- Home

- »

- Consumer F&B

- »

-

Brewer’s Yeast Market Size, Share & Growth Report, 2030GVR Report cover

![Brewer’s Yeast Market Size, Share & Trends Report]()

Brewer’s Yeast Market Size, Share & Trends Analysis Report By Product (Dry, Liquid), By Application (Food Supplements, Feed Supplements), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-2-68038-632-5

- Number of Pages: 124

- Format: Electronic (PDF)

- Historical Range: 2017 - 2021

- Industry: Consumer Goods

Brewer’s Yeast Market Size & Trends

The global brewer’s yeast market size was estimated at USD 5.81 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 9.6% from 2023 to 2030. Brewer's yeast is rich in essential nutrients such as B vitamins, protein, and minerals, making it a valuable addition to various food products, including bread, nutritional supplements, and savory snacks. As consumers become increasingly health-conscious and seek products with added nutritional value, the demand for brewer's yeast as a natural source of nutrients has surged. The growth of the craft beer industry has significantly increased the demand for brewer's yeast. Craft brewers often experiment with unique yeast strains to create diverse beer styles and flavors, leading to increased consumption of brewer's yeast.

The genetically modified brewer’s yeast is used to enhance the flavor profile of craft beer. Brewer’s yeast is genetically modified to support its usage in craft beer production to enhance the flavor of the end-product and reduce its bitterness. Therefore, the growing popularity of craft beers is expected to result in an increased demand for specific yeast strains.

The continuous demand for novel and sustainable alternative proteins is also driving the demand for brewer’s yeast. Technological innovations in the brewer’s yeast industry support the growing demand for yeast proteins. Yeast biomass is such that 35%-60% of its dry weight is proteins. Due to their ideal amino acid composition, yeast proteins offer significant potential as alternative proteins. Yeast proteins extracted from brewer’s yeast can be hydrolyzed to produce yeast peptides, which are used in protein supplements, meat extenders, and fining agents.

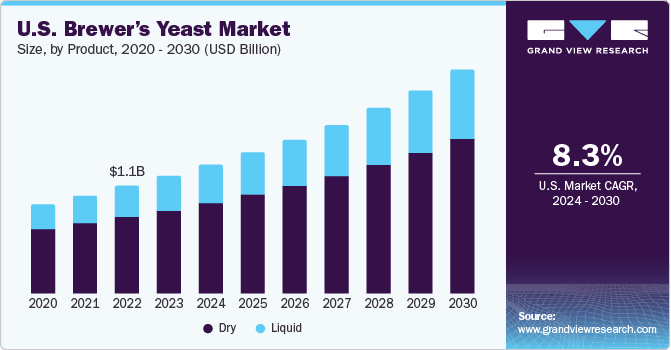

The market in the U.S. is expected to grow in the coming years, driven by the increasing demand for brewer's yeast from the feed and food supplement industries. The key players in the market are expected to focus on innovation and product development to maintain their market shares. Growing meat consumption in the U.S. and stringent regulations regarding meat quality are expected to remain key driving factors for the market. Moreover, consumers are concerned about the environmental impact of traditional meat production and are seeking sustainable and ethical options. This has led to an increase in demand for organic, grass-fed, and free-range meat products.

The healthcare industry in the U.S. invests heavily in research & development activities considering the presence of numerous pharmaceutical companies. In addition, rising awareness among the population regarding the use of nutritive supplements instead of synthetic drugs is anticipated to increase the demand for brewer's yeast over the forecast period. Easy availability, convenience, and awareness among consumers regarding the use of brewer's yeast in ready-to-drink tea beverages are also likely to augment product demand over the forecast period. Moreover, the usage of brewer's yeast is increasing in bakery and confectionery products on account of its favorable properties.

Product Insights

Based on product, the dry brewer’s yeast segment held the largest revenue share of 71.2% in 2022. Dry brewer’s yeast offers more consistent results in terms of fermentation and flavor profiles and has a lower risk of contamination due to temperature changes. The lower production and shipping costs of dry yeast contribute to its cost-effectiveness, making it an attractive option for brewers on a budget. Dry brewer's yeast is easier to export and distribute globally compared to its liquid counterpart. This has allowed yeast manufacturers to expand their market reach and offer products to a wider customer base.

The liquid brewer’s yeast segment is projected to grow at the fastest CAGR of 10.4% over the forecast period. Liquid yeast suppliers offer a wide range of yeast strains, including conventional brewer's yeast strains (Saccharomyces cerevisiae), which are the most commonly used yeast for beer fermentation. They also provide wild yeast strains (Brettanomyces) that can add unique and complex flavors to certain beer styles, as well as bacterial cultures (Lactobacillus and Pediococcus) used in sour ale production.

