- Home

- »

- Medical Devices

- »

-

Breast Reconstruction Market Size & Share Report, 2030GVR Report cover

![Breast Reconstruction Market Size, Share & Trends Report]()

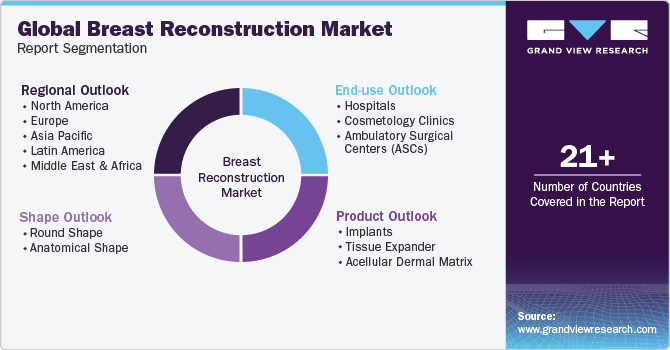

Breast Reconstruction Market Size, Share & Trends Analysis Report By Product (Implants, Tissue Expander), By Shape (Round, Anatomical), By End-use (Hospitals, Cosmetology Clinics), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-3-68038-129-0

- Number of Pages: 140

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Healthcare

Report Overview

The global breast reconstruction market size was estimated at USD 492.1 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 6.81% from 2023 to 2030. The growth can be attributed to the increasing number of breast cancer patients and the availability of favorable reimbursement policies. Moreover, an increase in the number of breast reconstruction procedures along with technological advancements is expected to propel the market growth.

There has been an increase in number of breast cancer patients globally. For instance, according to WHO, around 2.3 million women globally were diagnosed with breast cancer in the year 2020. Furthermore, according to the statistics published by breastcancer.org, breast cancer accounts for approximately 30% of all cancer cases registered among women in the U.S. every year. Moreover, in 2023, it is projected that approximately 297,790 new cases of invasive breast cancer will be registered among women in the U.S., along with 55,720 new cases of DCIS (ductal carcinoma in situ).

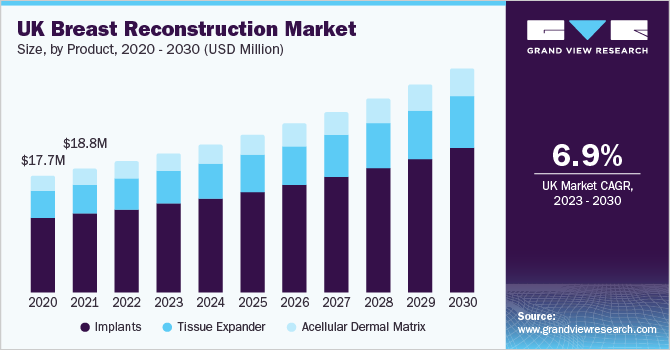

Similarly, as per Breast Cancer Now, one in every seven women in the UK is expected to be diagnosed with breast cancer. Thus, with the increase in number of people suffering from breast cancer, the demand for breast reconstruction is expected to increase, thereby propelling the market growth over the forecast period.

According to Medicare, breast reconstruction can be reimbursed if the person has undergone breast mastectomy because of breast cancer. In addition, as per Services Australia, the external breast prosthesis reimbursement program can reimburse the breast prosthesis after breast cancer. Thus, due to the aforementioned factors, the growth of the market is anticipated to experience a boost during the forecast period.

Moreover, to cope up with the increasing demand for breast reconstruction, the market players are entering into various strategic initiatives such as product launches, awareness campaigns, and geographic expansion. For instance, in October 2021, Sientra, Inc. along with Mission Plasticos launched a philanthropic initiative, ‘Reshaping Lives: Full Circle’ for women living in poverty in America. This was aimed at providing women living in poverty with breast reconstruction post-mastectomy.

Product Insights

Based on the product, the implants segment held the largest revenue share of 63.47% in 2022. This can be attributed to the rising use of breast implants during breast augmentation surgeries. For instance, according to NCBI, around 8.08 women per 1,000 in the U.S. have one or other type of breast implant. Moreover, according to the University of Utah Health, approximately 35 million women have textured breast implants, whereas, as per a similar source, it is believed that more than 1.5 million women have breast implants every year.

