- Home

- »

- Electronic Devices

- »

-

Automated Test Equipment Market Size & Share Report, 2028GVR Report cover

![Automated Test Equipment Market Size, Share & Trends Report]()

Automated Test Equipment Market Size, Share & Trends Analysis Report By Product (Non-memory, Memory, Discrete), By Vertical (Automotive, Aerospace & Defense, IT & Telecom), By Region, And Segment Forecasts, 2021 - 2028

- Report ID: 978-1-68038-176-4

- Number of Pages: 167

- Format: Electronic (PDF)

- Historical Range: 2017 - 2019

- Industry: Semiconductors & Electronics

Report Overview

The global automated test equipment market size was valued at USD 6.87 billion in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 3.3% from 2021 to 2028. The growth is driven by the use of Automated Test Equipment (ATE) in the automotive and semiconductor industry. A significant increase in the number of connected devices and consumer electronics, along with an increasing focus of many companies on quality improvement along with end-to-end testing solutions, is expected to further drive the market. Implementation of ATE in semiconductor manufacturing companies to enhance performance capability and speed of operation and, in turn, reduce the cost of semiconductor devices is expected to positively influence growth.

Increasing adoption of System on Chip (SoC) and high demand for consumer electronics is expected to be a key driving force for the ATE market over the forecast period. Growing electronic components in the automotive sector and penetration of smartphones are expected to drive the market. Miniaturization has widened the scope of ATE application. Additionally, considerable technological advancements coupled with design complexity and the need for effective testing are expected to fuel the market.

Advancements in semiconductor manufacturing processes, along with the expansion of wireless networks in developing nations, are expected to significantly drive the automatic test equipment market growth in the forthcoming years. Additionally, considerable technological advancements coupled with design complexity and the need for effective testing are a few factors expected to benefit the market expansion.

Recent technological advancements have significantly reduced the cost and time for manufacturing semiconductor ICs and have increased the profit margin for the companies. The ATE manufacturing companies constantly invest in R&D activities to enhance their product portfolio and to fit in with the latest improvements in semiconductor devices.

COVID-19 Impact Analysis

The COVID-19 pandemic has had an adverse impact on several markets, and the ATE market is no exception. The stringent lockdowns implemented due to the rapid spread of the virus meant that the ATE market had to suffer from a production standpoint. From the demand perspective, regulated demand from the IT & Telecom segment, especially during the second half of 2020, kept the demand for ATE products afloat in 2020. The ongoing trend of working remotely led to increased demand for connectivity and IT products, consequently driving the need for automated test equipment.

Market Dynamics

Automated Test Equipment (ATE) is used to identify defects in Devices Under Tests (DUT) and helps to ensure the quality of devices. Significant increase in the number of consumer electronics along with an increasing focus of the companies on quality improvement is driving the market demand. Consumer electronics industry had grown significantly in terms of revenue. The major factor for the growth of the consumer electronics industry is the rise in smartphone sales. Technological advancements and the emergence of 5G technology are expected to drive smartphones demand in the forthcoming years.

Companies focus on reducing the selling price of electronic devices, such as personal computers, cell phones, and other electronics devices, as a marketing strategy to maintain their position and stay ahead in the competition. Due to growing consumer demands, there is a continuous price pressure on semiconductor manufacturers wherein they adopt economies of scale to maintain their margins. Packaging and testing costs account for more than 50% of the overall production cost of ICs, which is expected to rise to over 73% in the future. The fabrication costs are not considered as a part of the profit margin in the manufacturing of semiconductor chips. The companies concentrate on enhancing their fabrication technologies to reduce losses due to damages.

Product Insights

The non-memory ATE segment led the automated test equipment market and accounted for more than 66% share of the global revenue in 2020. Recent innovations in IoT devices and autonomous vehicles, along with significant advancements in the defense and aerospace sectors, have drastically changed the market dynamics. Companies are focusing on enhancing customer satisfaction by ensuring faster time-to-market along with superior product quality and low testing costs. These factors act as significant growth drivers for the market.

The product segment is further segregated into non-memory, memory, and discrete automated test equipment. Increased complexities in semiconductor chip manufacturing need a significant amount of test cost and time. Semiconductor companies focus on reducing testing costs and consider outsourced equipment for the testing process instead of in-house development, which is one of the primary factors driving the growth.

