- Home

- »

- Consumer F&B

- »

-

Carob Powder Market Size, Share & Trends Report, 2030GVR Report cover

![Carob Powder Market Size, Share & Trends Report]()

Carob Powder Market Size, Share & Trends Analysis Report By Application (B2B, B2C), By Product (Natural, Organic), By Region (Europe, Asia Pacific, North America)), And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68038-216-7

- Number of Pages: 80

- Format: Electronic (PDF)

- Historical Range: 2017 - 2021

- Industry: Consumer Goods

Report Overview

The global carob powder market size was estimated at USD 53,929 thousand in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 4.2% from 2023 to 2030. Increasing awareness about health and wellness has led to a growing demand for healthier food options. Carob powder is perceived as a healthier alternative to cocoa powder as it is naturally sweet, low-fat, and contains no caffeine. It is also gluten-free and rich in protein, fiber, and calcium, which makes it a highly preferred option among health-conscious consumers. Thus, the product is widely used in the confectionery, bakery, and pet food sectors. It is free from common allergens, such as dairy, soy, and nuts, making it suitable for individuals with allergies or dietary restrictions. Thus, it is also a popular choice among vegans.

The caffeine-free nature of the product makes it highly popular, resulting in its increased adoption among caffeine-intolerant consumers, thus driving market growth. In addition, it has approximately three times as much calcium as cocoa. Therefore, it is particularly well-liked by people with calcium deficiencies. Carob powder possesses several functional properties making it desirable in the food industry. For example, it acts as a natural-thickening agent, imparting a smooth texture to products, and enhancing the flavor profile. These properties make it a sought-after ingredient in various applications, including confectionery, bakery, and beverages. In addition, carob trees are considered a sustainable crop due to their ability to thrive in arid regions with minimal water requirements.

Moreover, these trees contribute to soil health and have a positive impact on the environment. The sustainability aspect of its production appeals to environmentally conscious consumers. Such factors are expected to boost market growth in the coming years. Consumers are increasingly seeking natural and organic food products. Carob powder is derived from the pods of carob trees without the need for additional processing, making it a natural ingredient. In addition, organic carob powder, produced without the use of synthetic chemicals, caters to the demand for organic food choices. This ingredient is used in various food and beverage applications. Organic carob powder is commonly used as a cocoa powder substitute in baked goods, chocolate products, hot beverages, and ice creams.

The versatility of this ingredient opens up opportunities in both commercial food production and home cooking further driving the market growth. As the vegan population is growing globally, the demand for plant-based or vegan food and beverages is also growing. With the increasing demand for vegan products, the use of carob powder is also expected to grow, offering key growth opportunities for the global market. According to the data published by The Future of Plant-based, the average annual growth of the launch of food products claimed plant-based or vegan has increased by 21% between 2015 and 2019, whereas the growth of the launch of plant-based beverages grew by 58% during the same period.

Such factors are expected to expand the scope of this ingredient as a vegan ingredient in the formulation of various food products. Due to sedentary lifestyles and changes in habits, the global diabetic population is significantly growing. According to the data published by the International Diabetes Federation (IDF), in 2021, approximately, 537 million adults aged 20 to 79 years had diabetes. Moreover, this figure is expected to reach 643 million by 2030 and 783 million by 2045. However, consumers are becoming more conscious and are opting for healthier options. This scenario is expected to increase the product application scope as a natural sweetener.

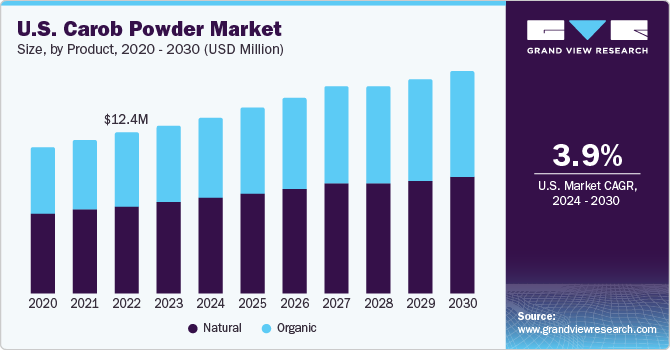

Product Insights

The natural product segment held the largest revenue share of 56.5% in 2022. This can be attributed to the wider penetration, popularity, and easy availability of natural carob powder, which is the raw material for chocolates. In addition, natural carob powder is inexpensive making it easily accessible and a major factor driving the segment growth. Moreover, the growing consumer preference for natural and plant-based food ingredients has contributed to the rise in demand for carob powder. Carob powder is derived from the carob tree and is considered a natural alternative to cocoa powder.