However, the tissue expander segment is projected to witness the fastest CAGR of 6.97% over the forecast period. The growth rate can be attributed to the increasing use of tissue expanders for breast reconstruction. For instance, according to a report by Science Direct, tissue expander reconstruction contributed up to 65% of the total breast reconstruction performed. Moreover, as per Medscape, with 101,657 breast reconstruction surgeries performed in the U.S. in 2018, 69% included tissue expanders and implants. In addition, breast reconstruction with the use of a tissue expander has several advantages such as, it is faster, simpler, and relatively cheaper. Furthermore, market players are focusing on launching a wide range of tissue expanders to increase their market share. For instance, in June 2023, Sientra, Inc. received FDA approval for its AlloX2 Pro Tissue Expander.

Shape Insights

In terms of shape, the round-shaped segment held the largest revenue share of 55.25% in 2022. The dominance can be accredited to the rising number of product launches, regular FDA updates on breast implant safety, and the conduction of various clinical trials. For instance, in May 2021, GC Aesthetics launched its next-generation round silicone breast implant PERLE. Moreover, in October 2021, the US FDA updated its safety requirements for breast implants, and restricted the sales & distribution of breast implants, to ensure patients undergoing breast implant surgery have adequate information. Thus, due to the above-mentioned factors, round-shaped breast implants are expected to have a significant growth rate.

However, the anatomical shape segment is projected to grow with the fastest CAGR of 6.97% during the forecast period. The growth rate can be attributed to several advantages of anatomically shaped breast implants. For instance, according to the Sayah Institute, these breast implants provide a natural shape and textured surface, therefore, the implant does not shift after placement. Moreover, their texture makes them ideal for breast augmentation in women with little natural breast tissue. Thus, propelling the segment growth.

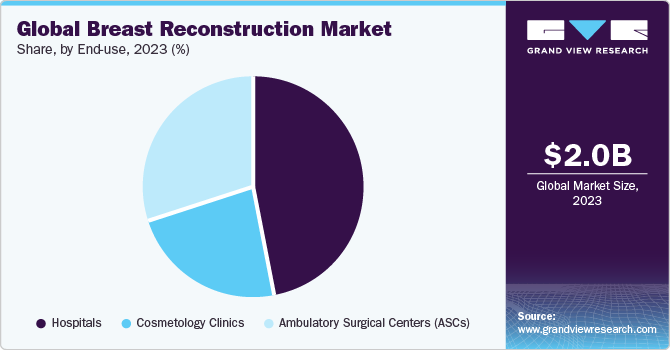

End-use Insights

In terms of end-use, the hospitals segment dominated the market with a share of 46.91% in 2022. The dominance of the segment can be attributed to a rise in the number of hospitals worldwide. For instance, according to the Athar Institute of Health Management & Studies, the hospitals in India make up 80% of the total healthcare market. Moreover, as per The Canadian Encyclopedia, there are 706 public & 193 private hospitals in Canada. In addition, there has been an increase in medical tourism globally. An increase in medical tourism is expected to increase the quality of healthcare facilities provided by the hospitals. Thus, due to the aforementioned factors, the hospital segment is anticipated to have a significant growth rate over the forecast duration.

The ambulatory surgical centers are projected to witness the fastest CAGR of 6.9% over the forecast period. The growth rate can be attributed to a global increase in number of breast reconstruction surgeries in the ASCs. For instance, as per the Plastic Surgery Statistics Report, approximately 1,692,717 breast reconstruction surgeries were performed in the ASCs. Moreover, as per the similar report, the percentage increase from 2019 to 2020 was around 7% in 2020. Thus, as a result of the above-mentioned factor, the segment is anticipated to have a significant growth rate.

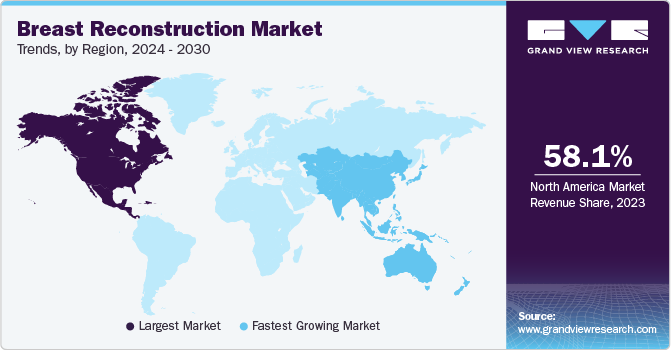

Regional Insights

In terms of region, North America held the largest market share of 44.48% in 2022. This can be attributed to the increasing number of breast cancer patients in this region. For instance, as per the Canadian Cancer Society, approximately 78 women in Canada are diagnosed with breast cancer every day, whereas 15 women die of breast cancer per day. Moreover, according to a similar source, 28,600 women in Canada are predicted to be diagnosed with breast cancer in 2022. This number represents 25% of the new cases of cancer overall. Therefore, above mentioned factors are expected to boost the market growth in the region.