Vertical Insights

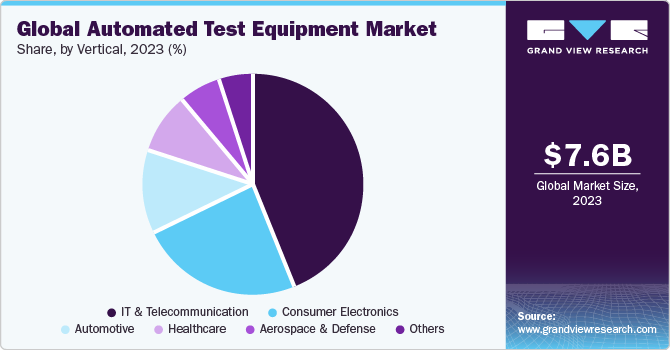

The IT and telecommunications ATE segment led the market and accounted for more than 48% share of the global revenue in 2020. Based on vertical, the market is categorized into automotive, consumer, aerospace and defense, IT and telecommunications, and others. The others segment includes Banking, Financial Services and Insurance (BFSI), entertainment, e-commerce, and medical. Increasing application of automatic test equipment in the semiconductor assembly and manufacturing industry is expected to drive the demand for ATE. The IT and telecommunication vertical is expected to have a significant market over the forecast period.

Demand for automated test equipment is driven mainly by increasing ST production, complexity, and performance level of semiconductor devices used in electronic products along with the emergence of development in semiconductor device technology. Furthermore, increasing pricing pressure among semiconductor manufacturers has forced suppliers to leverage the utilization of capital equipment across multiple devices. Increasing application in the semiconductor assemble and manufacturing industry is expected to drive the product demand.

Regional Insights

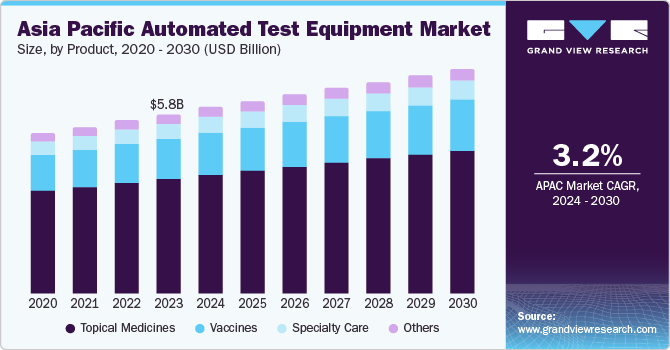

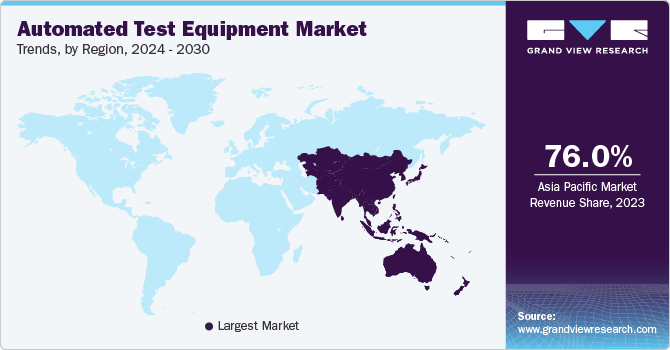

The Asia Pacific segment led the market and accounted for more than 75% share of the global revenue in 2020. The region is expected to dominate over the forecast period, attributed to the significant presence of semiconductor industries. China and Taiwan are expected to hold the maximum regional revenue share. Adaptive testing, advanced Design-For-Test (DFT), faster mixed-signal testers, fine-pitch probe cards, and design standards among others are few future technologies expected to significantly change the market dynamics. Increase in government initiatives by countries like China, Indonesia, Malaysia, Singapore, Thailand, and Taiwan to develop advanced manufacturing processes is also expected to boost growth.

The North America region is anticipated to witness significant gains, in terms of revenue share, over the forecast period due to the increasing application of automated test equipment in the aerospace and defense sector.

Key Companies & Market Share Insights

The ATE market is consolidated, wherein the top players accounted for the majority of the market share in 2020. The companies such as Teradyne Inc. and Advantest Co., Inc. are identified as the prominent ATE providers. There is also significant growth regarding revenue for these companies which lead the market. At the same time, other players such as CHROMA ATE INC. and Aemulus Holdings Bhd have been marked as promising and emerging players in the global ATE industry.

Business expansion through strategic partnership and new service offerings is an important strategy adopted by the key players in the market. Additionally, new facility center expansion is also considered part of their key strategies, which would help these key ATE providers cater to the significantly growing demand for transportation and warehousing services. Some of the prominent players operating in the global automated test equipment market are:

-

Aemulus Holdings Bhd (“Aemulus”)

-

Chroma ATE Inc.

-

Aeroflex Inc. (a subsidiary of Cobham plc)

-

Astronics Corporation

-

Advantest Corporation

-

LTX-Credence Corporation (Xcerra Corporation)

-

Teradyne Inc.

-

STAr Technologies Inc. (a subsidiary of Innotech Corporation)

-

Tesec Corporation

-

Roos Instruments, Inc.

-

Marvin Test Solutions Inc.

-

Danaher Corporation

Recent Developments

-

In April 2023, STAr Technologies Inc. unveiled the latest 3D/2.5D MEMS micro-cantilever probe card for the reliability testing of Wafer Acceptance Test (WAT). The probe card provides physical characteristics, thus contributing towards enhanced testing efficiency.

