- Home

- »

- Advanced Interior Materials

- »

-

Ammunition Market Size, Share & Outlook Report, 2023-2030GVR Report cover

![Ammunition Market Size, Share & Trends Report]()

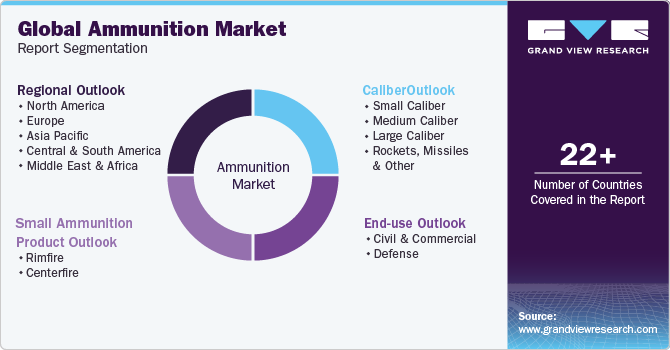

Ammunition Market Size, Share & Trends Analysis Report By Caliber (Small, Rockets & Missiles), By Small Ammunition Product (Rimfire, Centerfire), By End-use (Civil & Commercial, Defense), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-1-68038-183-2

- Number of Pages: 140

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Advanced Materials

Ammunition Market Size & Trends

The global ammunition market size was estimated at USD 58.28 billion in 2022 and is expected to decline at a compound annual growth rate (CAGR) of -5.6% from 2023 to 2030. A rise in the number of terrorist activities and hostilities across the globe is likely to increase the procurement of defense equipment by prominent militaries across the globe, thereby directly benefiting the market over the forecast period. Rising trends for sports and shooting that utilize rifles and pistols are expected to increase the penetration of small-caliber ammunition in the projected time. Moreover, technological advancements have introduced lightweight bullets made from polymer-based cases, thus supporting the overall industry.

The primary factor restraining the market’s growth is the low defense budget in targeted economies. The defense spending in some economies, such as Bangladesh, Sri Lanka, Philippines, Malaysia, Indonesia, Benin, Algeria, Burkina Faso, Peru, Chile, and others, is low compared to major economies in respective regions. Unstable economic conditions, political disputes, and low industrial output are the factors for low defense budgets in the economies.

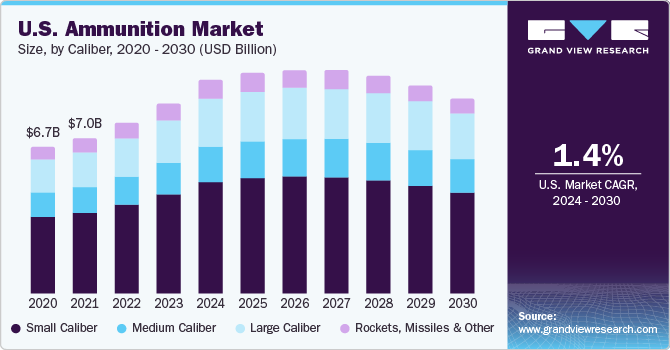

High investments by the U.S. government for enhancements in the military and armed forces are expected to support the market growth in the country. The procurement of small-caliber ammunition by civilians and the homeland security department is expected to bolster the overall market. Moreover, enhancing sales channels such as online sales in the country will likely supplement the growth.

A rise in the adoption of advanced materials for producing lightweight ammunition is expected to lead to fuel-efficient transportation, reducing the overall transportation cost. Furthermore, the above-mentioned trend is anticipated to enable the transportation of more rounds within the same weight limits, thereby positively impacting the market.

Commercially these ammunition products are not widely available on account of the restrictions on weapons in major economies. However, defense organizations in major territories have agreed to procure these products to enhance their security capabilities. Moreover, enhancements in the military by major economies like China, India, France, and Russia are expected to support market growth in the estimated time.

The ammunition industry globally is characterized by collaborations and acquisitions between major players and the government for the long term. Several governments across the globe, especially India, aim to enhance their defense forces by procuring and developing indigenous production facilities from foreign players.

The industry participants cater to their customers through direct supply or third-party distributors. Ammunition intended for commercial and civilian use, including hunting, sporting, and self-defense, is distributed through B2B or B2C channels. In B2B, manufacturers sell their finished goods to other businesses, such as ammunition shops or distributors, whereas, in the B2C channel, manufacturers sell their products directly to the customers.

Caliber Insights

The small caliber ammunition segment accounted for about 27.9% of the global revenue in 2022. This trend is attributed to many small-caliber ammunition applications, including shotgun pistols, assault rifles, rifles, and revolvers. Also, it will likely witness the fastest growth due to increasing demand from security forces to tackle the rising instances of armed conflicts.

Increasing procurement of medium caliber ammunition by the U.S. Army and its alliances, such as air, land, and sea, are expected to increase the overall ammunition market in the estimated time. Moreover, the enhancements in medium caliber ammunition to penetrate light armor materials will likely offer growth opportunities to the ammunition industry.

