- Home

- »

- Pharmaceuticals

- »

-

Asthma Therapeutics Market Size And Share Report, 2030GVR Report cover

![Asthma Therapeutics Market Size, Share & Trends Report]()

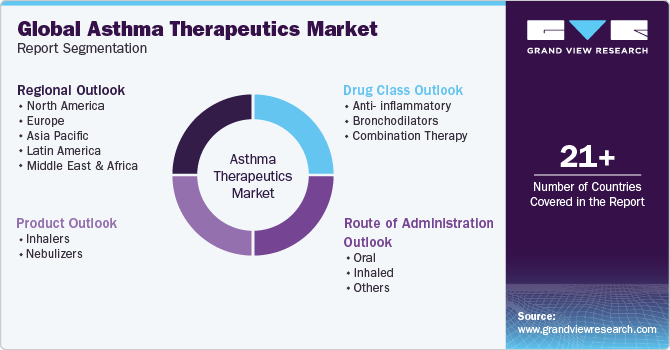

Asthma Therapeutics Market Size, Share & Trends Analysis Report By Drug Class (Anti-inflammatory, Combination Therapy), By Product (Inhalers, Nebulizers), By Route Of Administration, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: 978-1-68038-936-4

- Number of Pages: 126

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Healthcare

Report Overview

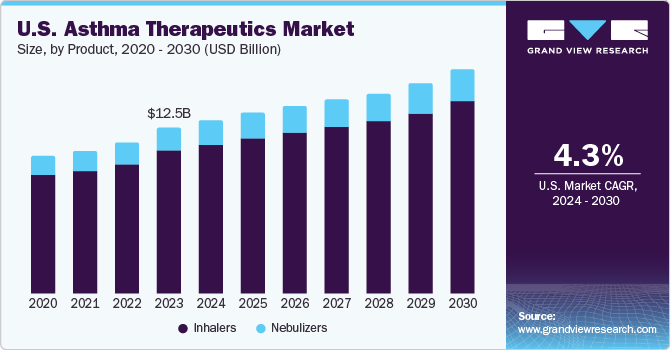

The global asthma therapeutics market size was estimated at USD 23.6 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 4.3% from 2023 to 2030. This is attributed to the increasing incidences of respiratory diseases coupled with the demand for cost-effective treatment options. According to the factsheet published by the World Health Organization (WHO) in May 2023, asthma affected approximately 262 million people in 2019 and led to the deaths of 455,000 people worldwide. Furthermore, factors, such as the rising indoor and outdoor causative agents including pollution, allergens, dust, and changing lifestyles that influence the incidences of asthma are further expected to drive the growth of the asthma therapeutics industry.

Other factors such as rising awareness and education about asthma and its management among patients, caregivers, and medical professionals can give a further boost to the treatments. For instance, the World Congress of Asthma event is held every year to raise awareness about the disease and various advancements made among experts, researchers, clinicians, and patients. This helps in the understanding and development of advanced treatment options.

According to a report published by the Forum of International Respiratory Societies in 2022, approximately 1000 people die daily from asthma, and these deaths are occurring as a result of the focus being on reliever medication rather than on preventive medication. In this light, various healthcare companies are also aiming to create awareness regarding preventive treatments to facilitate early diagnosis and treatment and reduce the death count. For instance, in May 2023, Alkem Labs launched #RelieverFreeIndia, an asthma awareness campaign that aims at spreading awareness about the risks associated with over-usage of reliever medications and substituting them with SMART therapy.

The increasing investment in research and development (R&D) of novel drugs and devices that offer better efficacy, safety, and convenience for asthma patients, such as biologics, biosimilars, inhalers, nebulizers, and smart devices is expected to further help in the treatment of asthma and consequently foster market growth. For instance, an article published by AJMC The Centers for Biosimilars suggests that BiosanaPharma had completed the phase 1 clinical trials for its biosimilar to omalizumab, an FDA-approved drug in the U.S. for the treatment of asthma and chronic idiopathic urticaria. These developments are expected to be catalysts in improving patient’s accessibility to treatment.

