- Home

- »

- Medical Devices

- »

-

Bronchial Biopsy Devices Market Size & Share Report, 2030GVR Report cover

![Bronchial Biopsy Devices Market Size, Share & Trends Report]()

Bronchial Biopsy Devices Market Size, Share & Trends Analysis Report By Product (Biopsy Forceps, Transbronchial Needle Aspiration (TBNA) Needles, Cytology Brushes), By Region (North America, Europe, Asia Pacific), And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-126-7

- Number of Pages: 250

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Healthcare

Report Overview

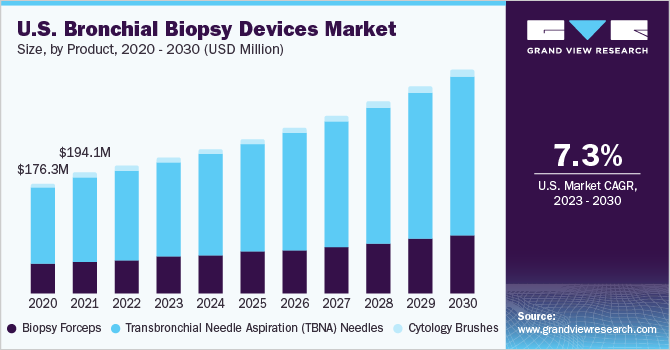

The global bronchial biopsy devices market size was estimated at USD 564.11 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 7.2% from 2023 to 2030. Using bronchial biopsies for diagnosing lung cancer and related conditions such as asthma, pulmonary fibrosis, and others is driving the market growth. Increasing awareness and screening initiatives by organizations have contributed to the higher demand for bronchial biopsies than other biopsies. In developed countries such as the U.S., physicians in outpatient and office settings are being trained in bronchial biopsies, leading to a rise in the adoption of disposable devices to save time.

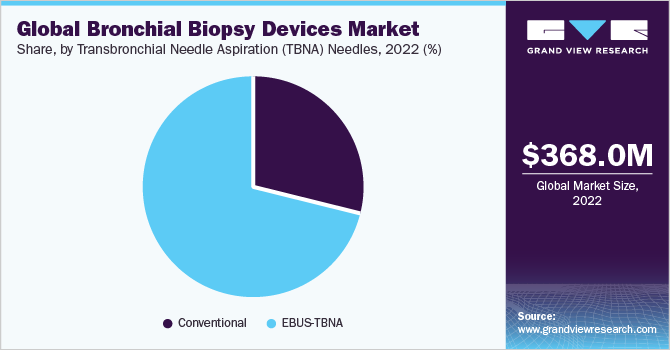

Conversely, in economically sensitive countries like India, reusable devices are preferred. Moreover, the adoption of newer diagnostic techniques such as Endobronchial Ultrasound-Guided Transbronchial Needle Aspiration (EBUS-TBNA) still needs to be improved in India. According to a 2019 article titled “Endobronchial Ultrasound-Guided Transbronchial Needle Aspiration: Techniques and Challenges,” only 27% of surveyed respiratory physicians in India performed EBUS-TBNA, while 74% used conventional TBNA. Although EBUS-TBNA offers cost-effectiveness and safety advantages over invasive surgical procedures, it still entails significant expenses.

The COVID-19 pandemic had a limited negative impact on the market, as companies such as Olympus Corporation, Boston Scientific, and CONMED reported sales volume growth in late 2020. This growth was driven by the recovery of deferred and elective procedures and the easing of restrictions, particularly in countries like the US. For instance, Olympus Corporation stated a revenue recovery in the H2 of 2020, with a significant slowdown in year-on-year revenue decline. The launch of the ViziShot 2 25 G EBUS-TBNA Needle for lung cancer staging and diagnosis in July 2020 is further anticipated to support the company's revenue recovery.

“As the only company manufacturing and selling both bronchoscopes and needles, Olympus is proud to expand our EBUS-TBNA product family portfolio with the 25 G EBUS-TBNA needle. Our comprehensive pulmonary solutions bring great value to our physician customers striving to advance diagnosis and staging capabilities for lung disease and lung cancer.” - Lynn Ray, Vice President, General Manager, Global Respiratory, Olympus.

Moreover, the Percepta Bronchial Genomic Classifier, adopted by some institutions in developed economies like the US, evaluates cytological samples from non-diagnostic biopsies of smokers to determine their risk level for lung cancer and guide further screening. This technology could reduce the need for follow-up biopsies, as low-risk patients can opt for CT monitoring instead of invasive and costly procedures. Although this can limit the use of bronchial biopsy devices, it offers a less invasive alternative. In August 2020, Veracyte presented new data at the American Thoracic Society conference, demonstrating the classifier's effectiveness in classifying patients with inconclusive bronchoscopy results as high or low risk for lung cancer.

Product Insights

Based on product, the market is segmented into biopsy forceps, Transbronchial Needle Aspiration (TBNA) needles, and cytology brushes. In 2022, the TBNA needles segment dominated the market with a 65.23% revenue share. The growth of this segment can be attributed to the advantages of EBUS-TBNA over conventional TBNA and other biopsy methods like mediastinoscopy. The increasing preference for EBUS-TBNA, driven by its greater accuracy, is fueling market demand.

However, EBUS-TBNA needles are more expensive than conventional TBNA needles. Nevertheless, adopting EBUS-TBNA in developed regions such as North America and Europe is expected to drive revenue growth for competitive market players and contribute to overall market expansion. The portable medical oxygen concentrators segment is expected to experience the fastest growth, with a CAGR of 7.0% during the forecast period. This growth is driven by increasing awareness of the benefits associated with the use of portable concentrators.

