- Home

- »

- Homecare & Decor

- »

-

Cat Litter Products Market Size And Share Report, 2030GVR Report cover

![Cat Litter Products Market Size, Share & Trends Report]()

Cat Litter Products Market Size, Share & Trends Analysis Report By Product Type (Clumping, Conventional), By Raw Material (Clay, Wood/Bamboo/Sawdust), By Distribution Channel (Convenience Stores, Online/E-commerce), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-3-68038-134-4

- Number of Pages: 130

- Format: Electronic (PDF)

- Historical Range: 2017 - 2021

- Industry: Consumer Goods

Cat Litter Products Market Size & Trends

The global cat litter products market size was estimated at USD 14.93 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 5.1% from 2023 to 2030. A rise in spending on pets coupled with an increase in the number of cat owners across the globe is expected to positively impact market growth. Two-thirds of respondents to a 2022 American Pet Products Association (APPA) study of pet owners said they take their animals into account while making financial goals. Pet owners showed a dedication to providing the required care for their animals, including food (75%) and brand loyalty (56%).

The cat litter products industry is experiencing growth due to the introduction of innovative products, such as paper-based and scented cat litter. Traditional cat litter products require cat owners to collect and dispose of the litter in plastic bags, which can be inconvenient. However, paper-based cat litter, made from materials similar to toilet paper, offers the advantage of easy disposal in the toilet. In addition, scented cat litter is gaining traction in the market, benefiting from the overall increase in demand for scented consumer products. With convenience being a priority for pet owners, the online retail channel has witnessed a surge in cat litter sales.

Consumers prefer car litter that is biodegradable, renewable, and does not contain chemicals or any fragrances. Companies are therefore investing in research and development (R&D) to introduce new natural products that are safe and efficient at the same time. For instance, The Original Poop Bags, a Georgia, U.S.-based company, launched Catfidence, a 100% organic bamboo cat litter. It is manufactured from sustainable pine and bamboo and is certified as compostable. Rising initiatives by various companies in this space are expected to have a positive impact on the market.

Consumers want natural cat litter with functions and features similar to clay-based litter. This means the product should be easy to clean and scoop and offer efficient odor control. Sustainably Yours, a U.S.-based natural cat litter brand, mixes cassava and corn to develop sustainable and renewable cat litter with exceptional performance. The unique formulation results in cat litter with outstanding odor-control and clumping properties, making it extremely easy to scoop and clean.

In the past decade, global pet adoption has significantly increased. A 2021 report from the European Pet Food Industry Federation (FEDIAF) revealed that 46% of European Union households owned a pet, with 26% of the European population having at least one cat, totaling 113.58 million cats in Europe. Pet adoption initiatives play a pivotal role in promoting pet ownership and boosting revenue for pet care product manufacturers. These initiatives raise awareness about the benefits of pet adoption, encourage responsible pet ownership, and provide resources to prospective pet owners.

To capitalize on the prevailing trends market players have been expanding their product facilities enabling it to meet growing demand. In October 2022, for instance, The Clorox Company announced the opening of its Martinsburg cat litter facility. The purpose of constructing this plant was to facilitate the production of cat litter brands, specifically Fresh Step and Scoop Away. The company had publicly announced its intentions to establish the facility in January 2020, highlighting a significant investment of USD 190 million in the Berkeley County location.

Cat litter has become a very common product among cat owners, primarily among multi-cat owners. However, the high price associated with the product and the unwillingness of a few pet owners to buy costly products for their pets may act as a market restraint. Further, this results in a situation where the market fails to introduce premium products, in turn, hampering the market growth.

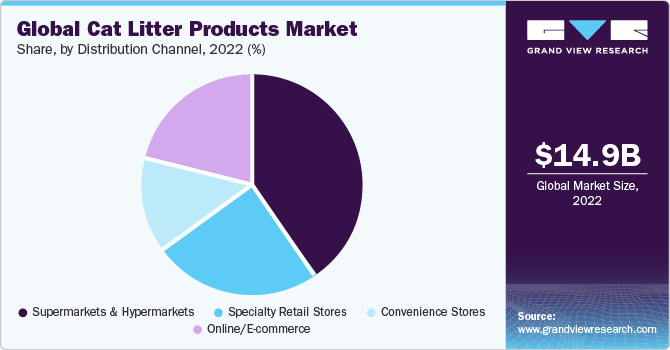

Distribution Channel Insights

Based on distribution channel, the supermarkets and hypermarkets segment dominated the market with a revenue share of about 39% in 2022. Pet owners prefer purchasing pet care, pet food, and pet grooming products from these channels as these are less expensive than prescription-based products due to various discounts & sales offered at the stores. According to survey data published in an article by Global Pet Industry in February 2020, Walmart stood out as the leading choice among cat owners for purchasing cat litter, with 37% of them making litter purchases at Walmart from 2019 to 2020. Apart from Walmart, big stores such as Target and Kmart were also popular places for buying cat litter, with around 25% of cat owners choosing them for litter shopping.

