- Home

- »

- Advanced Interior Materials

- »

-

Global Aramid Fiber Market Size & Growth Report, 2023GVR Report cover

![Aramid Fiber Market Size, Share & Trends Report]()

Aramid Fiber Market Size, Share & Trends Analysis Report By Product, By Application (Security & Protection, Frictional Materials, Rubber Reinforcement, Optical Fibers), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: 978-1-68038-883-1

- Number of Pages: 198

- Format: Electronic (PDF)

- Historical Range: 2018 - 2020

- Industry: Advanced Materials

Report Overview

The global aramid fiber market size was valued at USD 3.82 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 7.8% from 2023 to 2030. Rising demand for the product from various industries such as oil & gas, healthcare, manufacturing, and others owing to the stringent government regulations related to workplace safety is estimated to fuel the market growth over the forecast period. The aramid fiber demand witnessed a steep decline in growth, owing to a lack of demand from the industrial sector during the Covid-19 crisis. The government-imposed restrictions caused a temporary closure across wide range of industries, which resulted in limiting the product demand.

Aramid fibers are widely utilized in two types of applications, namely reinforcement in composites like military vehicles, sports goods, & aircraft and fabrics in clothing such as bulletproof vests or fire protection clothes. Aramid fiber is extensively utilized in various application segments such as protective gloves, sailcloth, flame & cut resistant clothing, snowboards, helmets, filament wound pressure vessels, body armor, optical fiber cable systems, ropes & cables, reinforcement for tires & rubber goods, tennis strings & hockey sticks, jet engine enclosures, asbestos replacement, and circuit board reinforcement.

The growth of the U.S. Aramid Fibers is expected to be driven by increase in adoption of several advanced material handling equipment such as wagon tipplers, belt conveyer systems, and bucket elevators for easy movement and handling and materials, in the cement industry. In addition, the adoption of advanced robotic systems in warehousing as per the trend of zero-labor warehousing in the U.S. is expected to benefit the market growth for aramid fibers.

In addition, a large number of manufacturers suffered huge financial losses due to the pandemic, leading to a number of manufacturers opting to postpone the installation of new automation systems. However, the aramid fiber industry witnessed a significant rise in product demand from the medical sector, which benefited the market.

Increasing demand for security & protective measures in various end-use industries such as military and construction is anticipated to boost the demand for aramid fibers over the forecast period. Aramid fiber is widely utilized in the making of protective clothing, equipment, and accessories owing to its excellent fiber, chemical, mechanical, and thermal properties.

Protective clothing is specifically designed, treated, and fabricated to protect personnel from hazards that are caused by dangerous work environments and extreme environmental conditions. Some of the protective clothing is designed to protect workers from pollution or infection. Protective clothing is widely utilized in various end-use industries such as healthcare/medical, mining, oil & gas, manufacturing, building & construction, military, and others.

Increasing onshore and offshore drilling activities coupled with the growing shale oil & gas industry is expected to drive the demand for aramid fibers in the U.S. over the forecast period. Para-aramid fiber segment is projected to witness significant growth on account of increasing demand from application segments owing to the rigid molecular structure of para-aramid fibers.

Product Insights

Para-aramid product segment led the market and accounted for about 75.1% share of the revenue in 2022. The excellent strength-to-weight ratio coupled with high tensile strength and modulus behavior is anticipated to benefit the segmental growth over the forecast period.

The product exhibits properties such as low elongation to break, good chemical resistance, good heat & flame resistance, excellent ballistic properties are expected to fuel its demand. In addition, high cut resistance, and good chemical resistance are projected to promote its consumption across various applications including aerospace, security & protection, and frictional materials.

Meta aramid fiber is manufactured using wet spinning technology, which includes spinning of the fiber in a chemical solution and forming a semi-crystalline product. The product exhibits the ability to sustain extreme tensile stress when exposed to flames and temperatures up to 400°C, which favors its adoption in high-temperature applications.

The meta-aramid fiber accounted for USD 951.7 million in 2022 and is projected to grow at a significant growth over the forecast period. Growing adoption of the product in protective clothing for military personals, electrical insulation, auto racers, and protective equipment is projected to benefit the market growth.

