- Home

- »

- Advanced Interior Materials

- »

-

Calcium Carbonate Market Size And Share Report, 2030GVR Report cover

![Calcium Carbonate Market Size, Share & Trends Report]()

Calcium Carbonate Market Size, Share & Trends Analysis Report By Type (GCC, PCC), By Application (Automotive, Building & Construction, Pharmaceutical, Agriculture, Pulp & Paper), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-2-68038-296-9

- Number of Pages: 110

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Advanced Materials

Calcium Carbonate Market Size & Trends

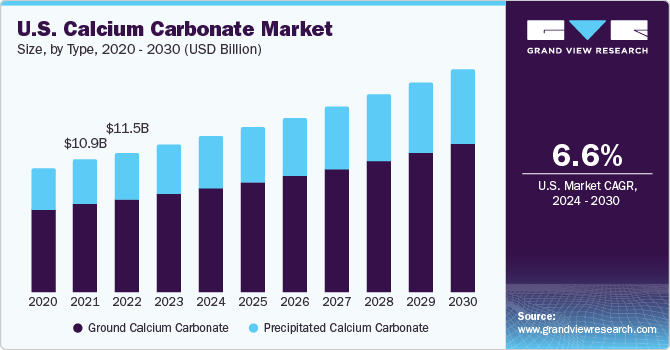

The global calcium carbonate market size was valued at USD 44.7 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 6.6% from 2023 to 2030. Increasing demand for paper from packaging applications and hygiene-related products like tissue paper is a significant growth driver. However, product demand witnessed a decline in 2020 owing to the coronavirus outbreak. The pandemic caused widespread shutdowns across the globe, which significantly impacted the economy worldwide in the first half of 2020. With the ease in restrictions in the second half of the year, companies are putting in extra efforts to resume their operations, which is a positive sign for market growth.

The U.S. has been a prominent destination for the product considering high demand from industries including paints & coatings, adhesives & sealants, and paper manufacturing. Paper is the largest application segment of the market, and the U.S. is among the world’s largest paper manufacturers. Despite the pandemic that impacted the country’s economy, the demand for calcium carbonate continues to persist, especially in the paper production sector, owing to a growing emphasis on cleanliness.

Calcium carbonate is used to produce calcium citrate (citric acid), which is used as a food additive, a preservative, an acidifier, or a flavoring agent. It is used in applications such as cleaning agents, cosmetics, pharmaceuticals, and dietary supplements. It is also used to adjust the pH value of water through the neutralization process. Untreated water is passed through filters, which contain calcium carbonate; the material dissolves in the water and raises its pH levels to greater than 6. The demand for treated drinking water is rising with an increase in population, which is expected to drive the use of calcium carbonate as a water-treating ingredient in the coming years.

The calcium carbonate market has been hampered by supply chain instability, a slowdown in raw material production, trade movement slowing, and a decline in construction, vehicle, and paint and coatings demand due to the COVID-19 pandemic. Calcium carbonate demand is tied directly to numerous industries experiencing business uncertainty, such as automotive, paper, plastics, and building & construction.

A drop-in paper consumption from corporate offices, schools & universities, and the newspaper and printing industries have hampered the paper industry's growth. However, new application categories, including hygiene paper products, food packaging, medical specialty sheets, and corrugated packaging, have provided opportunities for the business, which is driving up demand for calcium carbonate, reducing the pandemic's impact to some extent.

According to the American Forest & Paper Association, the U.S. paper and wood products industry recorded high levels of tissue production in February and March 2020. The U.S. mills produced around 700 kilotons of tissue in March. Factors like lockdown and extra hygiene concerns led to panic buying and stockpiling of tissues and other cleaning products, thereby benefitting the market growth.

Despite the demand for calcium carbonate in the paper segment, the market witnessed a dip in 2021 owing to restricted transportation, a halt in manufacturing operations for non-essential industries, and the shutdown of mines across various regions. Several market players reported negative sales and profits for the first half 2021.

