- Home

- »

- Medical Devices

- »

-

Botulinum Toxin In Urology Market Size & Share Report 2030GVR Report cover

![Botulinum Toxin In Urology Market Size, Share & Trends Report]()

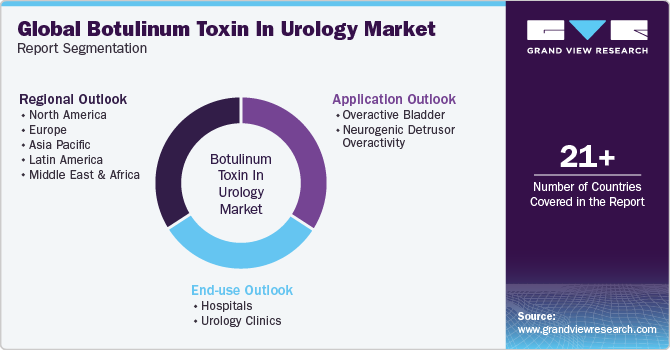

Botulinum Toxin In Urology Market Size, Share & Trends Analysis Report By Application (Overactive Bladder, Neurogenic Detrusor Overactivity), By End-use (Hospitals, Urology Clinics), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-138-5

- Number of Pages: 110

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Healthcare

Market Size & Trends

The global botulinum toxin in urology market size was estimated at USD 907.08 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 6.0% from 2023 to 2030. Botulinum toxin is produced by the bacterium Clostridium botulinum. When injected into muscle, it acts as a specific blocker of acetylcholine produced from nerves, which prevents neural transmission from the nerves. Due to factors such as the increasing geriatric population, increase in the number of botulinum toxin procedures, and growing prevalence of neurogenic urologic disorders such as refractory urinary incontinence, urgency, and frequency, the demand for botulinum toxin is growing.

The rise in the use of botulinum toxin injection in several lower urinary tract conditions, including the treatment of overactive bladders, bladder pain syndrome, pediatric urinary incontinence, and others, is projected to boost the market growth during the forecast period. The availability of various botulinum toxin products such as disport, botox, and others is expected to accelerate the market growth. For instance, in June 2022, according to MDPI, the product botulinum toxin type A (BoNT-A) in various preparations was used to treat urinary tract conditions.

Globally, the increasing geriatric population associated with urinary tract conditions, especially urinary incontinence, is projected to impact the market's growth. The senior population, particularly those aged 65 and above, is more prone to urinary incontinence problems, requiring botulinum toxin injections to treat these conditions. For instance, in November 2022, the article" Senior Population Statistics: A Portrait of Aging Americans," reported that around 54.1 million (16.3%) individuals in the U.S. are aged 65 or above. Thus, the growing geriatric population is attributed to the increasing demand for botulinum toxin injections. In addition, rising investment in the R&D program by key market players to explore the therapeutic use of botulinum toxin in urinary tract conditions is building opportunities for expanding its market over the forecast period.

The COVID-19 pandemic has had a major impact on healthcare systems, including the market for botulinum toxin. Market players have experienced huge losses due to the cancellation or postponement of urinary treatments. For instance, in July 2022, according to NCBI, it is reported that the Italian Society of Urodynamics found that approximately 78.4% of treatments regarding urology investigations, procedures, and consultations were canceled during a pandemic. After the pandemic, the growing number of individuals receiving treatment for urinary tract conditions increased the demand for botulinum toxin injection.

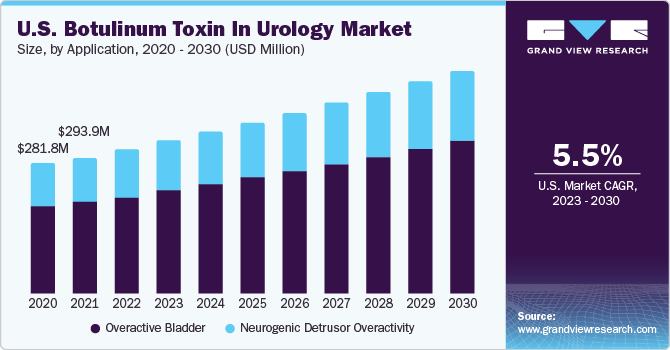

Application Insights

Based on application, the market is bifurcated intooveractive bladder and neurogenic detrusor overactivity segments. In 2022, the overactive bladder segment held the largest revenue share at 67.14%. Factors such as incomplete bladder emptying, overweight, obesity, and urinary tract infections, contribute to overactive bladder. For instance, according to the Cleveland Clinic, in the U.S., about 33 million adults are affected by overactive bladder, including 40% of women and 30% of men. Thus, the growing incidence of overactive bladder boosts the market growth.

Individuals with Parkinson's disease, multiple sclerosis, and Spina bifida are more vulnerable to neurogenic detrusor overactivity. For instance, according to the Cleveland Clinic, neurogenic detrusor overactivity affects more than 90% of people and is common with spinal cord injuries. Approximately 50% to 80% of people with multiple sclerosis and 95% with spina bifida have neurogenic detrusor overactivity. Thus, the increasing prevalence of chronic diseases has led to a rise in neurogenic detrusor overactivity problems, further resulting in market growth over the forecast period.

