- Home

- »

- Consumer F&B

- »

-

Beef Market Size, Share & Trends Analysis Report, 2030GVR Report cover

![Beef Market Size, Share & Trends Report]()

Beef Market Size, Share & Trends Analysis Report By Cut (Brisket, Shank, Loin), By Slaughter Method (Kosher, Halal), By Region (North America, Europe, Asia Pacific, Central & South America, MEA), And Segment Forecasts, 2022 - 2030

- Report ID: 978-1-68038-175-7

- Number of Pages: 80

- Format: Electronic (PDF)

- Historical Range: 2017 - 2020

- Industry: Consumer Goods

Report Overview

The global beef market size was valued at USD 467.7 billion in 2021 and is expected to progress at a compound annual growth rate (CAGR) of 4.8% from 2022 to 2030. With increasing globalization, the food preferences of consumers around the world have witnessed some significant changes. Consumers are increasing their protein intake, resulting in the rising demand for meat. Meat and its products are packed with a host of essential ingredients and nutrients and save a lot of time and effort in cooking. Therefore, manufacturers are primarily focusing on the quality of the meat and its products.

The COVID-19 pandemic has caused disruptions in the market. The limited availability of some meat products in retail stores resulted in a price rise. The COVID-19 outbreak has impacted numerous meat production facilities across the globe. These outbreaks affected a large number of plants, which led to the disruption of the supply chain, closure of some factories, and posed a substantial threat to the meat supply across regions. In May 2020, Cargill, Inc.’s beef processing plant in High River, Alberta was the largest factory outbreak in Canada. More than 1,000 cases were linked to the plant, and it was considered the single largest virus cause in North America.

Rising health consciousness among the masses, along with the increasing demand for animal-sourced protein, is one of the key factors driving the market. With changing dietary habits, consumer preferences are rapidly shifting toward food products with low fat and calorie content and high protein value. Additionally, the increasing utilization of beef in the food industry is favoring market growth. Beef-based burgers, hotdogs, sausages, fillets and steaks, and stews are widely served across cafes and restaurants to provide consumers with authentic and multi-cuisine dishes.

Some of the key factors propelling the demand for meat are the constantly rising income of middle-class consumers in the developing countries of Latin America and the Asia Pacific, as well as the significant demand for convenience foods among the working population and the younger generations who are keen on cooking at home. Over the past few years, the busy daily schedules of consumers have widened the market scope for ready-to-eat meat products across the globe.

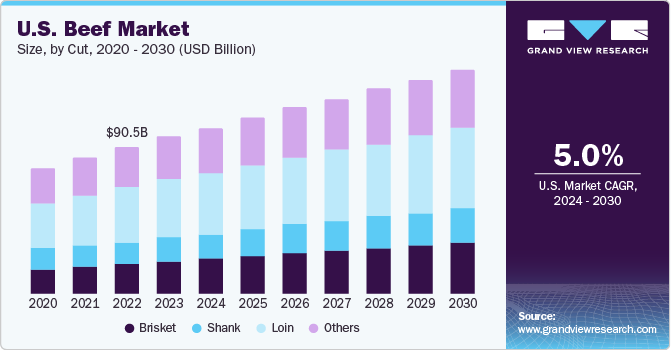

Cut Insights

The loin segment dominated the market and accounted for the largest revenue share of 36.5% in 2021. The rising health consciousness among the masses, along with the increasing demand for animal-sourced protein, is one of the key factors driving the market. Loin cut benefits greatly from dry aging. Also, these are the tenderest, juiciest, and the most flavorful.

The brisket segment is expected to witness a significant CAGR during the forecast period. Brisket is the meat surrounding the breastbone; it is the lower breast or pectoral muscle of the animal and is one of the primal cuts. Since this area is so well-exercised, it makes for a rather tough piece of meat that is full of connective tissues and therefore, is best suited for a low and slow cooking process. It is coarse-grained and thick meat, which requires a lot of time and low temperature to tenderize and break down. Brisket is one of the most flavorful cuts of meat. Brisket cuts are popular due to their low cost and are mostly used in BBQ.

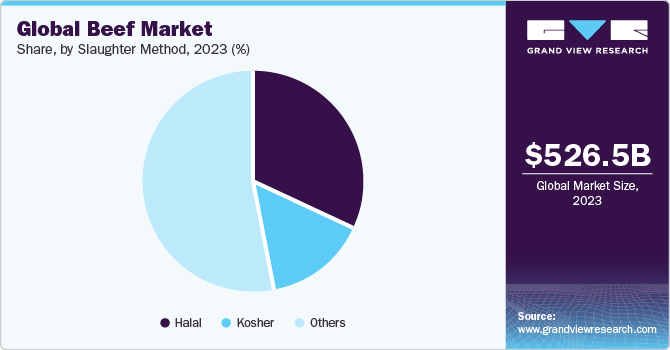

Slaughter Method Insights

The halal segment is projected to witness a CAGR of 4.5% during the forecast period. Demand for halal products is mostly driven by the growing Islamic population around the world. Halal beef is the one that is free from any component that Muslims are prohibited from consuming and these are processed or produced in accordance with Islamic law. It is commonly known as the Islamic slaughter method wherein the cut must sever at least three of the trachea, esophagus, and the two blood vessels on either side of the throat. Halal beef is one of the most preferred forms of meat for the followers of Islam since the religion prohibits the consumption of pork.

Kosher is a form of beef primarily consumed by the Jewish population around the world. Kosher beef is consumed in accordance with the Jewish dietary laws, which dictate what Jewish people can and cannot eat based on their religion and how food items should be prepared. The word kosher is an umbrella term for foods that fit into these dietary laws according to the Jewish traditions. Cattle that have died of natural causes, those that are killed by other animals or have diseases or flaws cannot be used for kosher beef.