The Asia Pacific region is projected to drive the market growth with the fastest CAGR of 7.18% over the forecast period. The growth rate can be attributed to the rapidly increasing breast cancer population and growing awareness regarding breast reconstruction surgery. For instance, according to the International Agency for Research on Cancer, in 2020, about 416,371 new breast cancer cases were reported in China, with 117,174 deaths in the same year. The same source stated that breast cancer cases are expected to reach 1,390,095 by 2025.

Key Companies & Market Share Insights

Key players are adopting various strategies such as geographic expansion, mergers and acquisitions, partnerships, launching new products, and seeking government approvals to strengthen their foothold in the market. For instance, in March 2023, Establishment Labs announced entering into a collaborative agreement with companies in Europe and a secondary partner network in Japan, to launch Mia Femtech, a minimally invasive breast aesthetics solution. Key players are investing heavily in research and development to manufacture technologically advanced products. Some prominent players in the global breast reconstruction market include:

-

Mentor Medical Systems B.V. (Johnson & Johnson)

-

Allergan, Inc. (AbbVie)

-

Sientra, Inc.

-

Ideal Implant Incorporated

-

Establishment Labs

-

POLYTECH Health & Aesthetics GmbH

-

RTI Surgical

-

Sebbin

-

Integra LifeSciences

-

GC Aesthetics

Breast Reconstruction Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 521.4 million

Revenue forecast in 2030

USD 826.9 million

Growth rate

CAGR of 6.81% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

September 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, shape, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa (MEA)

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Norway; Sweden; Japan; China; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Mentor Medical Systems B.V.; Allergan Inc.; Sientra Inc.; Ideal Implant Incorporated; Establishment Labs S.A.; POLYTECH Health & Aesthetics GmbH; RTI Surgical Holdings; Sebbin; Integra LifeSciences; GC Aesthetics

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Breast Reconstruction Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis on the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global breast reconstruction market report based on product, shape, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Implants

-

Silicone Breast Implants

-

Saline Breast Implants

-

-

Tissue Expander

-

Saline Expander

-

Air Tissue Expander

-

-

Acellular Dermal Matrix

-

-

Shape Outlook (Revenue, USD Million, 2018 - 2030)

-

Round Shape

-

Anatomical Shape

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Cosmetology Clinics

-

Ambulatory Surgical Centers

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

- Kuwait

-

-

Frequently Asked Questions About This Report

b. The global breast reconstruction market size was estimated at USD 492.1 million in 2022 and is expected to reach USD 521.4 million in 2023.

b. The global breast reconstruction market is expected to witness a compound annual growth rate of 6.81% from 2023 to 2030 to reach USD 826.9 million by 2030.

b. North America dominated the breast reconstruction market with a share of 44.48% in 2022. This is attributable to rising healthcare awareness and constant research and development initiatives.

b. Some key players operating in the breast reconstruction market include Mentor Worldwide LLC, Allergan Inc., Sientra, Inc., Deal Implant Incorporated, Establishment Labs S.A, POLYTECH Health & Aesthetics GmbH, RTI Surgical Holdings, Inc., and GROUPE SEBBIN SAS.

b. Key factors that are driving the breast reconstruction market growth include the rising number of breast reconstruction procedures, the increasing incidence of breast cancer, and the introduction of technologically advanced products across the world.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."

Important: Covid19 pandemic market impact

With COVID-19 infections rising globally, the apprehension regarding a shortage of essential life-saving devices and other essential medical supplies in order to prevent the spread of this pandemic and provide optimum care to the infected also widens. In addition, till a pharmacological treatment is developed, ventilators act as a vital treatment preference for the COVID-19 patients, who may require critical care. Moreover, there is an urgent need for a rapid acceleration in the manufacturing process for a wide range of test-kits (antibody tests, self-administered, and others). The report will account for COVID-19 as a key market contributor.