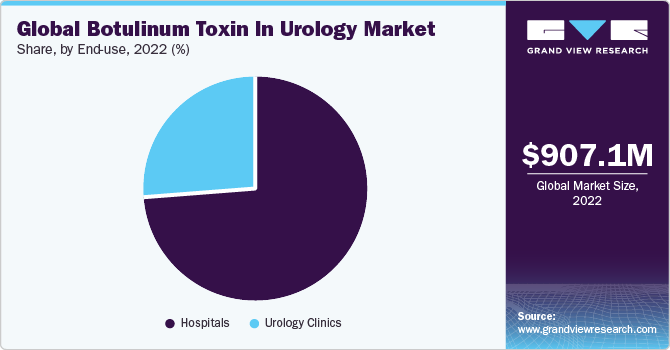

End-use Insights

Based on end-use, the market is bifurcated into Hospitals and urology clinics segments. The Hospitals segment held the largest revenue share of 73.74% in 2022 and is projected to grow at the fastest CAGR over the forecast period. Increasing awareness for applications of botulinum toxin in urinary conditions, rising elderly population, and a growing number of Hospitals in developed and emerging nations are attributed to the segment growth. For instance, in August 2023, according to NVBI, it is stated that 11% of Hospitalized elderly patients have urinary incontinence at admission and 23% at discharge. Hospitals play a vital role in specialized medical care for diagnosing and treating urinary tract conditions, thus fueling market growth.

The urology clinics offer diagnostic testing and therapies for conditions affecting the genitourinary system and urinary bladder. Patients preferring more specialized Hospitals to gain more precise and accurate treatment boost the market growth.

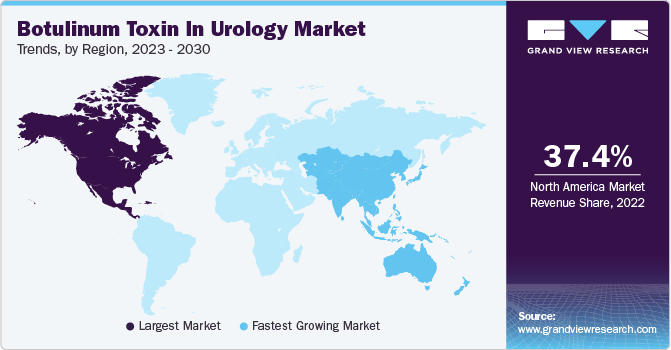

Regional Insights

North America held the largest revenue share of 37.41% in 2022 due to several factors, including a growing elderly population, increasing prevalence of urinary incontinence, strong presence of industry players in the region, well-developed healthcare infrastructure, and rising awareness among the public. For instance, in August 2023, according to an article titled “Urinary Incontinence,” it was reported that around 13 million Americans suffer from urinary incontinence, and the prevalence is 50% or above among residents of nursing facilities. Thus, the rising prevalence of urinary incontinence is driving the market growth in the region.

The Asia Pacific region is anticipated to register the fastest CAGR of 7.3% over the forecast period due to several contributing factors. An aging population, high consumption of beverages such as tea and coffee, and diabetes are leading to increased urinary incontinence. For instance, in November 2022, according to the World Health Organization (WHO), in the Southeast Asia region, more than 96 million individuals are predicted to have diabetes, with another 96 million pre-diabetic individuals causing at least 600,000 casualties annually. These factors create a higher demand for effective treatment options such as botulinum toxin type A (BoNT-A) in the Asia Pacific region.

Key Companies & Market Share Insights

The global botulinum toxin in the urology industry is competitive and highly regulated. The major key players in the market are implementing strategic initiatives, such as acquisitions, mergers, product approval, new product launches, partnerships, and collaborations, to maximize their market dominance. For instance, in February 2021, AbbVie Inc. received approval from the U.S. Food and Drug Administration (FDA) for its BOTOX (Onabotulinumtoxin A) to treat neurogenic detrusor overactivity in pediatric patients. Some prominent players in the global botulinum toxin in urology market include:

-

AbbVie Inc.

-

Merz Pharma

-

Ipsen Pharma

-

GALDERMA

-

Allergan PLC

-

Sun Pharmaceutical Industries Ltd.

-

Biovencer Healthcare Pvt Ltd

Botulinum Toxin In Urology Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 966.76 million

Revenue forecast in 2030

USD 1.45 billion

Growth rate

CAGR of 6.0% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Mexico, Argentina; South Africa; Saudi Arabia, UAE; Kuwait

Key companies profiled

AbbVie Inc.; Merz Pharma; Ipsen Pharma; GALDERMA; Allergan PLC; Sun Pharmaceutical Industries Ltd.; Biovencer Healthcare Pvt Ltd

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Botulinum Toxin In Urology Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global botulinum toxin in urology market report based on application, end-use, and region:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Overactive Bladder

-

Neurogenic Detrusor Overactivity

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Urology Clinics

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global botulinum toxin in urology market size was estimated at USD 907.08 million in 2022 and is expected to reach USD 966.76 million in 2023.

b. The global botulinum toxin in urology market is expected to grow at a compound annual growth rate of 6.0% from 2023 to 2030 to reach USD 1.45 billion by 2030.

b. North America dominated the botulinum toxin in urology market with a share of 37.41% in 2022. This is attributable to the growing geriatric population, increasing prevalence of urinary incontinence, and the strong presence of industry players in the region.

b. Some of the players operating in this market are AbbVie Inc., Merz Pharma, Ipsen Pharma, GALDERMA, Allergan PLC, Sun Pharmaceutical Industries Ltd., and Biovencer Healthcare Pvt Ltd.

b. Key factors that are driving the botulinum toxin in urology market growth include the increasing geriatric population associated with urinary tract conditions, increase in number of botulinum toxin procedure, and growing prevalence of neurogenic urologic disorders.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."