- Home

- »

- Clothing, Footwear & Accessories

- »

-

Baby Products Market Size, Share & Trend Report 2030GVR Report cover

![Baby Products Market Size, Share & Trends Report]()

Baby Products Market Size, Share & Trends Analysis Report By Product (Baby Cosmetics & Toiletries, Baby Food, Baby Safety & Convenience), By Region, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-1-68038-751-3

- Number of Pages: 80

- Format: Electronic (PDF)

- Historical Range: 2017-2020

- Industry: Consumer Goods

Report Overview

The global baby products market size was valued at USD 214.13 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 5.7% from 2022 to 2030. One of the primary factors driving market expansion is consumer preferences are shifting toward high-quality, utility-driven, and premium baby products. Additionally, the significant increase in awareness among parents pertaining to baby's health and hygiene fuels market expansion and many medical practitioners recommend parents regular usage of personal care products for better skin nourishment of the baby boosts the market growth. Covid-19 was an incomparable global public health crisis that affected almost every industry vertical, and the long-term effects are anticipated to impact the industry growth during the forecast period.

In the month of April 2020, when India was in complete lockdown to overcome COVID-19 pandemic, there was a decline observed in the spending share of baby care products, particularly in the convenience stores across major cities, as per research study conducted by GVR. Among types of baby care products, wipes and baby diapers witnessed lowered spending indices between March and April that same year, meanwhile, baby food saw a significant increase towards the end of April 2020.

Parents around the world have become more cautious when selecting any baby-related products, be it baby food, baby cosmetics & toiletries, or baby safety & convenience. Demand for chemical-free and harmless baby care toiletries has been mounting due to rising awareness associated with various health-related issues, such as fungal and bacterial infections, caused by synthetic baby products and toiletries. This has spurred the demand for skin, bathing, and other toiletries products for which consumers are willing to pay premium prices depending on their quality. Moreover, innovative packaging and the incorporation of specific organic ingredients that have multiple health benefits are likely to boost the growth of the market.

The rise in the population of working women particularly in an emerging country such as India contributes to the increased baby care products sector, making it one of the most significantly growing markets in India. The demand for baby products has seen to be growing significantly owing to increased disposable income and the spending power of the population on such superior quality products that assure improved baby health. Rising awareness about the health benefits of consuming baby food that have fewer pesticide residues and is particularly formulated for infants to toddlers, approximately between six months to two years of age further augments its demand.

Infants and toddlers are more prone to foodborne illness as their immune systems are not fully developed to combat infections. Therefore, factors such as premium quality products and their safety are amongst the most important criteria influencing the buyer’s decision. Moreover, the growing demand for gluten-free versions of baby food products is uplifting the industry growth of baby products. Health organizations such as FDA, have set strict guidelines for baby foods and the use of chemicals owing to their side effects on the human body. These factors in turn are likely to supplement the market growth.

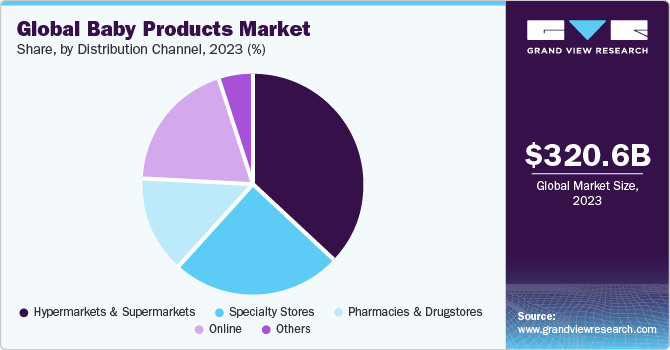

The online availability of baby care products and the increase in internet penetration consolidate the market expansion across the globe. The rising number of smartphone users, easy access to internet connectivity, and the rise in the use of e-banking systems is projected to aid in the sales of baby products through online platform. Owing to hectic lifestyles, consumers opt for the convenience of online shopping instead of visiting physical stores, which not only offer instant doorstep delivery but multiple discounts and offers at the same time. The use of mobile wallets is anticipated to increase in the years to come.