Drug Class Insights

Based on drug class, the asthma therapeutics market is segmented into combination therapy, anti-inflammatory drugs, and bronchodilators. The combination therapy segment including inhaled corticosteroids with long-acting beta-agonists dominated the overall therapeutic class market in 2022. This drug class boasts of the following benefits: enhanced therapeutic effect, extensive availability, and enhanced patient medication adherence.

The reduced inflammation, bronchoconstriction, and airway hyperresponsiveness, with a higher probability of reduced side effects of individual medication, as well as improved convenience offered by this class can further drive the segment growth. In June 2022, Glenmark Pharmaceuticals Limited launched India’s first Indacaterol+Mometasone fixed-dose combination drug for uncontrolled asthma named Indamet. It is available in three strengths with a fixed 150mcg of Indacaterol and 80mcg, 160mcg, and 320mcg of Mometasone. The development of such new and advanced drugs is anticipated to boost the growth of this segment.

The high efficacy and adoption rates of asthma therapeutics related to the dual-action combination therapy accounted for a significant revenue share as compared to the other drug combinations. Moreover, the increasing research and development efforts about the development of novel biologics, such as Duplimab and Lebrikizumab, in conjunction with the expected launch of pipeline products during the forecast period are anticipated to contribute towards the growth of the anti-inflammatory drugs market segment as this is expected to diminish the impact of generic competition.

For instance, in January 2023, AstraZeneca, a research-based biopharmaceutical company, received Food and Drug Administration (FDA) approval for Airsupra, a first-in-class pressurized metered-dose inhaler (pMDI) containing albuterol and budesonide. The treatment is anticipated to help in the prevention of bronchoconstriction and reduce the exacerbation risk in asthma patients above 18.

Route Of Administration Insights

Based on route of administration, the asthma therapeutics market is segmented into oral, inhaled, and others. The inhaled drugs segment held the largest revenue share in 2022 owing to the higher penetration rates and better patient medication compliance of pulmonary drug delivery systems in asthma treatment plans. The heightened patient awareness levels of alternative asthma therapeutic options and ease of use associated with these enhanced drug delivery systems are gaining prominence thereby encouraging the segment growth over the forecast period.

Oral medication is one of the treatment options for asthma, especially for people who have severe or persistent symptoms. Oral medication can help reduce inflammation, relax the muscles around the airways, and prevent asthma attacks. However, it also has some side effects, such as weight gain, mood changes, osteoporosis, and an increased risk of infections. Therefore, oral medication should be used only as prescribed by a doctor and under close monitoring. Oral medication is not a substitute for inhalers used to treat sudden asthma symptoms. For instance, Prednisone, a class of corticosteroids, is used in severe asthma attacks, it decreases the swelling of the airways over hours. It needs to be consumed for several days until the swelling is reversed.

Product Insights

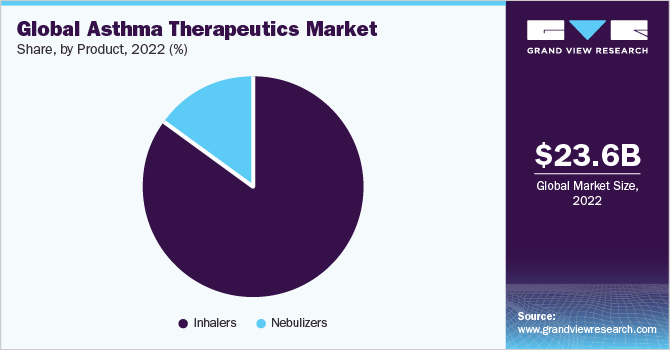

Based on product, the market is segmented into inhalers and nebulizers. Inhalers are further classified as dry powder, metered dose, and soft mist inhalers. The inhalers segment dominated the market with a share of 84.8% globally.This is majorly attributed to the reliability, versatility, self-containment, easy availability, portability, and cost-efficient medical aerosol delivery options among others. Increasing requirements for emergency treatment options aimed against sudden asthma attacks and portable devices constitute the crucial determinants contributing to the significant market share of dry powder inhalers (DPIs).