For instance, LafargeHolcim, an integrated player in the market, reported a 14% profit fall in Q1 of 2020 as the pandemic caused building sites to shut down worldwide. The company mines limestone produces calcium carbonate, and uses it to manufacture cement, which is further catered to the construction industry. The company had to stop its mining activities in March 2020 in Meghalaya, India, due to lockdown; however, the operations resumed after a couple of months as mining activities were allowed by the state government with the enforcement of social distancing norms and proper hygiene conditions.

Type Insights

The ground calcium carbonate segment dominated with a revenue share of 68.7% in 2022. This growth is attributed to the fact that when compared to other inorganic powders, GCC powder is relatively affordable and possesses superior whiteness, inertness, and incombustibility, as well as low oil- and water adsorption. It is commonly utilized in polymer composites to enhance physical properties and improve workability. Simultaneously, the cost of polymer composites can be significantly reduced by replacing expensive resins with affordable GCC fillers.

The precipitated calcium carbonate segment is expected to grow fastest over the forecast period. It is a novel lime-derived substance with numerous industrial applications. It is produced by hydrating high-calcium quicklime and reacting the resultant slurry with carbon dioxide. The finished product is bright white with homogeneous narrow particle size dispersion.

PCC is available in various crystal morphologies and sizes that can be adjusted to enhance performance in a particular application. Applications of PCC include food & beverages, pharmaceuticals, rubbers, PVC/plastics, paints, adhesives & sealants, and thermal & electrical insulators. It is also used as a substitute for additives and wood pulp for manufacturing high-quality paperboard and paper as it is a cost-effective mineral.

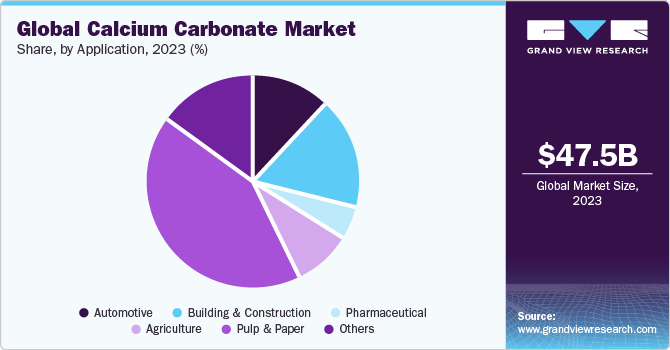

Application Insights

The paper segment emerged as the largest application segment in 2022 and accounted for a revenue share of around 41.8%. Calcium carbonate is added as a filler to the paper pulp or is applied as a coating pigment. Its addition enhances the brightness and opacity of the paper. Although the Internet did impact the print media market, it did not restrict the demand for paper in other applications, such as packaging and tissue paper.

The pandemic has compelled manufacturers to ramp up their production to cater to the rising consumer needs. For instance, in August 2020, Celulosa Argentina announced an increase in its production of paper packaging by 30%. The company focused on the food industry as the demand surged in this sector. With a rise in the e-commerce sector and the growing usage of tissue papers, the paper application segment is anticipated to continue its dominance over the forecast period.

Building & construction is expected to witness growth over the forecast period. The global construction industry is a fast-growing sector. However, the outbreak of COVID-19 and the lockdown imposed by governments hampered the expansion of the construction industry. With the opening up of markets, the sector gained momentum immediately. According to Oxford Economics, the global construction industry is expected to reach ~USD 8 trillion by 2030 and will be mainly driven by the U.S. and India. The growth is attributed to the high demand for better public infrastructure, such as rail transport systems, roadways, airports, and harbors, triggering demand for calcium carbonate over the forecast period.