Product Insights

The global baby products market is segmented into three major segments including baby cosmetics & toiletries, baby food, and baby safety & convenience. The baby cosmetics & toiletries segment is further bifurcated into baby skincare, bath, baby hair care, and other cosmetics & toiletries products. Baby food is sub-segmented into baby milk, frozen baby food, baby juice, baby food snacks, and baby food cereals. Baby safety & convenience is further segmented into baby strollers and baby car seat market.

The global baby food market size stood at USD 91.92 billion in 20201. It is anticipated to expand at 5.6% in terms of revenue during the forecast period. Baby food is formulated in such a manner that can be easily consumed digested by infants and toddlers. It is available in several varieties, tastes, and forms. Baby food can be table food that has been mashed or can be readily available and purchased from a manufacturer. Rapidly growing urbanization, busy work schedules of the working class, and changing lifestyles are propelling demand for packaged foods for babies. An increase in parental concerns regarding baby’s nutrition has been a primary aspect to drive the growth of the segment.

New food technologies have been enabling food product manufacturers to provide good quality products added with nutritional benefits. The increasing demand, particularly for infant formula, is triggering the growth of the market. For instance, Nestle SA, with its products, such as Nestle Cerelac fortified baby cereal with milk multi grain & fruits, caters to the demand for fortified baby food in India. Nutrients used in fortifying baby food include calcium, iron, zinc, and multiple vitamins such as A, B, E, K, C, and B. Since, iron deficiency is the most common nutritional deficiency found amongst Indian children, manufacturers are introducing new products in the market that are rich in iron and folic acid for the baby’s physical and mental growth.

The baby safety and convenience segment held a significant share of the market and is poised to grow at a steady pace over the next coming years. A noticeable inclination toward nuclear families and a rising need for infant protection, along with an increasing number of government initiatives to control the rising death incidents among babies have been driving the market. The government is taking preventive initiatives by introducing new rules and safety standards, as the number of child deaths has been increasing. For instance, in Europe, the United Nations Economic Commission of Europe (UNECE) Regulation No. 129 and Regulation No. 44 has set the standards for child restraint systems and every baby car seat must meet these standards.

The baby cosmetics & toiletries segment contributed the second-largest share of the market and is projected to register the fastest CAGR from 2022 to 2030. Baby skincare accounted for more than 36.0% market share. New product launches by companies including Cotton Babies, Inc., Danone S.A., Honest Company, Inc, and Weleda among others are driving the growth of the sub-segment. Toiletries such as body lotion, moisturizer, and baby shampoo have been widely used by parents to ensure good health and maintain proper hygiene of the baby. Baby lotions help to moisten and soften their skin and restrict it from dryness and irritation. While shampoo made for babies are more gentle and used for cleaning baby's delicate skin and hair without taking moisture away.

Regional Insights

Asia Pacific is expected to witness a CAGR of 6.7% from 2022 to 2030. The market in this region is primarily driven by the number of working mothers and the increase in the birth rate in developing countries including India and China. According to the EPRA International Journal of Economic and Business Review, the female workforce participation rate has increased by 4.1% over the last three decades, which in turn is providing a boost for various baby-related products such as baby food, baby cosmetics & toiletries, and baby safety & convenience. In addition, a rise in disposable income triggered the spending power of consumers, thereby uplifting product demand.

India baby products market is anticipated market was valued at USD 15.06 billion in 2021 and is projected to grow at a CAGR of 7.7% over the forecast period. The market is mainly driven owing to the rising awareness among parents about the importance of nutrition and health for babies coupled with a rising focus on breastfeeding and organic/natural products in the country. Moreover, parents are placing greater importance on baby safety, leading to increased demand for safety-oriented baby products.

The ASEAN baby products market is projected to grow at a CAGR of 5.6% over the forecast period. Parents in ASEAN countries are becoming more aware of the importance of baby health, nutrition, and safety which further propelling the growth of the market. Moreover, Malaysia baby products market is likely to grow at a CAGR of 6.1% over the forecast period owing to the rising number of growing preferences for organic and eco-friendly baby products in the country. Consumers seek products made from natural ingredients, free from harmful chemicals, and with sustainable packaging. Market players have introduced smart baby monitors that come equipped with advanced features such as real-time video monitoring, temperature and humidity sensors, night vision capabilities, and two-way audio communication. For instance, the Nanit Plus is a high-tech baby monitor that incorporates various advanced functionalities to provide parents with real-time monitoring and enhanced convenience.