The organic product segment is expected to grow at a CAGR of 4.7% over the forecast period. Consumers are increasingly seeking organic food products due to concerns about pesticides, synthetic additives, and environmental sustainability. Organic carob powder is produced without the use of synthetic fertilizers, pesticides, or genetically modified organisms (GMOs), making it an attractive choice for health-conscious and environment-conscious consumers. The rising awareness about health and wellness has fueled the demand for organic products, including carob powder. Organic carob powder is perceived as a healthier alternative to conventional one, as it is produced using organic farming practices that prioritize soil health, biodiversity, and natural inputs. These factors drive the segment growth.

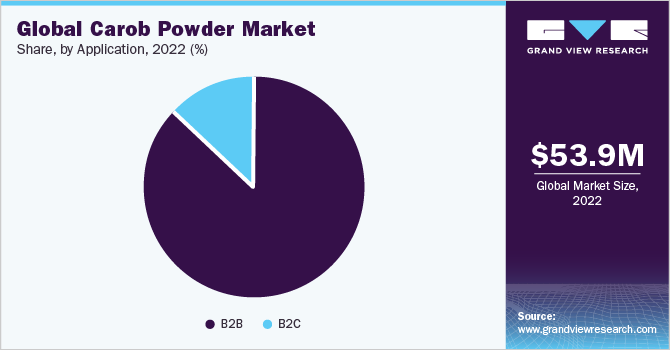

Application Insights

The B2B segment held the largest share of 87.1% in terms of application and generated a revenue of USD 46,957.1 thousand in 2022. This is attributed to the increasing application of carob powder in confectionery and bakery products along with sauces, spreads, beverages, and others. In recent years, the global bakery industry has been witnessing growth as the industry participants have been increasingly spending on the development of healthy baked goods and premium artisanal products. Therefore, carob powder is expected to find utility as a functional ingredient in the manufacturing of these baked goods.

The B2C segment is anticipated to be the fastest-growing segment, growing at a CAGR of 5.9% from 2023 to 2030. The growth of the market is driven by health consciousness, dietary suitability, vegan trends, clean label preferences, unique flavor profile, and accessibility through online retail channels. As consumers seek out healthier, allergen-free, and plant-based alternatives, carob powder provides an appealing option for a variety of homemade recipes and consumer-packaged goods. Moreover, as consumers worldwide are becoming more interested in healthier food options, they have been practicing baking at home to avail actual nutrition benefits. This trend is expected to promote the utility of carob powder as a baking agent in home recipes over the next few years.

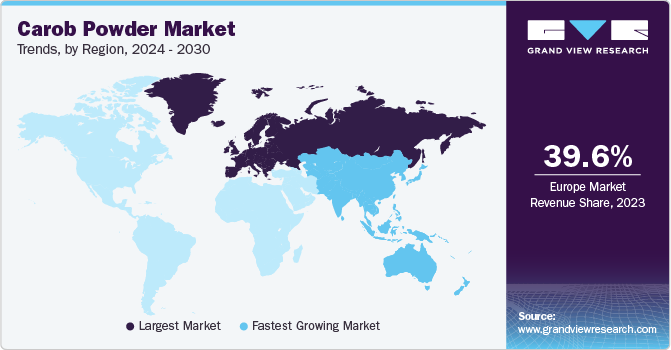

Regional Insights

Europe held a share of 39.7% of the overall revenue in 2022. This is attributed to growing consumer interest in healthier alternatives to chocolate. Europe is among the largest consumers of chocolates and bakery products globally. Moreover, consumers are increasingly shifting toward plant-based or plant-derived products, leading to an increase in the vegan population. This is eventually fueling demand for this product in the region. In addition, the UK market was valued at USD 3,468.8 thousand in 2022 and is anticipated to grow at a CAGR of 2.8% over the forecast period from 2023 to 2030. This is attributed to its increasing product usage owing to its unique flavor and versatility.

