- Home

- »

- Medical Devices

- »

-

Atherectomy Devices Market Size And Share Report, 2030GVR Report cover

![Atherectomy Devices Market Size, Share & Trends Report]()

Atherectomy Devices Market Size, Share & Trends Analysis Report By Type (Directional Atherectomy, Rotational Atherectomy, Orbital Atherectomy, Laser Atherectomy), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-1-68038-416-1

- Number of Pages: 120

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Healthcare

Report Overview

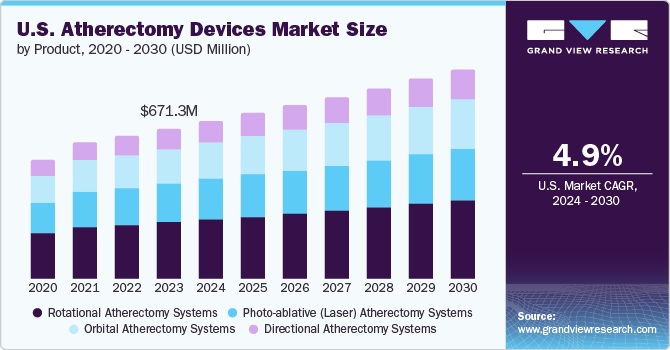

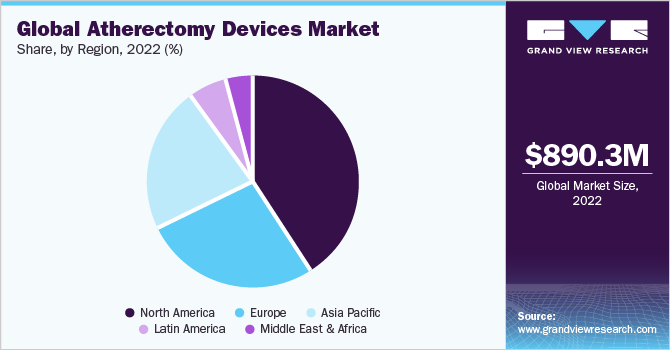

The global atherectomy devices market size was valued at USD 890.3 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 8.1% from 2023 to 2030. Owing to the rising prevalence of target diseases such as coronary artery disease (CAD) and peripheral artery disease (PAD). The prevalence of these diseases is increasing globally, due to factors such as the aging population, unhealthy lifestyles obesity. According to the National Center of Biotechnology Information, (NCBI), more than 230 million people worldwide suffer from peripheral artery disease (PAD), with high prevalence in the geriatric population. Additionally, there is an estimated increase in PAD prevalence of more than 17%. Furthermore, globally, in 2019, 113, million people lived with PAD and 10 million new cases occurred, resulting in 74,063 deaths. The growing demand for minimally invasive procedures and the increasing number of patients with cardiovascular disease is driving the growth of the market.

The COVID-19 pandemic harmed the atherectomy devices market. The pandemic has decreased interest in the number of elective procedures, including atherectomy procedures. Hospitals and clinics were overwhelmed with patients with COVID-19, which has caused a decrease in the availability of resources for elective procedures. In addition, patients were reluctant to undergo elective procedures due to concerns about the risk of contracting COVID-19. The restrictions imposed by the government to slow down the spread of COVID-19 decreased the demand for atherectomy devices.

The demand for minimally invasive surgeries/procedures (MIS) is on the rise as these surgeries have a success rate of around 90%. These procedures result in fewer traumas to the patient and quicker recovery than invasive procedures. An additional reason for this shift is the possibility of the occurrence of infection with invasive surgeries. Atherectomy is a minimally invasive procedure, therefore, the rising demand for minimally invasive surgeries is expected to render a high-impact driver for the market during the forecast period.

Traditionally, open surgery has been used to address plaque buildup. which is invasive, hazardous, and takes a long time to recover from. However, atherectomy devices, have allowed doctors to undertake less intrusive treatments that enable speedier recovery times and decreased risk of complications. In addition, atherectomy devices have the potential to increase drug efficacy by evaluating the use of orbital atherectomy to treat CAD in patients who are not eligible for Coronary Artery Bypass (CAB) grafting and evaluating the use of rotational atherectomy to treat PAD in patients who are not eligible for Endovascular Therapy (EVT). The results of these clinical trials are expected to further demonstrate the potential of atherectomy devices and could lead to their wider adoption in the treatment of cardiovascular diseases.