North America is expected to witness a CAGR of 4.6% from 2022 to 2030. Consumers in the countries such as U.S. and Canada are willing to pay a high price which concerns their baby’s lives and health. Technological advancement, working parents, government initiatives for infant safety, and early adoption of advanced products have been contributing to the growth of the market in North America. According to TABS Industry Report, consumers with an income of more than USD 150,000 presented an increase in penetration for baby products. Additionally, the presence of established manufacturers such as Johnson & Johnson Services, Inc. Company, Johnson & Johnson Limited, and Kimberly-Clark Corporation in the region has positively impacted the market growth.

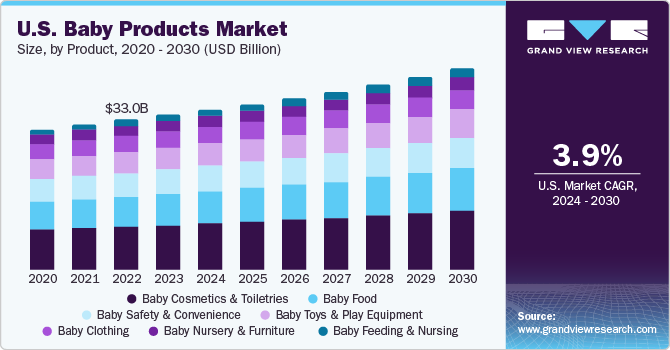

The U.S. baby products market was valued at 28.97 billion in 2021 and is projected to grow at a CAGR of 3.7% over the forecast period. The major factors that drive the market growth include changing demographics, online retail, safety and quality considerations, eco-consciousness, and technological advancements. Moreover, the market players provide new features, smart technologies, and product enhancements to meet the changing needs of modern parents, such as smart monitors, wireless connectivity, and app integration. For instance, the Owlet Smart Sock Baby Monitor is an innovative product that combines smart technology with baby monitoring to provide parents with peace of mind and real-time insights about their baby's well-being.

Europe baby products market was valued at USD 44.45 billion in 2021 and is anticipated to grow at a CAGR of 5.2% over the forecast period. Busy lifestyles and the increasing participation of both parents in the workforce have resulted in a demand for baby products that offer convenience and time-saving features. The major countries such as the U.K., Germany, France, Italy, and Spain are contributing significantly to the market growth. U.K. baby products market size was valued at USD 4.26 billion in 2021 and is projected to grow at a CAGR of 4.0% over the forecast period. Influencer marketing and social media play a significant role in shaping consumer perceptions and purchasing decisions in the UK baby products market. For instance, Tommee Tippee has partnered with various parenting influencers in the UK to promote its products and engage with its target audience. One notable collaboration is with a popular parenting influencer, Sarah Turner, also known as "The Unmumsy Mum.

African baby products market is expected to grow at a CAGR of 4.9% over the forecast period. Modern urban parents are increasingly seeking convenience, safety, and quality in baby products, resulting in a shift towards branded and value-added products. South Africa baby products market is projected to grow at a CAGR of 5.9% over the forecast period driven by factors such as population growth, rising disposable incomes, urbanization, and changing consumer preferences. Understanding the diverse needs and preferences of African parents, ensuring affordability, and complying with local regulations are key considerations for companies operating in this market.

Key Companies & Market Share Insights

The market includes both international and domestic participants. Key market players focus on strategies such as innovation and new product launches in retail about natural products to enhance their portfolio offering in the market.

-

In October 2022, Nature's One added an organic infant formula to its Baby's Only Formula range, making it the first of its kind. The Baby's Only Organic Premium Infant Formula is specially formulated to meet all FDA nutrient requirements, ensuring it fulfills the nutritional needs of infants from birth as a complete source of nourishment or as a supplement alongside breastfeeding.

-

In August 2020, Kimberly-Clark Corporation, the premium nappy brand, launched a new product as it plans to increase penetration and cater to children across a wider age range.

-

In September 2021, Personal care Johnson & Johnson launched its new range of ‘Cottontouch” baby care products that include lotion, oil, wash, and cream as it experiences increased demand in the Indian market. The company plans to sell these products through multiple channels such as stores and multi-brand e-commerce platforms such as Flipkart, Nykaa, Amazon India, BigBasket, and FirtstCry, among others.