Regional Insights

The Asia Pacific dominated the market and accounted for a revenue share of 47.8% in 2021. The key beef markets in the Asia Pacific are China, India, Pakistan, Japan, and Australia. China is one of the world’s largest markets for beef as the country is witnessing a significant rise in consumption, driven by increasing disposable incomes. Ongoing shortages and pandemic-related labor shortages specifically in the country like China are likely to support the increasing import of frozen beef, with Australia remaining the biggest supplier.

In North America, the market is expected to register a significant CAGR of 5.4% over the forecasting period, the presence of effective and sound infrastructure like sophisticated processing facilities and transportation networks, as well as intellectual expertise on issues like genetics, meat quality, and legal property rights, is supporting the market in the region. North America is the world’s largest producer of beef for domestic and export markets. Despite the fact that grasslands are North America’s most threatened terrestrial ecosystem, largely due to climatic and market pressures, most beef cattle are grass-fed at some point during their lifecycle.

Key Companies & Market Share Insights

The market is characterized by the presence of various global players such as Tyson Foods, Inc.; Danish Crown; Cargill Incorporated; Marfrig Global Foods S.A.; NH Foods Ltd.; Minerva Foods; St. Helen’s Meat Packers; Hormel Foods Corporation; JBS USA; National Beef Packing Company, LLC; Vion Food Group; Australian Agricultural Company Limited.

-

In February 2022, JBS, a global leader in protein-based food, presented at Gulfood 2022, the world's largest annual food and beverage trade show, held in Dubai (United Arab Emirates). Friboi, the top-selling Brazilian beef brand under JBS, offered attendees a premium experience with the Black Friboi and 1953 ranges. Black Friboi consists of the brand's most premium halal portfolio derived from the top genetic Black Angus in the USA: only 1% of the cattle meet the selection criteria.

-

In July 2021, Israel-based cultured meat company Aleph Farms received USD 105 million in a Series B investment round, bringing its funding to date up to USD 119.4 million, according to Crunchbase. It planned to use the money to prepare for a 2022 product launch by scaling up manufacturing facilities, growing international operations, and expanding its product lines and tech platform.

Some of the prominent players in the beef market include:

-

Tyson Foods, Inc.

-

Danish Crown

-

Cargill Incorporated

-

Marfrig Global Foods S.A

-

NH Foods Ltd

-

Minerva Foods

-

St. Helen’s Meat Packers

-

Hormel Foods Corporation

-

JBS USA

-

National Beef Packing Company

-

LLC

-

Vion Food Group

-

Australian Agricultural Company Limited.

Beef Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 497.3 billion

Revenue forecast in 2030

USD 712.5 billion

Growth Rate

CAGR of 4.8% from 2022 to 2030

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Cut, slaughter method, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; Russia; Switzerland; China; India; Japan; Australia; South Korea; Brazil; Argentina; Colombia

Key companies profiled

Tyson Foods, Inc.; Danish Crown; Cargill Incorporated; Marfrig Global Foods S.A.; NH Foods Ltd.; Minerva Foods; St. Helen’s Meat Packers; Hormel Foods Corporation; JBS USA; National Beef Packing Company; LLC; Vion Food Group; Australian Agricultural Company Limited.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global beef market report based on cut, slaughter method, and region:

-

Cut Outlook (Revenue, USD Million, 2017 - 2030)

-

Brisket

-

Shank

-

Loin

-

Others

-

-

Slaughter Method Outlook (Revenue, USD Million, 2017 - 2030)

-

Kosher

-

Halal

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

Russia

-

Switzerland

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

Colombia

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global beef market is expected to grow at a compound annual growth rate of 4.8% from 2022 to 2030 to reach USD 712.5 billion by 2030.

b. The Asia Pacific was the largest market for beef and accounted for 47.8% of the global demand in 2021. The key beef markets in the Asia Pacific are China, India, Pakistan, Japan, and Australia. China is one of the world’s largest markets for beef as the country is witnessing a significant rise in consumption, driven by increasing disposable incomes. Ongoing shortages and pandemic-related labor shortages specifically in the country like China is likely to support the increasing import of frozen beef, with Australia remaining the biggest supplier

b. Some key players operating in the beef market include Tyson Foods, Inc.; Danish Crown; Cargill Incorporated; Marfrig Global Foods S.A.; NH Foods Ltd.; Minerva Foods; St. Helen’s Meat Packers; Hormel Foods Corporation; JBS USA; National Beef Packing Company; LLC; Vion Food Group; Australian Agricultural Company Limited.

b. Key factors that are driving the market growth include rise in population, increasing consumer disposable income, and emergence of beef as a key source of protein.

b. The global beef market size was estimated at USD 467.7 billion in 2021 and is expected to reach USD 497.3 billion in 2022.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."

Important: Covid19 pandemic market impact

Amidst the global pandemic crisis and the indefinite lockdown across nations, the consumer food & beverage industry first witnessed high demand for household staples, healthy food items, and consumables with longer shelf lives. The demand for frozen food products, fruits & vegetables, eggs, flour, and whole grains, among others, witnessed a considerable increase during the early stages of the crisis. Presently, most companies in the industry are faced with low consumption of their products and supply chain challenges. The companies are focusing more on altering their supply chains in order to reinforce their online presence and delivery measures, in an attempt to adapt to the present business environment. The changes in consumer buying behavior and the dynamic shifts towards online and D2C distribution channels may have serious implications on the near future growth of the industry. Our team is diligently working towards accounting these factors in our report with the aim of providing you with the up-to-date, actionable market information and projections.