- Home

- »

- Advanced Interior Materials

- »

-

Automotive Metal Market Size, Share, Global Industry Report, 2025GVR Report cover

![Automotive Metal Market Size, Share & Trends Report]()

Automotive Metal Market Size, Share & Trends Analysis Report By Product (Aluminum, Steel, Magnesium), By Application (Body Structure, Power Train, Suspension), By End-use, And Segment Forecasts, 2018 - 2025

- Report ID: GVR-1-68038-560-1

- Number of Pages: 139

- Format: Electronic (PDF)

- Historical Range: 2014 - 2016

- Industry: Advanced Materials

Industry Insights

The global automotive metal market size was worth USD 84.66 billion in 2016. Growing demand for vehicles coupled with abundant raw material availability is the key factor for the growth globally. In addition, government efforts to enhance the manufacturing capabilities in the emerging economies are anticipated to positively affect the market over the forecast period.

The sector has been witnessing significant development in terms of materials as well as technologies used for the manufacturing of vehicle components. Stringent fuel efficiency regulations have facilitated R&D to develop lightweight & cost-effective materials for the automotive sector. Moreover, new technologies including 3D printing are being utilized for the manufacturing of large metal parts.

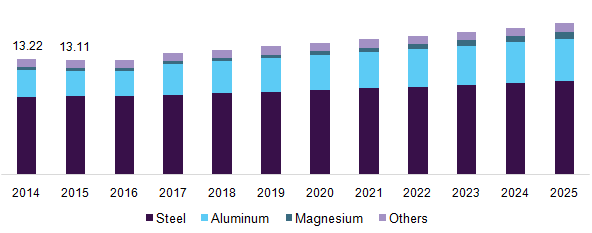

U.S. automotive metal market revenue, by product, 2014 - 2025 (USD Billion)

Aluminum and Magnesium are the fastest growing materials in the automotive industry. The lightweight of these products has led to increasing in their utilization in the manufacturing of car components, body structure, power trains, etc. In addition, the rising focus of consumers on car racing and sports cars is likely to have a positive impact on the market growth over the next eight years.

In the steel segment, manufacturers have been conducting extensive research for the development of grades that can reduce car weight equivalent to other metals and also provide cost-effectiveness. AHSS is one of the fastest-growing steel grades in the automotive sector. It not only leads to mass reduction but also reduces greenhouse gas emissions from vehicles.

ArcelorMittal SA, Voestalpine Steel Division, Magna International Inc., Alcoa Corporation, Hyundai Mobis, Schaeffler AG, Benteler International, Gestamp, Dana Limited, and GKN plc are some of the players in the global market. These companies are involved in the manufacturing of metals for automobiles.

The products are generally distributed to the end-users through direct supply agreements. However; some of the companies also prefer third-party sources/distributors for the supply of their products in various economies. These products are used by vehicle manufacturers including Volkswagen Group, Toyota Motors, Daimler, Ford Motors, BMW Group, General Motors, Nissan Motors, and Honda Motors for the manufacturing of vehicles.

Product Insights

Steel dominated the global market with a revenue share of 66.6% in 2016. Affordability and superior properties of new steel grades including advanced/ultra high strength steel are likely to positively affect its utilization in the automotive sector over the next eight years.

Steel is considered to have high recycling efficiency as compared to other metals. The End of Life Vehicles (ELV) regulations in Europe, Japan, South Korea, and India are expected to propel the utilization of steel in the automotive industry over the coming years.

Magnesium is likely to witness the fastest CAGR of 8.4%, in terms of revenue, from 2017 to 2025 due to its features including low specific weight, better elongation, 20.0% to 30.0% less cycle time, and ease of casting as compared to the other metals. Magnesium alloys are highly used in the interior applications of vehicles but have been witnessing significant development in terms of their use in other components including powertrain, chassis, and exterior parts.

Aluminum has been witnessing significant growth in the demand from the automotive industry due to its lightweight and high recyclability as compared to steel. Aluminum can absorb twice the crash energy as compared to mild steel and provides a weight reduction of up to 50.0%., which is expected to propel its demand over the coming years.

Application Insights

Body structure dominated the automotive metal market in 2016 and is projected to witness considerable growth of 4.5%, in terms of revenue, from 2016 to 2025. Ease of maintenance and repair of stamped metal parts and high recyclability as compared to plastics & composites are some of the major factors augmenting the demand for the product in vehicle body structure.

Suspension accounted for a share of 18.1%, in terms of volume, in 2016. Numerous manufacturers are shifting towards lightweight products such as aluminum and magnesium in order to reduce vehicle weight. In addition, specialized applications such as the military are also utilizing titanium alloys for manufacturing suspension for armored vehicles.

Suspension and body frame requires the use of strong materials in order to ensure vehicle safety. Manufacturers are increasingly moving towards aluminum and magnesium thereby augmenting the market growth.

The power train consists of various forged metal parts including transmission shafts & gears, clutch hubs, driveshaft, and universal joints. In addition, the engine also utilizes forged pistons in order to increase its durability. High mechanical strength and resistance to heat, corrosion, & porosity have led to the high utilization of metal forged products in high-pressure valves, valve bodies, and fittings & flanges.