Type Insights

Based on type, the market has been segmented into directional, rotational, orbital, and laser atherectomy devices. The directional atherectomy segment dominated the market with the largest revenue share of 35.9% in 2022 owing to its advantages such as availability in various sizes and the ability of plaque debulking as they can precisely target and remove plaque, without damaging the surrounding tissue and less likely to cause bleeding or damage to the artery.

In August 2021, Medtronic updated its old medical device HawkOne Directional Atherectomy System which was launched in 2015 to boost its presence in the global market. Food and Drug Administration (FDA) approved the device application update. Various clinical trials to prove the efficacy of the device also contribute to the high demand. Clinical trials such as DEFINITIVE LE, which evaluated the efficacy of the SilverHawk peripheral plaque excision system for the treatment of infrainguinal vessels and lower extremities, and EASE (Endovascular Atherectomy Safety and Effectiveness), have demonstrated a success rate exceeding 90%, thereby providing compelling evidence regarding the effectiveness of these specific medical devices.

The laser atherectomy segment is expected to grow at the fastest CAGR of 9.4% over the forecast period from 2023 to 2030 as these devices have become more sophisticated over the past few years, making them more effective and safer. This has led to increased adoption of laser atherectomy by physicians. The increasing prevalence of peripheral artery disease (PAD) is driving the segment as Laser atherectomy is a minimally invasive procedure that can be used to remove plaque and improve blood flow in the legs. In September 2020, AngioDynamics, Inc. which is a leading provider of PAD, minimally invasive medical devices for vascular access, and oncology; launched the Auryon Atherectomy System. It is an innovative and newly developed device for the treatment of different peripheral artery diseases, such as; In-Stent Restenosis (ISR), and Critical Limb Ischemia (CLI).

The rotational atherectomy devices segment held a significant revenue share in 2022 due to the increased prevalence of cardiovascular disease and improvement in the safety and effectiveness of treating a variety of cardiovascular conditions, including coronary artery disease, peripheral artery disease, and carotid artery disease. For example, they are increasingly being used to treat calcified lesions, which were previously difficult to treat with other methods. and also less expensive than other treatment options. In April 2022, Rotapro Rotational Atherectomy Device was launched to treat triple vessel disease which is an extreme] form of CAD. Medica (Kolkata) was the first hospital to use this technology to cure a 70-year-old man suffering from triple vessel disease.

The reimbursement scenario is also favorable for atherectomy devices, contributing to its growth. In November 2018, the Centers for Medicare and Medicaid Services released the 2019 reimbursement scenario. The reimbursement rates for the hospital outpatient payment system for atherectomy were decreased by 8%. Additionally, in August 2020, the Ministry of Solidarity and Health initiated to reimburse Rotapro and Rotalink Plus which are rotational atherectomy systems by Boston Scientific Corporation. The devices were listed in Title V of the List of Reimbursable Products and Services (LPPR List).

Regional Insights

North America dominated the market with the largest revenue share of 41.5% in 2022. Suitable reimbursement scenarios and a high number of FDA-approved devices are the key reasons for this dominance. For instance, in April 2019, Avinger, Inc. received 510(k) clearance from the FDA for Pantheris SV (Small Vessel) image-guided atherectomy system. A product line extension of its Lumivascular image-guided atherectomy platform is expected in the Pantheris market by 50% thereby increasing its share in the global market.

Asia Pacific is expected to grow at the fastest CAGR of 9.5% over the forecasted period from 2023 to 2030. Factors like socioeconomic changes, unhealthy diets, smoking, consumption of alcohol, and an aging population have resulted in an increase in target diseases. Around 114 million people were affected by PAD in 2022 in the region. The prevalence of PAD increased with age, with 18.38% of men and 18.83% of women aged 85-89 years affected. Factors such as the increasing prevalence of PAD in the region, in addition to increasing product approvals, indicate the huge scope for market expansion in the region. For instance, in September 2022, Lepu Medical Technology Co. Ltd. received approval from the National Medical Products Administration (NMPA) to launch its peripheral cutting balloon to treat PAD in Beijing, China.