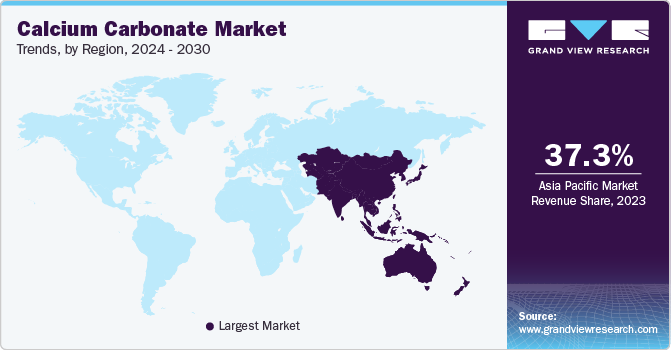

Regional Insights

Asia Pacific dominated the global market and accounted for the largest revenue share of more than 37.6% in 2022. The region is anticipated to expand further at a steady CAGR from 2023 to 2030 due to rising investments in the infrastructure development and manufacturing sector. However, due to the pandemic, the manufacturing operations and supply chain have been immensely impacted. Apart from China, all other major Asian countries have reported negative GDP growth for the second quarter of 2020.

Economies are putting in extra efforts for the proper functioning of operations in different sectors by maintaining essential protocols required during the pandemic. As the operations resume, specific industries have reported positive news; for instance, automotive sales in India increased in the past two months. Also, the demand for paints & coatings, and vehicles is anticipated to increase, which, in turn, will augment the demand for calcium carbonate.

North America was the second-largest regional market. Though the pandemic has severely impacted the region, the end-use industries of the market have begun their operations at minimal capacity considering the rise in consumer demand. Industries including medical, packaging, and DIY are boosting the demand for products such as adhesives and paper, a positive sign for the calcium carbonate industry.

For instance, In January 2021, Gabriel Performance Products (Gabriel) was acquired by Huntsman Corporation from Audax Private Equity. Gabriel is a North American specialty chemical producer of specialized epoxy curing agents and additives for the sealants, coatings, composites, and adhesives end markets.

The U.S. held the largest share in the North American region and is expected to maintain its dominance over the forecast period. Considering the product demand in the country, companies are engaged in boosting their production capacities and expanding their presence there.

For instance, in March 2020, Anglo Pacific Group PLC announced entering into a financing agreement with Incoa Performance Minerals LLC for funding the construction of a calcium carbonate-associated infrastructure in the Dominican Republic.

Key Companies & Market Share Insights

The market is highly competitive as various players are integrated across the value chain with their presence in mining operations, processing facilities, and the application sector. Manufacturers have collaborated with market leaders to produce calcium carbonate to enhance their market penetration and product positioning. For example, in February 2022, The Sherwin-Williams Company entered a deal with the city of Statesville, the state of North Carolina, and Iredell County to considerably increase its architectural coatings and paint manufacturing capacity and open a more extensive distribution facility in Statesville, North Carolina.

In addition, in November 2019, Imerys acquired three manufacturing facilities from EDK (a leading Brazilian producer of GCC). The acquisition aimed at expanding the former’s footprint in South America and boosting its product portfolio for paints & coatings applications. The competitive scenario was quite intense post-2019 with the coronavirus outbreak, with various players reporting losses in their sales. Some prominent players in the global calcium carbonate market include:

-

AGSCO Corp.

-

Carmeuse

-

Blue Mountain Minerals

-

GCCP Resources

-

GLC Minerals, LLC

-

Greer Limestone Company

-

Gulshan Polyols Ltd.

-

ILC Resources

-

Imerys

-

Mineral Technologies

-

Mississippi Lime

-

Omya

-

Parchem Fine & Specialty Chemicals

-

The National Lime & Stone Company

-

United States Lime & Minerals, Inc.