Furthermore, the increasing prevalence of asthma, chronic obstructive pulmonary disease (COPD), and the development of advanced products are expected to further boost the growth of the inhalers segment. For instance, in September 2020, GlaxoSmithKline plc (GSK) and Innoviva, Inc., announced the approval of a new indication for Trelegy Ellipta containing fluticasone furoate, vilanterol, and umeclidinium for the treatment of asthma and COPD, which makes Trelegy the first triple therapy inhaler in the U.S.

The nebulizer segment is projected to grow at a significant CAGR of 4.8% over the forecast period. The nebulizer delivers the drug in liquid form, which is dispensed by compressed air. The optimal design of the nebulizers facilitates the administration of medication in debilitated, geriatric, and pediatric patients. Compressors, ultrasonic, and mesh nebulizers represent the major types of nebulizers available commercially. These devices demonstrate significant benefits in the home healthcare section which is expected to provide this segment with future growth opportunities. In addition, nebulizers are small portable and can dispense medication directly into the respiratory tract. These associated benefits are expected to boost their usage rates during the forecast period.

Regional Insights

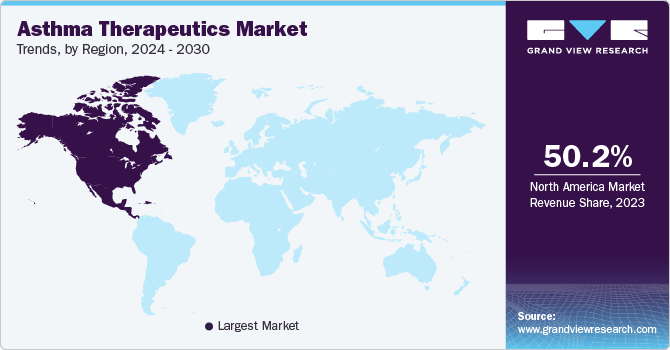

North America dominated the market and held a revenue share of 49.9% in 2022. The escalated incidence rate of asthma increased awareness levels about treatment options, and the rising adoption of inhaled therapeutics are some of the major factors attributing the largest revenue share of this region. The European market is set to witness steady growth mainly due to the presence of a considerably developed pharmaceutical industry and the significant demand for asthma-related therapeutics. The increasing geriatric population, susceptible to acquiring respiratory conditions, such as asthma, will further support the growth of the U.S. market. According to America’s Health Rankings, in 2021, the U.S. had more than 55.8 million people aged above 65, which approximates 16.8% of its population that is prone to asthma.

Asia Pacific is expected to grow at the fastest CAGR of 6.7% over the forecast period attributable to the generic competition, increasing asthma prevalence, and the demand for cost-effective treatment options for patients. The increasing investments in the healthcare sector and infrastructure development coupled with various government initiatives to support asthmatic patients are further expected to boost the market growth.

Moreover, urbanization is leading to higher levels of pollution which can cause asthma in younger and older populations. According to the United Nations Environment Program (UNEP), 70% of the global deaths occurring due to air pollution are from the Asia Pacific region, whereas the Climate & Clean Air Coalition states that 4 billion people, which is 92% of the total population of Asia Pacific region, are exposed to pollution levels that can adversely affect their health. This can further increase the incidence of respiratory diseases in this region, leading to further market growth.

