- Home

- »

- Electronic Devices

- »

-

Brushless DC Motor Market Size And Share Report, 2030GVR Report cover

![Brushless DC Motor Market Size, Share, & Trends Report]()

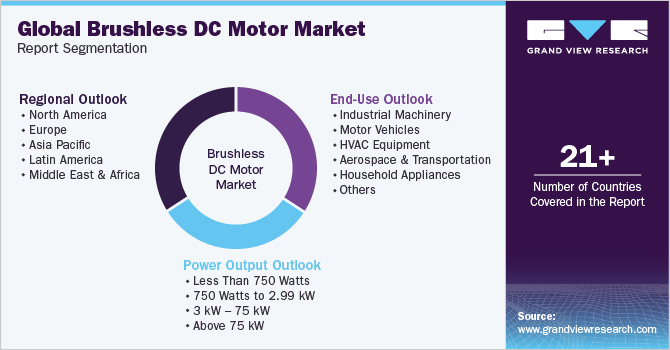

Brushless DC Motor Market Size, Share, & Trends Analysis Report By Power Output (Less than 750 Watt, 750 watt- 2.99kW, 3kW- 75 kW, Above 75kW), By End-use, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-2-68038-820-6

- Number of Pages: 110

- Format: Electronic (PDF)

- Historical Range: 2017 - 2021

- Industry: Semiconductors & Electronics

Report Overview

The global brushless DC motor market size was valued at USD 18,825.4 million in 2022 and is expected to witness a CAGR of 6.5% from 2023 to 2030. The ability of Brushless DC (BLDC) motors to save energy and increase the operational efficiency of equipment in which they are used is expected to drive the growth of the market over the forecast period. These motors offer optimum efficiency and reliability at the same time, which proves to be economical in the majority of applications, such as window lifters, air conditioners, and sun-roof actuators. These motors are thermally resistant, require low maintenance, and operate at low temperatures, eliminating any threat of sparks.

The emergence of sensor-less controls for BLDC type is likely to boost the durability and reliability of the product, thereby reducing the number of mechanical misalignments, electrical connections, as well as the weight and size of the end product. These aforementioned factors are estimated to drive market growth. Furthermore, the market is driven by the rising activity in the Electric Vehicle (EV) industry, globally. The growing popularity of vehicle features, such as motorized seats, adjustable mirrors, and sunroof systems, is driving the demand for BLDC motors.

The market is witnessing tremendous growth. This can be attributed to the increase in automobile production and the number of BLDC motors used in a car. Automotive motors are used in vehicle powertrain systems, chassis, and safety fittings. The increasing popularity of features, such as motorized seats, wipers, doors, adjustable mirrors, and massage seats, is helping drive their demand, especially BLDC motors.

The increasing adoption of EVs is contributing to the alleviation of problems, such as oil dependency, global warming, and environmental pollution. Several governments have initiated and implemented different policies to encourage and stimulate EV adoption and production. The advantages offered by them, such as less rotor heat and higher peak point efficiency, prove to be critical in a variety of applications, particularly in electrical and hybrid vehicles, which are estimated to result in their increased adoption in hybrid vehicles over the coming years. Moreover, electric car manufacturers prefer using BLDC motors in vehicles owing to low maintenance, higher efficiency, high operating speed, and quick response.