Calcium Carbonate Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 47.53 billion

Revenue forecast in 2030

USD 74.64 billion

Growth Rate

CAGR of 6.6% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million, Volume in kilotons, and CAGR from 2023 to 2030

Report coverage

Volume forecast, revenue forecast, company market positioning, competitive landscape, growth factors, and trends

Segments covered

Type, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; Spain; Valencia; China; India; Japan; South Korea; Argentina; Brazil; Saudi Arabia; South Africa

Key companies profiled

AGSCO Corp.; Carmeuse; Blue Mountain Minerals; Carmeuse Lime & Stone Company; GCCP Resources; GLC Minerals, LLC; Greer Limestone Company; Gulshan Polyols Ltd.; ILC Resources; Imerys; J.M. Huber Corp.; LafargeHolcim; Midwest Calcium Carbonates; Mineral Technologies; Mississippi Lime; Mountain Materials, Inc.; NALC, LLC; Omya; Parchem Fine & Specialty Chemicals; The National Lime & Stone Company; United States Lime & Minerals, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase option

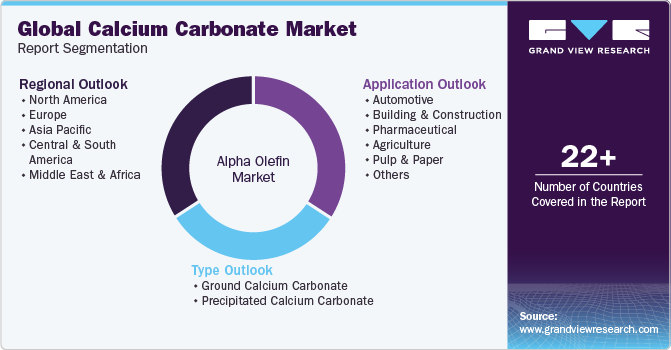

Global Calcium Carbonate Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global calcium carbonate market report based on type, application, and region:

-

Type Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

Ground Calcium Carbonate

-

Precipitated Calcium Carbonate

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

Automotive

-

Building & Construction

-

Pharmaceutical

-

Agriculture

-

Pulp & Paper

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Valencia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Argentina

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global calcium carbonate market size was estimated at USD 44.7 billion in 2022 and is expected to reach USD 47.53 billion in 2023.

b. The global calcium carbonate market is expected to grow at a compound annual growth rate of 6.6% from 2023 to 2030 to reach USD 74.64 billion by 2030.

b. The paper segment emerged as the largest application segment in 2022 and accounted for a revenue share of around 41.8%. Calcium carbonate is added as a filler to the paper pulp or is applied as a coating pigment. Its addition enhances the brightness and opacity of the paper.

b. Some of the key players operating in the calcium carbonate market are AGSCO Corp., Carmeuse, Blue Mountain Minerals, Carmeuse Lime & Stone Company, GCCP Resources, GLC Minerals, LLC, Greer Limestone Company, Gulshan Polyols Ltd., ILC Resources, Imerys, J.M. Huber Corp., LafargeHolcim, Midwest Calcium Carbonates, Mineral Technologies, Mississippi Lime, Mountain Materials, Inc., NALC, LLC, Omya, Parchem Fine & Specialty Chemicals, The National Lime & Stone Company, United States Lime & Minerals, Inc.

b. One of the key factors is rising concerns pertaining to health awareness that is boosting the demand for hygiene-related products such as tissue paper, which is anticipated to propel calcium carbonate market growth.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."

Important: Covid19 pandemic market impact

The mining industry accounts for a vital share of the global economy and is responsible for supplying key raw materials for several applications and end-use industries, thus being a key sector of focus amidst the ongoing pandemic outbreak. Mining industries in China are expected to return to normal operations by Q3 of 2020 as enterprises indicated towards the returning of their workers soon. Moreover, Iron ore producers are known to be the least impacted. Major players such as BHP and Vale reported experiencing no major influence on their operations due to the COVID-19 virus. The iron ore prices reached above USD 90 per ton amidst the pandemic situation which may negatively impact the end-use industries. The report will account for Covid19 as a key market contributor.