The adoption of EBUS-TBNA has been supported by recommendations from the American College of Chest Physicians, which endorse its use as an initial step in the mediastinal staging of lung cancer and provide technical guidelines for successful procedures. These recommendations have been in place since 2015, leading to an increasing preference for EBUS-TBNA over conventional methods in the U.S. Furthermore, in 2022, EBUS-TBNA accounted for the majority of revenue in the U.S. market, surpassing the revenue share of the Conventional TBNA sub-segment.

The biopsy forceps product segment is divided into disposable and reusable sub-segments. The disposable sub-segment is expected to dominate the market and hold the fastest CAGR of 7.6% during the forecast period.

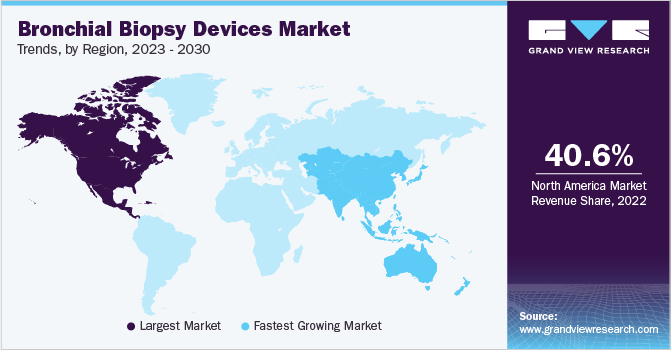

Regional Insights

North America dominated the market with a revenue share of 40.6% in 2022 owing to its advanced healthcare infrastructure, high investment in research and development (R&D), and availability of the latest technologies.

The increase in product launches and positive clinical outcomes associated with these new products is expected to drive regional market growth and expansion during the forecast period. For instance, in October 2021, Intuitive Surgical released post-market data of its Ion endoluminal system, demonstrating encouraging diagnostic yield. These positive outcomes, including a diagnostic yield for smaller and larger nodules, a strong safety profile, and a sensitivity for malignancy ranging from 84% to 88%, are anticipated to increase physician preference and drive product acceptance over the forecast period.

“This study is another step to help confirm what we’ve seen and heard from physicians using Ion—that our technology helps them safely gain access to the appropriate portions of the lung to biopsy small nodules “The Ion system’s progress further demonstrates how minimally invasive technologies can help create better outcomes for patients, surgeons, and care teams.”

- Gary Guthart, CEO, Intuitive Surgical.

Asia Pacific is anticipated to experience the highest CAGR of 7.7% during the forecast period. This growth can be attributed to factors such as the aging population and the region's increasing prevalence of respiratory diseases. Furthermore, adopting technologically advanced products is also anticipated to contribute to the regional growth.

Key Companies and Market Share Insights

The bronchial biopsy devices market is poised for positive expansion, driven by strategies employed by key players to introduce new products and expand their networks. For instance, Intuitive Surgical gained entry into the market with its Ion lung biopsy system, which received FDA 510(k) clearance in 2019. The Ion lung biopsy system utilizes a flexible, robotic catheter to collect multiple lung cancer tissue samples from deep lesions, navigating through small airways. Furthermore, the popularity of EBUS-TBNA continues to grow, and it is expected to attract new entrants to the market. Some prominent players in the global bronchial biopsy devices market include:

-

Olympus Corporation

-

Boston Scientific Corporation

-

Cook Medical

-

CONMED Corporation

-

Medtronic

-

HOBBS MEDICAL INC

-

Telemed Systems, Inc.

-

Becton, Dickinson and Company

-

Argon Medical Devices

-

Horizons International Corp.

Bronchial Biopsy Devices Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 595.81 million

Revenue forecast in 2030

USD 972.43 million

Growth rate

CAGR of 7.2% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway;China; Japan; India; Australia; Thailand; South Korea; Brazil; Argentina; Mexico; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Olympus Corporation; Boston Scientific Corporation; Cook Medical; CONMED Corporation; Medtronic; HOBBS MEDICAL INC; Telemed Systems, Inc.; Becton, Dickinson and Company; Argon Medical Devices; Horizons International Corp.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Bronchial Biopsy Devices Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global bronchial biopsy devices market report based on product and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Biopsy Forceps

-

Durability

-

Disposable

-

Reusable

-

-

Transbronchial Needle Aspiration (TBNA) Needles

-

Conventional

-

EBUS-TBNA

-

-

Cytology Brushes

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global bronchial biopsy devices market size was estimated at USD 564.11 million in 2022 and is expected to reach USD 595.81 million in 2023.

b. The global bronchial biopsy devices market is expected to grow at a compound annual growth rate of 7.2% from 2023 to 2030 to reach USD 972.43 million by 2030.

b. North America dominated the bronchial biopsy devices market with a share of 40.6% in 2022. This is attributable to its advanced healthcare infrastructure, high investment in R&D, and availability of the latest technologies. The increase in product launches and positive clinical outcomes associated with these new products is also expected to drive regional market growth and expansion during the forecast period.

b. Some key players operating in the bronchial biopsy devices market include Olympus Corporation; Boston Scientific Corporation; Cook Medical; CONMED Corporation; Medtronic; HOBBS MEDICAL INC; Telemed Systems, Inc.; Becton, Dickinson and Company; Argon Medical Devices; Horizons International Corp.

b. Key factors that are driving the market growth include increasing awareness and screening initiatives by organizations, which have increased demand for bronchial biopsies over other biopsy types. Furthermore, bronchial biopsies are commonly used in the diagnosis of lung cancer and related conditions such as asthma and pulmonary fibrosis, etc.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."