-

In October 2022, Chroma ATE Inc. launched the next generation Chroma 3650-S2 high performance power IC test platform. It is an automated testing equipment designed for testing battery, power management ICs (PMICs), and power conversion.

-

In May 2022, Advantest Corporation launched the compact test station for the V93000 Platform while enabling 4x capacity increase in IC engineering laboratories. This equipment is designed for functional and structural test of digital devices in engineering environments.

-

In May 2021, Astronics Corporation introduced anti-microbial outlet units. These units are advanced test equipment for providing additional safety attributes, and the organization is able to uplift the travel experience and provide solutions for passengers, and airlines.

Automated Test Equipment Market Report Scope

Report Attribute

Details

Market size value in 2021

USD 7.12 billion

Revenue forecast in 2028

USD 8.94 billion

Growth Rate

CAGR of 3.3% from 2021 to 2028

Base year for estimation

2020

Historical data

2017 - 2019

Forecast period

2021 - 2028

Quantitative units

Revenue in USD Million and CAGR from 2021 to 2028

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, vertical, region

Regional scope

North America; Europe; Asia Pacific; South America; MEA

Country scope

U.S.; Canada; Mexico; U.K.; Germany; China; Japan; South Korea; Taiwan; Thailand; Singapore; Malaysia; Brazil

Key companies profiled

Aemulus Holdings Bhd (“Aemulus”); Chroma ATE Inc.; Aeroflex Inc. (a subsidiary of Cobham plc); Astronics Corporation; Advantest Corporation; LTX-Credence Corporation (Xcerra Corporation); Teradyne Inc.; STAr Technologies Inc. (a subsidiary of Innotech Corporation); Tesec Corporation; Roos Instruments, Inc.; Marvin Test Solutions Inc.; Danaher Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

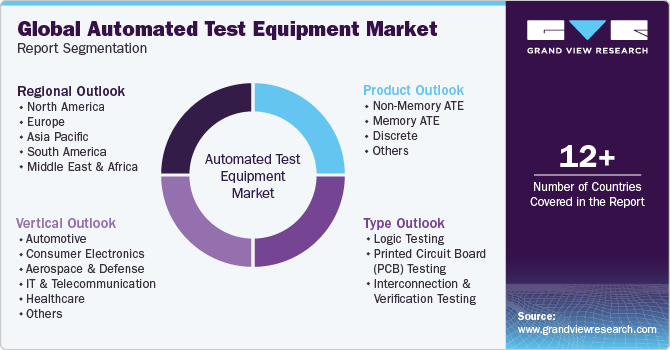

Global Automated Test Equipment Market Report SegmentationThis report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2028. For this study, Grand View Research has segmented the global automated test equipment market report based on product, vertical, and region:

-

Product Outlook (Revenue, USD Million, 2017 - 2028)

-

Non-Memory ATE

-

Memory ATE

-

Discrete ATE

-

-

Vertical Outlook (Revenue, USD Million, 2017 - 2028)

-

Automotive

-

Consumer

-

Aerospace & Defense

-

IT & Telecommunications

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2028)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

-

Asia Pacific

-

China

-

Japan

-

South Korea

-

Taiwan

-

Thailand

-

Singapore

-

Malaysia

-

-

South America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global ATE market size was estimated at USD 6.87 billion in 2020 and is expected to reach USD 7.12 billion in 2021.

b. The global ATE market is expected to grow at a compound annual growth rate of 3.3% from 2021 to 2028 to reach USD 8.94 billion by 2028.

b. Asia Pacific dominated the ATE market with a share of 75.7% in 2020. This is attributable to the significant presence of semiconductor industries. China and Taiwan are expected to hold the maximum regional revenue share.

b. Some key players operating in the ATE market include Aemulus Holdings Bhd (“Aemulusâ€); Chroma ATE Inc.; Aeroflex Inc. Astronics Corporation; Advantest Corporation; LTX-Credence Corporation; Teradyne Inc.; STAr Technologies Inc.; Tesec Corporation.

b. Key factors that are driving the ATE market growth include a significant increase in the number of connected devices and consumer electronics along with the increasing focus of the companies on quality improvement and end-to-end testing solutions.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."

Important: Covid19 pandemic market impact

The global electronics devices market (including consumer electronics and industrial electronics devices) is expected to be impacted significantly by COVID-19 as China is one of the major suppliers for the raw materials (used to manufacture devices) as well as the finished products. The industry is on the brink of facing a reduction in production, disruption in supply, and price fluctuations. While this can vastly encourage local manufacturers to step up and address the growing demand, the scarcity of raw material can still pose a challenge to this industry. The sales of prominent electronic companies is expected to be affected in the near future. The report will account for Covid19 as a key market contributor.