacity leadership with a total of 784,000 liters.

Key Cell Culture Media Companies:

- Sartorius AG

- Danaher

- Merck KGaA

- Thermo Fisher Scientific, Inc.

- FUJIFILM Corporation

- Lonza

- BD

- STEMCELL Technologies

- Cell Biologics, Inc.

- PromoCell GmbH

Cell Culture Media Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 5.27 billion

Revenue forecast in 2030

USD 10.70 billion

Growth rate

CAGR of 12.54% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

November 2023

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, application, type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France, Italy, Spain, Denmark, Sweden, Norway, China; Japan; India, South Korea, Australia, Thailand, Brazil; Mexico, Argentina, South Africa; Saudi Arabia, UAE, Kuwait

Key companies profiled

Sartorius AG; Danaher Corporation; Merck KGaA; Thermo Fisher Scientific, Inc.; FUJIFILM Corporation; Lonza; BD; STEMCELL Technologies; Cell Biologics, Inc.; PromoCell GmbH

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cell Culture Media Market Report Segmentation

This report forecasts revenue growth at global, regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global cell culture media market report based on product, application, type, end-use, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Serum-free Media

-

CHO Media

-

BHK Medium

-

Vero Medium

-

HEK 293 Media

-

Other Serum-free media

-

Classical Media

-

Stem Cell Culture Media

-

Specialty Media

-

Chemically Defined Media

-

Other Cell Culture Media

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Biopharmaceutical Production

-

Monoclonal Antibodies

-

Vaccines Production

-

Other Therapeutic Proteins

-

Diagnostics

-

Drug Screening And Development

-

Tissue Engineering And Regenerative Medicine

-

Cell And Gene Therapy

-

Other Tissue Engineering And Regenerative Medicine Applications

-

Other Applications

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Liquid Media

-

Semi-solid And Solid Media

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical And Biotechnology Companies

-

Hospitals And Diagnostic Laboratories

-

Research And Academic Institutes

-

Other End-users

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global cell culture media market size was estimated at USD 4.76 billion in 2023 and is expected to reach USD 5.27 billion in 2024.

b. The global cell culture media market is expected to witness a compound annual growth rate of 12.54% from 2024 to 2030 to reach USD 10.70 billion in 2030.

b. The serum-free media segment held the largest share of the cell culture media market. This is attributed to the increasing gene and cell therapy research along with advantages offered by SFM, which in turn is likely to increase the adoption and anticipate the market growth.

b. The key players competing in the cell culture media market include Danaher Corporation (CYTIVA), Sartorius Stedim Biotech, Thermo Fisher Scientific, Inc, and Merck KGaA.

b. Expansion of biosimilars and biologics, growth in stem cell research, and emerging bio manufacturing technologies for cell-based vaccines are the major factors which are likely to drive the cell culture media market.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."