The Asia Pacific market was valued at USD 11,269.0 thousand in 2022 and is expected to grow at a CAGR of 5.3% from 2023 to 2030. The growing popularity of carob powder owing to its rich nutritional content is the main factor driving the product demand in the region. Furthermore, the growing availability of carob powder at supermarkets and hypermarkets will boost the demand in the coming years. Moreover, shifting consumer inclination toward sugar-free alternatives owing to the growing prevalence of diabetes in countries, such as India and China, is expected to boost the product demand in the coming years.

North America was valued at USD 13,882.4 thousand in 2022 and is expected to grow at a CAGR of 4.4% over the forecast period. In addition, the U.S. market was valued at USD 12,372.1 thousand in 2022 and is expected to grow at a CAGR of 4.2% from 2023 to 2030. Carob powder has low fat and calorie content compared to cocoa powder and is perceived as a healthier choice. It is often used as a substitute for cocoa powder in various recipes, including baked goods, desserts, and beverages. Moreover, the demand for plant-based and vegan products is on the rise in North America. Carob powder, derived from the carob tree, is a plant-based ingredient that serves as a suitable substitute for cocoa powder in vegan recipes. It allows consumers to enjoy chocolate-like flavors while adhering to their dietary preferences. Such factors are driving the market growth in the region.

Key Companies & Market Share Insights

Key industry players face intense competition and have large customer bases for their products in both, regional and international markets. New product launches and establishment of strategic business units in developing economies including China and India are expected to remain the key strategies among the industry participants. Some of the key players operating in the global carob powder market include:

-

The Australian Carob Co.

-

The Carob Kitchen

-

Frontier Co-op.

-

Chatfield’s

-

OliveNation

-

NOW Foods

-

Ingredients UK

-

Jedwards International, Inc.

-

Eurl Ouasdi International

-

Healthworks

Carob Powder Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 56,571.7 thousand

Revenue Forecast in 2030

USD 75,101.5 thousand

Growth rate

CAGR of 4.2% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report upated

July 2023

Quantitative units

Revenue in USD thousand and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; Australia & New Zealand; South Korea; South Africa; Brazil

Key companies profiled

The Australian Carob Co.; The Carob Kitchen; Frontier Co-op.; Chatfield’s; OliveNation; NOW Foods; Ingredients UK; Jedwards International, Inc.; Eurl Ouasdi International; Healthworks

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

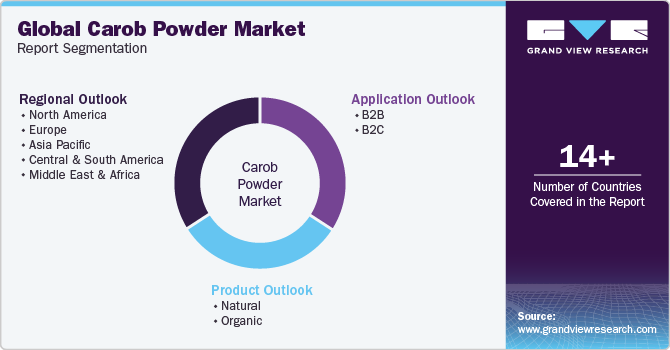

Global Carob Powder Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segment from 2017 to 2030. For this study, Grand View Research has segmented the carob powder market report based on product, application, and region:

-

Product Outlook (Revenue, USD Thousand, 2017 - 2030)

-

Natural

-

Organic

-

-

Application Outlook (Revenue, USD Thousand, 2017 - 2030)

-

B2B

-

Bakery

-

Confectionary

-

Others

-

-

B2C

-

-

Regional Outlook (Revenue, USD Thousand, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia & New Zealand

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global carob powder market size was estimated at USD 53,929 thousand in 2022 and is expected to reach USD 56,571.7 thousand in 2023.

b. The global carob powder market is expected to grow at a compounded growth rate of 4.2% from 2023 to 2030 to reach USD 75,101.5 thousand by 2030.

b. Europe dominated the global carob powder market with a share of 39.7% in 2022. This is attributed to the increasing shift of consumers towards plant-based or plant-derived products, leading to an increase in the vegan population thus resulting in increased demand for carob powder.

b. Some key players operating in the carob powder market include AUSTRALIAN CAROB CO.; The Carob Kitchen; Frontier Co-op.; Chatfield’s; OliveNation; NOW Foods; Ingredients UK; Jedwards International, Inc.; Eurl Ouasdi International; and Healthworks.

b. Key factors that are driving the carob powder market growth include increasing awareness about health and wellness and the growing use of carob powder as an alternative to cocoa powder.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."