Key Players & Market Share Insights

Key players are incorporating various business strategies to maintain and strengthen their position such as new product launches, approvals, acquisitions, and mergers. For instance, in February 2022 Mankind Pharma announced a pact with Dr. Reddy’s Laboratories Ltd. to acquire Combihale and Daffy. Combihale is a brand of inhaler used to treat asthma and COPD, which was valued at USD 109 million with 14% growth. The strategy is expected to help the company expand its product portfolio and gain a competitive edge against its rivals.

Patent expirations also play a significant role in this market, for instance, the ADVAIR and the ADVAIR DISKUS patents of GSK for asthma inhalation aerosol and inhalation powder, expired in 2010. In April 2021, Hikma Pharmaceuticals PLC announced its launch of generic versions of ADVAIR DISKUS in the U.S. after receiving approval for the same from the FDA, which is likely to boost competition in the market. However, the introduction of monoclonal antibodies holds a huge potential in offsetting the high asthma prevalence and reducing the daunting disease burden; these new technologies emerging in the market are expected to further augment the growth in the next seven years. Some prominent players in the global asthma therapeutics market include:

-

Teva Pharmaceutical Industries Ltd.

-

GSK plc.

-

Merck& Co., Inc.

-

F. Hoffmann-La Roche Ltd

-

AstraZeneca

-

Boehringer Ingelheim International GmbH.

-

Sanofi

-

Koninklijke Philips N.V.

-

BD

-

Sunovion Pharmaceuticals, Inc.

Asthma Therapeutics Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 24.6 billion

Revenue forecast in 2030

USD 33.2 billion

Growth rate

CAGR of 4.3% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Drug class, product, route of administration, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

Teva Pharmaceutical Industries Ltd.; GSK plc; Merck& Co., Inc.; F. Hoffmann-La Roche Ltd; AstraZeneca; Boehringer Ingelheim International GmbH; Sanofi; Koninklijke Philips N.V; BD; Sunovion Pharmaceuticals, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Asthma Therapeutics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global asthma therapeutics market report based on product, drug class, route of administration, and region:

-

Drug Class Outlook (Revenue, USD Million, 2018 - 2030)

-

Anti-inflammatory

-

Bronchodilators

-

Combination Therapy

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Inhalers

-

Dry powder inhalers

-

Metered dose inhalers

-

Soft mist inhalers

-

-

Nebulizers

-

-

Route of Administration Outlook (Revenue, USD Million, 2018 - 2030)

-

Oral

-

Inhaled

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global asthma therapeutics market size was estimated at USD 23.6 billion in 2022 and is expected to reach USD 24.6 billion in 2023.

b. The global asthma therapeutics market is expected to grow at a compound annual growth rate of 4.3% from 2023 to 2030 to reach USD 33.2 billion by 2030.

b. North America dominated the global asthma therapeutics market with a share of 49.9% in 2022. This is attributable to the high prevalence of asthma, increasing R&D initiatives by key players, and rising awareness among people about early diagnosis and treatment of asthma.

b. Some key players operating in the global asthma therapeutics market include Novartis AG; GlaxoSmithKline plc, Merck & Co., Inc.; F. Hoffmann-La Roche Ltd.; AstraZeneca plc; Boehringer Ingelheim GmbH; Teva Pharmaceuticals Industries Ltd.; Sunovion Pharmaceuticals; Inc.; Sanofi S.A.; and Cipla Ltd.

b. Key factors that are driving the market growth include robust product pipeline, rising government initiatives, and increasing awareness regarding asthma therapeutics and its available therapeutic options.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."

Important: Covid19 pandemic market impact

Multiple therapeutic regimens are being followed across the globe in attempts to come up with a reliable treatment for Covid-19. One line of treatment includes the use of hydroxychloroquine, while a second treatment line focuses to use antiviral drugs used in the disease management of HIV. Both these approaches have surged demand from advanced antivirals and antimalarial drugs. This impacts the drug manufacturers as an off label indication for these drug classes has to be worked upon. At the moment, the WHO has not prescribed any of these approaches, neither they have commented if one is better than the other. The report will account for Covid19 as a key market contributor.