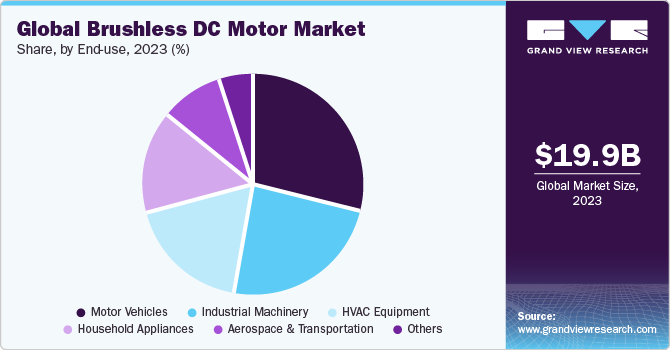

End-use Insights

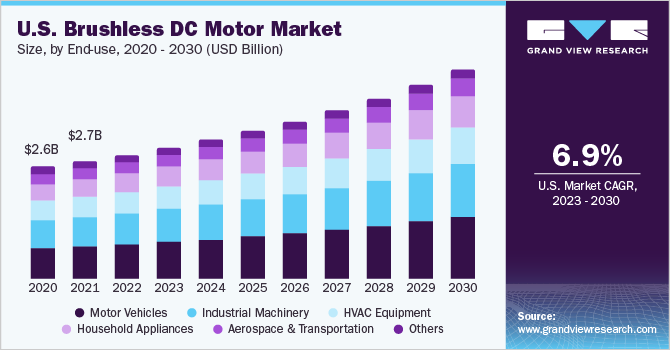

In terms of revenue, the motor vehicle segment dominated the market with a share of 28.2% in 2022. It is also anticipated to emerge as the fastest-growing segment at a CAGR of 7.5% from 2023 to 2030. The automobile industry uses motors of different types and specifications for numerous applications. Brushless DC motors are preferred over conventional powertrains primarily due to the absence of brushes resulting in less friction. Reduction in friction ensures less wear and tear of the brushless DC motor ultimately resulting in a reduction of maintenance required. These motors are thus ideal for numerous applications in motorized vehicles.

The motor vehicle end-use is further sub-segmented into safety, comfort, and performance. The comfort segment acquired the highest market share in 2022 and is expected to be the fastest-growing segment by 2030. Comfort motors are primarily used in automatic window operations, sun-roof actuators, mirror adjusters, and air conditioning, and HVAC systems. Multiple powertrains are required for each of the applications mentioned above which are subsequently expected to drive the demand for brushless DC motors in vehicles by 2030. The industrial machinery segment acquired a substantial market share of more than 24% in 2022 and is anticipated to grow steadily from 2023 to 2030. This growth is attributed to the deployment of such equipment in complex industrial applications such as feeder drives, extruders, and robotics. Additionally, technological advancements have resulted in increased efficiency of these motors which is further expected to drive the market over the forecast period.

Power Output Insights

In terms of revenue, less than 750 watt segment dominated the market with a share of 48.5% in 2022. This high share is attributed to the wide usage of these products in numerous applications, such as fans, pumps, compressors, machine tools, domestic appliances, electric cars, HVAC applications, power tools, and automated robots. The high-efficiency BLDC motors are gaining importance due to their long operating life, lower maintenance, low energy consumption, and a higher tolerance for fluctuating voltages. The rising demand for fractional power BLDC motors for various machinery from the agriculture sector in China and India further boosts the product demand.

The above 75 kW segment also is expected to witness substantial growth from 2023 to 2030. This is owing to advantages, such as better performance, in terms of efficiency and reliability over the traditional DC motors with the same power output rating. These BLDC motors are used for a variety of industrial applications, such as milling, drilling, and grinding, deployed in industrial machinery, such as the CNC machines. Moreover, growing consumer awareness and government policies concerning energy conservation are also predicted to drive the market over the forecast period.

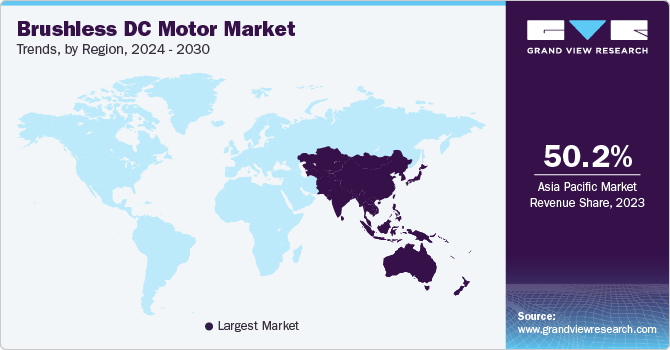

Regional Insights

The Asia Pacific dominated the brushless DC motor market, with a share of 49.6% in 2022. This is attributable to advancements in the agriculture sector and enormous investments in industrialization in countries, including India, South Korea, and Australia. Furthermore, Latin America and the Middle East and Africa are also expected to witness significant growth from 2023 to 2030. This is attributable to the changing regulatory scenario and rising awareness concerning the use of eco-friendly and sustainable products.