The online/E-commerce channel is expected to witness strong demand for cat litter products and is expected to grow with a CAGR of 6.2% over the forecast period. Online platforms have enabled manufacturers to gain potential customers, improve their communication, track finances, and cost-effectively boost brand awareness. Digitalization has offered the cat litter market several growth avenues and an active consumer base that prefers shopping online. Many cat litter manufacturers Purina Tidy Cats; World’s Best Cat Litter; and Arm & Hammer have their own websites where customers can purchase them directly.

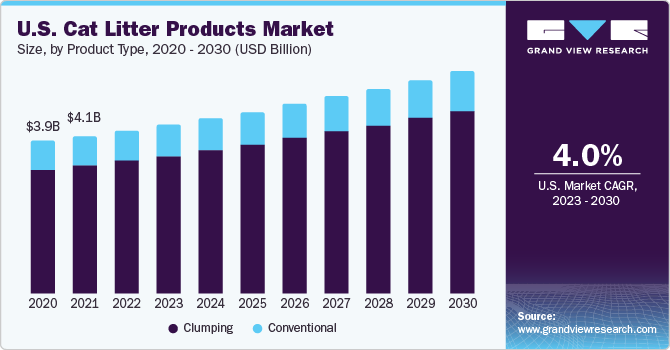

Product Type Insights

The clumping cat litter segment dominated the market with a revenue share of around 74% in 2022 and is anticipated to have the fastest CAGR of 5.3% over the forecast period. Clumping litter is increasingly gaining consumer attention as cat urine and feces can be removed easily without emptying the litter box. Moreover, the increasing prominence of clumping cat litter owing to its functionality and various benefits will likely draw consumer attention and boost product sales over the forecast period. Hard-clumping cat litter is often favored by cat owners. For instance, ARM & HAMMER offers HardBall cat litter, which is one of the hardest clumping litters. The product instantly and thoroughly absorbs moisture, forming clumps of rock-hard material that practically shrinks waste.

The conventional segment is anticipated to grow with a CAGR of 4.5% over the forecast period. The demand for traditional litter products is being driven by increased consumer preference toward entirely removing the odor associated with cat urine and feces. Rising consumer inclination toward low-priced litter products owing to their repeated usage is boosting the sales of conventional cat litter. According to a blog by PetSafe, the average price of conventional clay-based litter that requires weekly replacement is around USD 0.50, while the average price of clumping litter is around USD 0.75 to USD 1.30.

Regional Insights

The North America region dominated the global industry with a revenue share of about 39% in 2022. The trend of adopting pets gained momentum in the region, especially during the pandemic, when people were spending more time at home. According to the American Pet Products Association (APPA), the number of pet-owning households increased from 67% in 2019 to 70% in 2020. A surge in the utilization of technology in cat litter products has also been pushing the markets. For instance, in April 2023, HHOLOVE announced the launch of iPet Smart Litter Box on Kickstarter, a global crowdfunding platform, for North American consumers.

Europe is anticipated to have high potential in the market. This is attributable to cat adoption among consumers. Moreover, the increasing cat population over the past few years in Europe has resulted in a rising need for more than one cat in numerous households. As per the European Pet Food Industry Federation (FEDIAF), in 2020, more than 110 million cats were present as pets in 88 million European households. The UK cat litter products industry was valued at USD 456.3 million, which is primarily driven by the rising number of cat owners in the UK. According to the Pet Food Manufacturers’ Association (PFMA), in April 2022, more than 12 million cats were adopted as pets in UK households. Furthermore, in April 2022, 28% of the households in the UK had at least one cat as a pet, further driving the demand for cat litter in the country.

The Asia Pacific region is expected to witness strong demand and is anticipated to grow at a CAGR of 6.9% over the forecast period. The growth is primarily attributed to an increase in nuclear households and a rise in disposable income. Moreover, increasing pet ownership in the region, coupled with growing spending on healthcare, food, and litter products, is expected to have a positive impact on the business over the forecast period. China’s cat litter products industry was valued at about USD 762 million and is witnessing significant growth owing to an increase in the pet adoption rate in the country. For instance, according to the 2021 White Paper on China’s Pet Consumption Trends, Chinese cities saw an almost 50% increase in pets since 2015, demonstrating the industry’s enormous potential.

Raw Material Insights

Based on raw material, the clay segment dominated the market with a revenue share of about 81% in 2022. This is attributable to the increasing usage of clay in creating cat litter products, owing to its high absorbency and solid-formation qualities boosting the segment's expansion. Furthermore, clay-based products are less expensive than other materials, making them a popular choice among middle-income and multi-cat homes. Furthermore, such items are dust-free and odorless, lowering the risk of respiratory problems.

The wood/bamboo/sawdust segment is anticipated to grow at a CAGR of 8.2% over the forecast period. As consumers increasingly prioritize sustainable and eco-friendly choices, there is a growing demand for wood-based cat litter products. The pellets are produced from recycled softwood materials and offer versatility, effectiveness, and environmental benefits. Healthy Pet, a pet care product brand, offers a range of ökocat wood-based clumping and non-clumping cat litter. The line of eco-friendly and biodegradable cat litter features specially designed mini wood pellets known for their excellent moisture absorption properties.