Application Insights

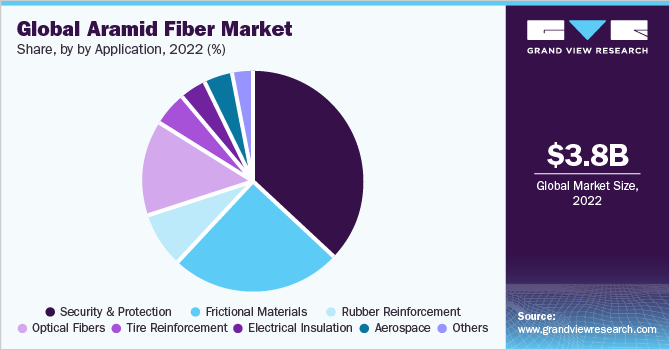

The security & protection segment led the market and accounted for more than 35.3% share of the global revenue in 2022. Increasing use of the product in bullet-resistant & protective clothing, stab-resistant products such as helmets and protective gloves, is projected to benefit the growth of the application segment.

Aramid fiber is increasingly used in aerospace components such as primary wing, and fuselage structures in new generation aircraft, landing gear doors, and leading & trailing edge panels. The properties of the product including its superior strength, impact resistance, and low weight are projected to result in high product consumption.

Aramid fibers are extensively used as a replacement of asbestos for friction and sealing products. In addition, the product is also used as reinforcement in friction products such as brake pads and clutch plates. Moreover, they are also used in high pressure/temperature hoses, gaskets, and seals. This is anticipated to benefit market growth over the forecast period.

Others segment include various applications such as composites, filtration, ropes & cables, recreational goods, and adhesives & sealants. Low density, high strength, good impact & abrasion resistance, excellent chemical resistance, and good resistance to thermal degradation are some of the key beneficial characteristics that are encouraging the product adoption.

Regional Insights

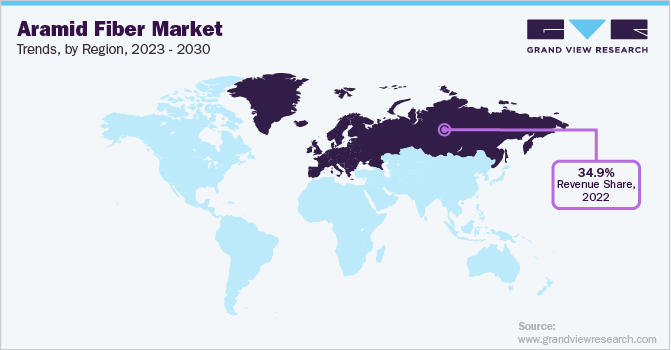

Europe region led the market and accounted for over 34.9% share of global revenue in 2022. It is expected to witness growth owing to rising employment of security & protection measures across several industries. In addition, increasing demand for the Internet from emerging economies, rapid industrialization, and robust growth in the telecom industry are likely to drive the productdemand.

Rising military expenditure in major economies such as China and India on account of the increasing geopolitical tensions is likely to offer growth opportunities for aramid fibers. In addition, rising investments in the construction, manufacturing, and healthcare sectors are anticipated to drive the demand for aramid fibers over the coming years.

North America is anticipated to reach USD 2,240.1 million by 2030. The growing number of refurbishing activities in the region coupled with stringent regulations pertaining to the security and protection measures of workers across various industries is projected to fuel the industry growth.

The protection standards laid down by the American National Standards Institute (ANSI) in the U.S. related to the of personnel protective equipment is likely to further fuel the demand for products such as protective gloves, helmets, and protective clothing. This is projected to benefit the expansion of aramid fiber industry in North America over the forecast period.

Key Companies & Market Share Insights

The key players in the market are employing strategies such as joint ventures, technical collaboration, capacity expansion, mergers & acquisitions in order to gain a stronger market position. In addition, the aramid fiber manufacturers are also engaged in developing cost-effective and high-quality production to gain a higher market share.

Yantai Tayho Advanced Materials Co., a manufacturer of aramid fiber operating in China, invested USD 89 million in July 2018 in order to expand its para-aramid manufacturing facility in China. The strategic initiative adopted by the company is projected to strengthen its market position in China and across the globe. Some prominent players in the global aramid fiber market include:

-

Teijin Ltd.