Key Companies & Market Share Insights

Product launches, approvals, strategic acquisitions, and innovations are just a few of the important business strategies used by market participants to maintain and grow their global reach. For instance, in February 2023, Abbott announced the acquisition of Cardiovascular Systems, Inc. According to the agreement, Abbott was set to acquire Cardiovascular Systems, Inc. for a sum of approximately USD 890 million, equivalent to a payment of USD 20 per share. This acquisition is expected to enable the integration of Cardiovascular Systems, Inc.'s portfolio of medical devices into Abbott's existing range of products, which are dedicated to treating vascular diseases. Abbott's product lineup will encompass their existing guidewires, catheters, and plaque-disrupting devices employed in atherectomies, as well as a pipeline of minimally invasive technologies designed for the removal of blood clots, presently in the developmental stage.

Similarly, in December 2021, Koninklijke Philips N.V. announced the acquisition of Vesper Medical Inc., a U.S.-based medical technology company specializing in the development of minimally invasive peripheral vascular devices. Through this acquisition, Koninklijke Philips N.V. enhanced its existing portfolio of diagnostic and therapeutic devices by incorporating Vesper Medical Inc.'s cutting-edge venous stent portfolio, specifically designed for the treatment of deep venous disease. This strategic move enabled Koninklijke Philips N.V. to further expand its offerings in the field of vascular healthcare. The following are some of the major participants in the global atherectomy devices market:

-

Boston Scientific Corporation

-

Cardiovascular Systems, Inc.

-

Medtronic

-

Avinger

-

Koninklijke Philips N.V.

-

BD

-

Abbott

-

Cordis

-

Terumo Medical Corporation

Atherectomy Devices Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 955.7 million

Revenue forecast in 2030

USD 1,648.2 million

Growth rate

CAGR of 8.1% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

September 2023

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

Boston Scientific Corporation; Cardiovascular Systems, Inc.; Medtronic; Avinger; Koninklijke Philips N.V.; BD; Abbott; Cordis; Terumo Medical Corporation

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Atherectomy Devices Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global atherectomy devices market based on type, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Directional Atherectomy

-

Rotational Atherectomy

-

Orbital Atherectomy

-

Laser Atherectomy

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global atherectomy devices market size was estimated at USD 890.3 million in 2022 and is expected to reach USD 955.7 million in 2023.

b. The global atherectomy devices market is expected to grow at a compound annual growth rate of 8.1% from 2023 to 2030 to reach USD 1,648.2 million by 2030

b. North America dominated the atherectomy devices market with a share of 41.5% in 2022. This is attributable to a suitable reimbursement scenario and a high number of FDA-approved devices.

b. Some key players operating in the atherectomy devices market include Boston Scientific Corporation, Cardiovascular Systems Inc., Medtronic (Covidien), Spectranetics, VOLCANO CORPORATION, Avinger Inc., Koninklijke Philips N.V, Straub Medical AG, ST. JUDE MEDICAL, BARD Peripheral Vascular, Cardinal Health (Cordis), and Terumo IS.

b. Key factors driving the market growth include the rising prevalence of target diseases, increasing demand for minimally invasive procedures/surgeries (MIS), and favorable reimbursement scenarios.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."

Important: Covid19 pandemic market impact

With Covid-19 infections rising globally, the apprehension regarding a shortage of essential life-saving devices and other essential medical supplies in order to prevent the spread of this pandemic and provide optimum care to the infected also widens. In addition, till a pharmacological treatment is developed, ventilators act as a vital treatment preference for the COVID-19 patients, who may require critical care. Moreover, there is an urgent need for a rapid acceleration in the manufacturing process for a wide range of test-kits (antibody tests, self-administered, and others). The report will account for Covid19 as a key market contributor.