-

In July 2020, Procter & Gamble, the Cincinnati-based maker of consumer goods launched a new line of Pampers diapers that are designed to help hospitals minimize the disturbance of sleeping babies who were born prematurely.

Some of the key players operating in the global baby products market include:

-

Johnson & Johnson

-

Kimberly-Clark Corporation

-

The Procter & Gamble Company

-

Unilever

-

Britax

-

Chicco

-

Dorel Industries

-

Beiersdorf AG

-

Fujian Hengan Group

-

Nestlé S.A.

Baby Products Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 225.47 billion

Revenue forecast in 2030

USD 352.65 billion

Growth Rate

CAGR of 5.7% from 2022 to 2030

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Germany; UK; China; India; Japan; Brazil; Saudi Arabia

Key companies profiled

Johnson & Johnson; Kimberly-Clark Corporation; The Procter & Gamble Company; Unilever; Britax; Chicco; Dorel Industries; Beiersdorf AG; Fujian Hengan Group; Nestlé S.A.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the latest trends and opportunities in each of the sub-segment from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the baby products market report on the basis of product and region.

-

Product Outlook (Revenue, USD Million; 2017 -2030)

-

Baby Cosmetics & Toiletries

-

Baby Skin Care Products

-

Bath Product

-

Baby Hair Care Products

-

Baby Diapers

-

Other Cosmetics & Toiletries

-

-

Baby Food

-

Baby Milk Products

-

Frozen Baby Food

-

Baby Juice

-

Baby Food Snacks

-

Baby Food Cereals

-

-

Baby Safety & Convenience

-

Baby Strollers

-

Baby Car Seats

-

Baby Monitors

-

Baby Proofing Products

-

Others(Baby Gates, Nasal Aspirators)

-

-

Baby Toys and Play Equipment

-

Rattles and Teethers

-

Stuffed Animals and Plush Toys

-

Baby Walkers

-

Others (Play mats, hanging toys, Jumpers & bouncers)

-

-

Baby Clothing

-

Bodysuits

-

Tops

-

Bottoms

-

Others (Outerwear, onesies)

-

-

Baby Nursery and Furniture

-

Cribs and Coats

-

Bassinets

-

High Chairs

-

Others (Dressers, Storages)

-

-

Baby Feeding and Nursing

-

Bottles and Nipples

-

Breast Pumps

-

Bottle Warmers and Sterilizers

-

Others (Nursing Pillows, High Chairs)

-

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

-

Europe

-

Germany

-

U.K.

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global baby products market size was estimated at USD 214.13 billion in 2021 and is expected to reach USD 225.48 billion in 2022.

b. The global baby products market is expected to grow at a compound annual growth rate of 5.7% from 2022 to 2030 to reach USD 352.65 billion by 2025.

b. The Asia Pacific dominated the baby products market with a share of 29.9% in 2021. This is attributable to rapid urbanization and changing lifestyles in countries such as China and India.

b. Some key players operating in the baby products market include Procter & Gamble Company, Kimberly-Clark Corporation, Johnson & Johnson Plc, Unilever Plc, Nestle S.A., Dorel Industries, Britax, Chicco, Fujian Hengan Group and Beiersdorf AG.

b. Key factors that are driving the baby products market growth include rising consumer awareness regarding child health worldwide and the growing middle-class population across several Asian countries

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."

Important: Covid19 pandemic market impact

The clothing, footwear, & accessories industry is anticipated to witness checkered growth throughout 2020, as a result of the unprecedented supply chain disruptions caused by the COVID-19 outbreak worldwide. The expected decline in the global sales of clothing, footwear, & accessories is attributable to massive supply chain disruptions across significant export markets, including China and India. However, the industry is likely to recover over the forecast timeframe, given the rising popularity of online/e-commerce sales. From a manufacturing standpoint, the sustainable or ethical fashion trend is expected to favor market growth throughout the forecast timeframe. Luxury apparel is another lucrative space for prospective manufacturers to target, given the mushrooming number of affluent and fashion-conscious consumers across the globe. Our team is diligently working towards accounting these factors in our report with the aim of providing you with the up-to-date, actionable market information and projections.