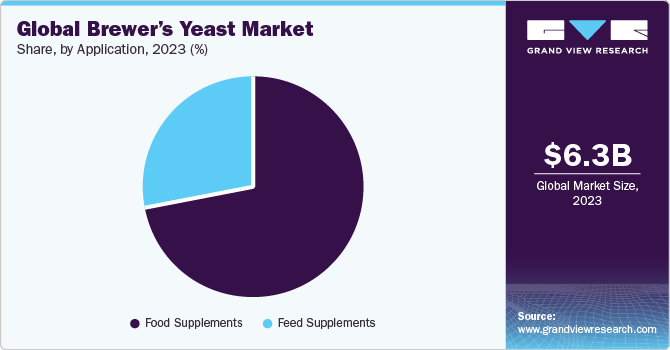

Application Insights

Based on application, the food supplements segment held the largest revenue share of 72.4% in 2022 in the global brewer’s yeast industry. Brewer’s yeast is also commonly used as a nutritional supplement as it is a rich source of B vitamins, minerals, and protein and can be consumed in various forms, such as tablets, capsules, flakes, or powder. B vitamins play a crucial role in various metabolic processes, and minerals like chromium and selenium have been linked to numerous health benefits. In addition, brewer's yeast's protein content makes it an attractive option for those looking to increase their protein intake for muscle building, repair, and overall health. For example, the B-complex vitamin is a nutritional supplement that contains brewer’s yeast and plays a crucial role in energy production and metabolism, helping the body convert food into energy.

The feed supplements segment is projected to grow at a CAGR of 9.2% from 2023 to 2030. The demand for meat and other animal-based products has increased with the growing global population, and livestock and poultry farming are major industries that cater to this soaring demand. To meet the increasing requirements of animal feed for livestock and poultry, farmers and producers are seeking alternative and sustainable sources of nutrition. Brewer's yeast, with its rich nutritional profile, including protein, B vitamins, and minerals, can be an attractive option as a feed supplement for animals. Brewer's yeast in animal diets can help improve their overall health, growth rate, and productivity.

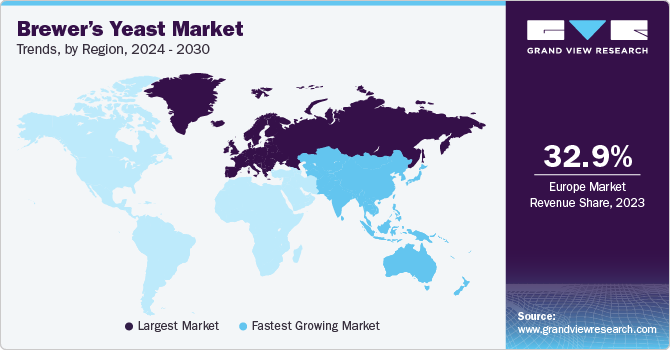

Regional Insights

Based on region, Europe dominated the market in 2022 with a revenue share of 33.1%. Europe has the presence of over 70 million pet-keeping households. Increased consumer awareness about the importance of a balanced diet for their pets is expected to have a positive impact on the demand for brewer’s yeast. In recent years, there has been a growing trend of consumers becoming more health-conscious and seeking healthier and more sustainable food options in Europe.

The market in the UK is expected to continue to grow in the coming years, driven by the increasing demand for brewer's yeast in the feed and food supplement industries. The key players in the market are expected to focus on innovation and product development to maintain their market share.

However, North America is expected to grow at a CAGR of 9.5% from 2023 to 2030. There is a high demand for brewer’s yeast in North America as the region is the largest producer of feed for cattle, turkey, pets, and horses. In addition, the U.S. has the lowest feed prices among all other economies, which is expected to develop new growth opportunities for the market players over the forecast period. Ruminant feed is the second-largest feed product produced in the U.S.

Asia Pacific is anticipated to witness the fastest CAGR of 10.4% over the forecast period. Animal feed is one of the major end uses of brewer’s yeast, and the region is one of the largest animal feed producers in the world, led by China, India, and Japan. This is expected to play a key role in boosting the utilization of brewer’s yeast in animal feed. Rising swine feed production in Indonesia and Vietnam is also expected to have a positive impact on market growth over the forecast period.

Brewer's yeast is a vital ingredient for the production of beer. With the growing popularity of craft beer, craft breweries across Japan have been experimenting with innovative brewing techniques and specialty yeast strains to create distinctive beer styles. This has significantly benefited the demand for diverse and specialized brewer's yeast in this region.