-

Yantai Tayho Advanced Materials Co

-

E. I. du Pont de Nemours and Company (DowDuPont)

-

Hyosung Corp.

-

Toray Chemicals South Korea, Inc.

-

Kermel S.A

-

Kolon Industries, Inc.

-

Huvis Corp.

-

China National Bluestar (Group) Co., Ltd.

-

SRO Aramid (Jiangzu) Co., Ltd.

Aramid Fiber Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 4.09 billion

Revenue forecast in 2030

USD 6.98 billion

Growth rate

CAGR of 7.8% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2020

Forecast period

2023 - 2030

Quantitative units

Volume in tons, revenue in USD billion, and CAGR from 2023 to 2030

Report coverage

Volume forecast, revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Russia; China; Japan; India; South Korea; Brazil

Key companies profiled

Teijin Ltd.; Yantai Tayho Advanced Materials Co; E. I. du Pont de Nemours and Company (DowDuPont); Hyosung Corp.; Toray Chemicals South Korea, Inc.; Kermel S.A; Kolon Industries, Inc.; Huvis Corp.; China National Bluestar (Group) Co., Ltd.; SRO Aramid (Jiangzu) Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Aramid Fibers Market Report Segmentation

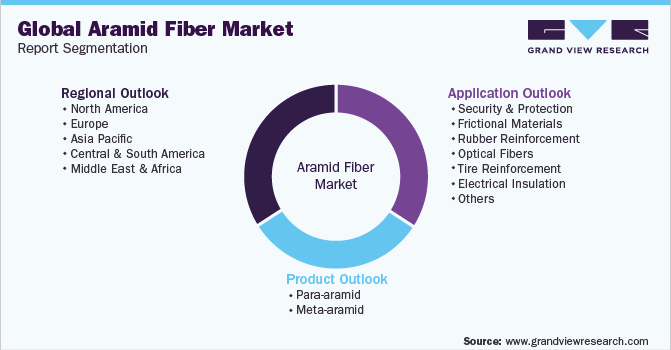

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the aramid fiber market on the basis of product, application, and region:

-

Product Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Para-Aramid

-

Meta-Aramid

-

-

Application Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Security & Protection

-

Frictional Materials

-

Rubber Reinforcement

-

Optical Fibers

-

Tire Reinforcement

-

Electrical Insulation

-

Aerospace

-

Others

-

-

Regional Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Russia

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. Some of the key players operating in the Aramid Fibers include Teijin Ltd., Yantai Tayho Advanced Materials Co, E. I. du Pont de Nemours and Company (DowDuPont), Hyosung Corp., Toray Chemicals South Korea, Inc., Kermel S.A, Kolon Industries, Inc., Huvis Corp., China National Bluestar (Group) Co., Ltd., SRO Aramid (Jiangzu) Co., Ltd.

b. Rising demand for the product from various industries such as oil & gas, healthcare, manufacturing, and others owing to the stringent government regulations related to workplace safety is estimated to fuel the market growth over the forecast period.

b. The global aramid fiber size was estimated at USD 3.82 billion in 2022 and is expected to reach USD 4.09 billion in 2023.

b. The global aramid fiber is expected to grow at a compound annual growth rate of 7.8% from 2023 to 2030 to reach USD 6.98 billion by 2030.

b. Security & protection application led the market and accounted for about 35.3% share of the revenue in 2022, due to increase in government regulations concerning worker safety in industrial working places.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."

Important: Covid19 pandemic market impact

The mining industry accounts for a vital share of the global economy and is responsible for supplying key raw materials for several applications and end-use industries, thus being a key sector of focus amidst the ongoing pandemic outbreak. Mining industries in China are expected to return to normal operations by Q3 of 2020 as enterprises indicated towards the returning of their workers soon. Moreover, iron ore producers are known to be the least impacted. Major players such as BHP and Vale reported experiencing no major influence on their operations due to the COVID-19 virus. The iron ore prices reached above USD 90 per ton amidst the pandemic situation which may negatively impact the end-use industries. The report will account for COVID-19 as a key market contributor.