Key Companies & Market Share Insights

The industry is characterized by the presence of a few established players and new entrants. Players in the market are diversifying and expanding their operations, adopting product launches, and other strategies to maintain market share.

-

In April 2023, Kent Corporation commenced the construction of its manufacturing plant in Muscatine, Iowa. Spanning 113,000 square feet, the facility will be situated on 70 acres of land adjacent to the KENT Distribution Center. It will be equipped with cutting-edge manufacturing machinery, dedicated research and development (R&D) spaces, and ample room for future expansion initiatives.

-

In December 2022, Church & Dwight Co., Inc. announced the expansion of its Ohio, U.S. plant. This expansion was aimed at increasing the facility’s manufacturing capacity for cat litter and involved a substantial investment in machinery, equipment, new processing equipment, and rail enhancements. Upon the project's completion in 2024, it is expected to generate 80 new job opportunities.

Key Cat Litter Products Companies:

- Nestlé S.A.

- The Clorox Company

- Mars, Incorporated

- Oil-Dri Corporation of America

- Church & Dwight Co., Inc.

- Kent Corporation

- Intersand

- Dr. Elsey's

- Weihai Pearl Silica Gel Co., Ltd.

- Pettex Limited

Cat Litter Products Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 15.65 billion

Revenue forecast in 2030

USD 22.31 billion

Growth rate

CAGR of 5.1% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product type, raw material, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; France; Germany; UK; Spain; Italy; China; India; South Korea; Japan; Taiwan; Brazil; South Africa

Key companies profiled

Nestlé S.A.; The Clorox Company; Mars, Incorporated; Oil-Dri Corporation of America; Church & Dwight Co., Inc.; Kent Corporation; Intersand; Dr. Elsey's; Weihai Pearl Silica Gel Co., Ltd.; Pettex Limited

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

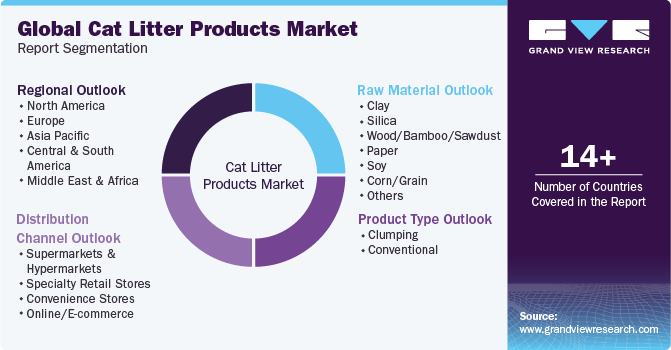

Global Cat Litter Products Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global cat litter products market report based on product type, raw material, distribution channel, and region:

-

Product Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Clumping

-

Conventional

-

-

Raw Material Outlook (Revenue, USD Million, 2017 - 2030)

-

Clay

-

Silica

-

Wood/Bamboo/Sawdust

-

Paper

-

Soy

-

Corn/Grain

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2017 - 2030)

-

Supermarkets and Hypermarkets

-

Specialty Retail Stores

-

Convenience Stores

-

Online/E-commerce

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

India

-

South Korea

-

Japan

-

Taiwan

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global cat litter products market size was estimated at USD 11.23 billion in 2022 and is expected to reach USD 11.64 billion in 2023.

b. The global cat litter products market is expected to grow at a compound annual growth rate of 5% from 2023 to 2030 to reach USD 16.63 billion by 2030.

b. North America led the global cat litter products market in 2022 accounting for a revenue share of over 40%.

b. Some key players operating in the cat litter products market include Teladoc; Doctor on Demand; iCliniq; IBM; Intel Corporation; Philips Healthcare; McKesson Corporation; AMD Telemedicine; GE Healthcare; CardioNet Inc.; 3m Health Information Systems; Medic4all; CirrusMD Inc.; Cisco; and American Telecare Inc.

b. Key factors that are driving the cat litter products market growth include the rising number of cat owners across the globe, coupled with the growing demand for advanced pet hygiene solutions.

b. The clay segment accounted for the maximum revenue share of more than 83% in 2022 and is expected to grow at a significant CAGR from 2023 to 2030 in the cat litter products market.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."

Important: Covid19 pandemic market impact

The home care & decor industry has been witnessing inconsistent growth, since the Covid 19 outbreak. As a result of the ongoing pandemic crisis, there has been a drop in the overall performance of discretionary products such as decorative fixtures, bedding products, to name a few. The virus outbreak has, however, led to substantial growth in categories such as cleaning and hygiene products. Prominent growth in the e-commerce business is also one of the positive influences of the outbreak, wherein companies are focusing on expanding their distribution networks to online channels in order to cater to the surging consumer demand. Our team is diligently working towards accounting these factors in our report with the aim of providing you with the up-to-date, actionable market information and projections.