Key Companies & Market Share Insights

The market includes both international and domestic participants. Brand share analysis indicates that key market players are focusing on strategies such as new product launches, partnerships, mergers & acquisitions, global expansion, and others. Some of the initiatives include:

-

In June 2023, Fermentis launched its new yeast SafŒno FV 19 for making fruity red wines. This yeast strain has a low consumption of malic acid during the fermentation process, which aids in maintaining a high total acidity in the wine. It produces high levels of black and red fruit aromas, such as cherry, pomegranate, blackberry, and black currant. The yeast can be used to make round red wines with soft tannins and reduces the perception of vegetal notes and astringency in red wines.

-

In September 2022, Lallemand Brewing, a business unit of Lallemand Inc., launched its new yeast strain LalBrew NovaLager. The non-GMO strain is a hybrid of Saccharomyces pastorianus. It has a fast fermentation time, high attenuation, and high flocculation. It also has a clean flavor profile with slight esters over a wide temperature range. The strain is available in 500g packs and 11g sachets.

Some prominent players in the global brewer’s yeast market include: -

-

Associated British Food plc

-

Leiber

-

Lallemand, Inc

-

Archer Daniels Midland Company

-

Chr. Hansen Holding A/S

-

Shandong Bio Sunkeen Co., Ltd.

-

Lesaffre Group

-

White Labs

-

Angel Yeast Co., Ltd.

-

HEBEI TOMATO INDUSTRY CO LTD.

Brewer’s Yeast Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 6.35 billion

Revenue forecast in 2030

USD 12.08 billion

Growth rate

CAGR of 9.6% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

October 2023

Quantitative units

Revenue in USD million/billion, volume in Kilo Tons, and CAGR from 2023 to 2030

Report coverage

Revenue and volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Middle East and Africa; Asia Pacific; Central and South America

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; Australia, South Korea; Brazil; Argentina; Saudi Arabia, UAE

Key companies profiled

Associated British Food plc; Leiber; Lallemand, Inc; Archer Daniels Midland Company; Chr. Hansen Holding A/S; Shandong Bio Sunkeen Co. Ltd.; Lesaffre Group; White Labs; Angel Yeast Co. Ltd.; HEBEI TOMATO INDUSTRY CO LTD.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

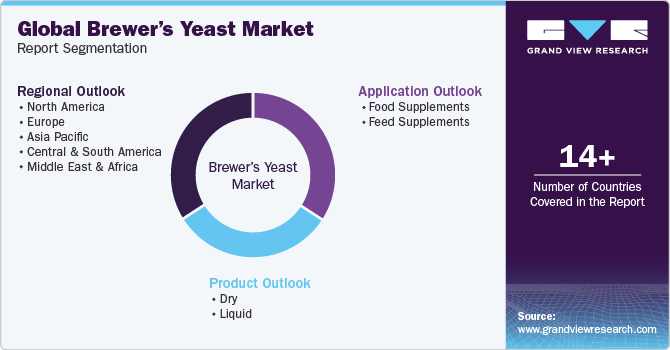

Global Brewer’s Yeast Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the latest trends and opportunities in each of the sub-segment from 2017 to 2030. For this study, Grand View Research has segmented the brewer’s yeast market report based on product, application, and region:

-

Product Outlook (Volume, Kilo Tons; Revenue, USD Million, 2017 - 2030)

-

Dry

-

Liquid

-

-

Application Outlook (Volume, Kilo Tons; Revenue, USD Million, 2017 - 2030)

-

Food Supplements

-

Feed Supplements

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Central and South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global brewer’s yeast size was estimated at USD 5.81 billion in 2022 and is expected to reach USD 6.35 billion in 2023.

b. The global brewer’s yeast is expected to grow at a compounded growth rate of 9.6% from 2023 to 2030 to reach USD 12.08 billion by 2030.

b. Some key players operating in white brewer’s yeast market are Associated British Food plc, Leiber, Lallemand, Inc, Archer Daniels Midland Company, Chr. Hansen Holding A/S, Shandong Bio Sunkeen Co., Ltd., Lesaffre Group, White Labs, Angel Yeast Co., Ltd., HEBEI TOMATO INDUSTRY CO LTD.

b. Some of the key market players in the brewer’s yeast market are Associated British Food plc., Lesaffre Group, Alltech, Leiber GmbH, Cargill, Incorporated, Angel Yeast Co., Ltd.

b. The increasing demand for alcoholic beverages, such as beer, wine, and spirits, is a significant driver. Brewer's yeast is a vital ingredient in the fermentation process, converting sugars into alcohol and carbon dioxide, thereby playing a crucial role in the production of these beverages.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."

Important: Covid19 pandemic market impact

Restrictions on manufacturing activities due to the advent of the COVID-19 pandemic shall cause a slump in the supply of feed, as well as its additives. The current stagnation in supply is, in turn, detrimental against the backdrop of ever-increasing demand for essential food products such as dairy and meat. The report will account for Covid19 as a key market contributor.