The imperative need to increase the power-generation capacities in order to effectively meet the demands of the expanding population has fueled the adoption of these motors across numerous applications in the Middle East region. The untapped potential for downstream activities in developing countries including Kuwait, UAE, and Qatar offers new growth avenues for the market from 2023 to 2030. The regional markets of North America and Europe together captured over 37% of the overall market share in 2022. The growth in this region is attributed to a rise in preference for BLDC motors owing to the increasing adoption of motorized vehicles in the regions and is anticipated to further spur market growth over the forecast period.

Key Companies & Market Share Insights

The market is fragmented in nature with the top players accounting for an estimated 30% share of the overall revenue. These key players are focusing on mergers and acquisitions to expand and diversify their product offerings. In addition, companies are also providing retrofitting solutions for the existing products. The key companies compete on the basis of product pricing, certification, and compliance from several organizations. Some of the key companies in the global brushless DC (BLDC) motor market include:

-

ABB Ltd.

-

Ametek, Inc.

-

Johnson Electric

-

Allied Motion Technologies, Inc.

-

Baldor Electric Company, Inc.

-

Johnson Electric

-

North American Electric, Inc.

-

Schneider Electric

-

Regal Beloit Corp.

Recent Development

-

In April 2021, Johnson Electric unveiled the ECI-048 brushless DC motor platform, offering exceptional performance in a compact form factor. The motor incorporates cutting-edge topologies and has undergone extensive application-specific testing to guarantee unmatched reliability

-

In August 2021, Johnson Electric unveiled the ECI-040 brushless DC motor platform, featuring direct mains AC power integration through its controller, streamlining the integration process. These electronically commutated motors deliver enhanced controllability, exceptional reliability, increased efficiency, and reduced noise, making them an ideal choice for various applications such as window shutters, smart furniture, and coffee machines

Brushless DC Motor Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 19,863.8 million

Revenue forecast in 2030

USD 30,862.4 million

Growth Rate

CAGR of 6.5% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Power output, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; U.K.; Germany; China; India; Japan; Brazil

Key companies profiled

ABB Ltd.; Ametek, Inc.; Johnson Electric; Allied Motion Technologies, Inc.; Baldor Electric Company, Inc.; Johnson Electric; North American Electric, Inc.; Schneider Electric; Regal Beloit Corp.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global brushless DC motor market report on the basis of power output, end-use, and region:

-

Power Output Outlook (Revenue, USD Million, 2017 - 2030)

-

Less than 750 Watts

-

750 Watts to 2.99 kW

-

3 kW – 75 kW

-

Above 75 kW

-

-

End-Use Outlook (Revenue, USD Million, 2017 - 2030)

-

Industrial Machinery

-

Motor Vehicles

-

Safety

-

Comfort

-

Performance

-

-

HVAC Equipment

-

Aerospace & Transportation

-

Household Appliances

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global brushless DC motor market size was estimated at USD 18,825.4 million in 2022 and is expected to reach USD 19,863.8 million in 2023.

b. The global brushless DC motor market is expected to grow at a compound annual growth rate of 6.5% from 2023 to 2030 to reach USD 30,862.4 million by 2030.

b. The motor vehicle segment dominated the global brushless DC motor market with a share of 28.2% in 2022.

b. The Less than 750 Watts segment dominated the global brushless DC motor market with a share of 48.5% in 2022.

b. Asia Pacific dominated the brushless DC motor market with a share of 49.6% in 2022. This is attributable to an increase in expenditure on the development of infrastructure and manufacturing facilities in countries such as China, Japan, and India.

b. Some key players operating in the brushless DC motor market include ABB Ltd; Ametek Inc.; Johnson Electric; Nidec Motor Corporation; Allied Motion Technologies, Inc.; Baldor Electric Company Inc.; Johnson Electric; North American Electric, Inc.; Schneider Electric; and Regal Beloit Corporation.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."

Important: Covid19 pandemic market impact

The global electronics devices market (including consumer electronics and industrial electronics devices) is expected to be impacted significantly by COVID-19 as China is one of the major suppliers for the raw materials (used to manufacture devices) as well as the finished products. The industry is on the brink of facing a reduction in production, disruption in supply, and price fluctuations. While this can vastly encourage local manufacturers to step up and address the growing demand, the scarcity of raw material can still pose a challenge to this industry. The sales of prominent electronic companies is expected to be affected in the near future. The report will account for Covid19 as a key market contributor.