End-use Insights

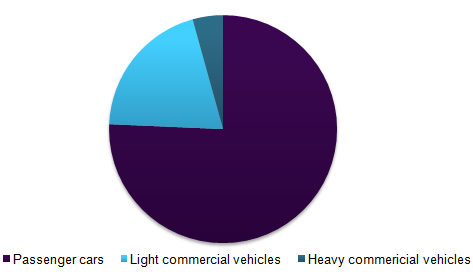

Passenger cars dominated the product demand in 2016 and are expected to witness a rapid growth of over 3.6%, in terms of volume, from 2017 to 2025. High demand for passenger cars in Asia Pacific, North America, and Europe are likely to positively impact the market over the coming years.

The market has witnessed an increase in consumers’ willingness to spend on vehicles with better quality and long life. This has led manufacturers to work on the development of new innovative products with high-end features at low cost. These factors are likely to promote the demand for metals in passenger cars.

Global automotive metals market revenue, by end-use, 2016 (%)

Government initiatives to upgrade the road infrastructure by improving the existing roads, adding highways, and management of traffic jams are likely to increase the demand for cars, thereby leading to an increase in the demand for automotive metals over the forecast period.

Light commercial vehicles are expected to witness a CAGR of 2.7%, in terms of volume, from 2017 to 2025. Increasing demand for commercial transportation services, including taxis is expected to propel the demand for light commercial vehicles over the forecast period.

Regional Insights

Asia Pacific accounted for 45.3% of the total market revenue in 2016. Consumer preference, government policies, environmental regulations, and competition are the key factors leading to the growth of the automotive industry in the region. Manufacturers are coming up with new designs and manufacturing processes in order to meet the rapidly changing consumer demand.

North America is one of the key markets for automotive metals worldwide. Initiatives undertaken by the government to increase vehicle fuel efficiency and reduce carbon dioxide emissions are expected to open new opportunities for the market over the coming years.

The U.S. population is equivalent to 4.3% of the global population, making it the third-largest economy in terms of population. High urban population and increasing GDP growth rate are likely to have a positive impact on the automotive sector, thereby augmenting the metals demand over the next eight years.

Central & South America accounted for a share of 3.5% of the global automotive metals demand in 2016. Rapid industrialization, shift in consumer lifestyle, and technological advancements have been witnessed in the region over the past years. Brazil, Argentina, Chile, Colombia, Venezuela, Puerto Rico, Ecuador, and the Dominican Republic are the key automotive markets in the region.

Automotive Metal Market Share Insight

The automotive metals market is characterized by the presence of numerous manufacturers across the world. The companies generally cater to the demand for a particular metal in the automotive industry.

The key players across the industry adopted expansion and mergers & acquisitions as their strategies in order to increase their reach and consumer base. Expansions were carried out through the setup of new facilities in the emerging markets.

Report Scope

Attribute

Details

Base year for estimation

2016

Actual estimates/Historical data

2014 - 2016

Forecast period

2017 - 2025

Market representation

Revenue in USD Million, volume in Kilo Tons, and CAGR from 2017 to 2025

Regional scope

North America, Europe, Asia Pacific, Central & South America, Middle East & Africa

Country scope

U.S., Germany, UK, China, India, Brazil

Report coverage

Revenue forecast, competitive landscape, growth factors and trends

15% free customization scope (equivalent to 5 analyst working days)

If you need specific market information, which is not currently within the scope of the report, we will provide it to you as a part of customization

Segments covered in the reportThis report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2014 to 2025. For the purpose of this study, Grand View Research has segmented the global automotive metal market on the basis of product, application, end-use, and region:

-

Product Outlook (Volume, Kilo Tons; Revenue, USD Million, 2014 - 2025)

-

Aluminum

-

Steel

-

Magnesium

-

Others

-

-

Application Outlook (Volume, Kilo Tons; Revenue, USD Million, 2014 - 2025)

-

Body structure

-

Power train

-

Suspension

-

Others

-

-

End-use Outlook (Volume, Kilo Tons; Revenue, USD Million, 2014 - 2025)

-

Passenger cars

-

Light commercial vehicles

-

Heavy commercial vehicles

-

-

Regional Outlook (Volume, Kilo Tons; Revenue, USD Million, 2014 - 2025)

-

North America

-

The U.S.

-

-

Europe

-

Germany

-

The U.K.

-

-

Asia Pacific

-

China

-

India

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."

Important: Covid19 pandemic market impact

The automotive & transportation industry is amongst the most exposed verticals to the ongoing COVID-19 outbreak and is currently amidst unprecedented uncertainty. COVID-19 is expected to have a significant impact on the supply chain and product demand in the automotive sector. The industry's concern has moved on from being centered on supply chain disruption from China to the overall slump in demand for automotive products. The demand for commercial vehicles is expected to plummet with the shutdown of all non-essential services. Furthermore, changes in consumer buying behavior owing to uncertainty surrounding the pandemic may have serious implications on the near future growth of the industry. Meanwhile, liquidity shortfall and cash crunch have already impacted the sales of fleet operators, which is further expected to widen over the next few months. We are continuously monitoring the COVID-19 pandemic, and assessing its impact on the growth of the automotive & transportation industry. The report will account for Covid19 as a key market contributor.