Medium caliber ammunition includes high-performance 20mm, 25mm, 30mm, and 40mm cartridges for a broad range of applications, including land, sea, and air, with the capability to penetrate light armor, material, and personnel target. The increasing application of guns and rifles by prominent militaries across the globe is anticipated to ascend the demand for medium-caliber ammunition.

Large-caliber ammunition dominated the market with a revenue share of 50.9% in 2022. The caliber can be classified into spin-stabilized, fin-stabilized, and rocket-assisted, a combination of spin-stabilized and fin-stabilized. A majority of the guns use the spin-stabilized large-caliber cartridge as it promotes flight stability using spinning, whereas fin-stabilized projectiles obtain stability through the fins located at the end of the projection period.

Small Ammunition Product Insights

The Centerfire small ammunition products segment led the market and accounted for about 70.8% of the global revenue in 2022. Centerfire ammunition is usually used for rifles, shotguns, and handguns. In centerfire ammunition, the primer is placed in the center of the casing base. This type of ammunition is reloadable and hence is the most common type of cartridge used.

Centerfire ammunition is employed as a universal standard in the military, police, and security forces owing to its potential to allow high pressure and the ability to reuse the casings. These cartridges are preferred for military operations owing to their thicker metal casing that can withstand rough handling without severe damage.

The rimfire small ammunition product segment is expected to register a CAGR of 1.0% during the estimated period owing to the increasing demand from shooters in light of the limited recoil offered. Beginners prefer rimfire bullets as they offer limited recoil when used. Moreover, they are cheaper as their thin casting with a flattened primer is easy to manufacture.

Although rimfire ammunition is a comparatively cheaper alternative, it is limited to small calibers. This can be attributed to the fact that the nature of the bullet casing is required it to be thin enough to crush and ignite the primer, which is challenging to accomplish in medium and large calibers. This type of ammunition is commonly used for .22LR.

End-Use Insights

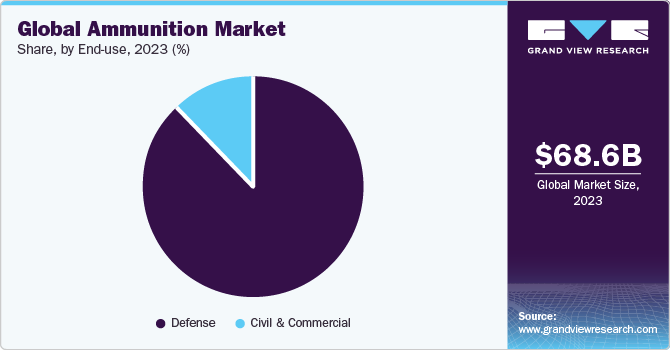

The defense end-use segment led the market and accounted for about 88.1% of the global ammunition market revenue in 2022. In addition, this segment is expected to maintain its dominance over the forecast period. Increasing cross-border conflicts have fueled the growth of the bullets market globally. Moreover, rising geopolitical tension and terrorist activities are expected to increase the penetration of products.

Full metal jacket bullets are used in military handguns on a large scale, whereas the air force tends to use hollow-point bullets for greater accuracy. Hollow-point bullets are popular among law enforcement and military personnel due to their rapid expansion property and excellent stopping power.

The semi-jacketed hollow-point bullets, known for their controlled penetration and high stopping power, can create a larger-than-average wound cavity and ensure effective results in a single shot. This bullet, thus, is typically used for self-defense, pistol target shooting, and backyard shooting. The rise in procurement of enhanced products is likely to offer growth opportunities.

With technological advancements, a bullet capable of turning, changing its speed, and sending data are being developed by countries including Russia and the U.S. It allows soldiers to stay in a protective cover and shoot around corners. Technological developments by the players are expected to aid the market growth.

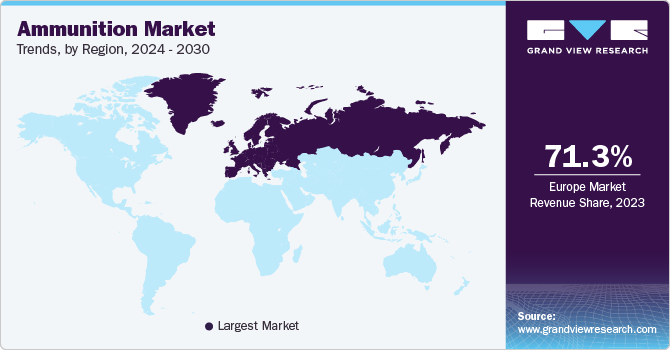

Regional Insights

North America was the second largest market, accounting for about 13.4% of the revenue share in 2022. The growing threat from terrorism coupled with lenient gun laws is expected to promote the consumption of bullets. Furthermore, the surge in sports & hunting activities is expected to be a crucial factor for expansion.

The North American bullets market is expected to grow significantly due to high demand from the U.S. The defense budget in North America has increased, which is heavily influencing the bullet market in the region. Long term competitive strategy of the U.S. Department of Defense for the development of technologies and new concepts of warfare is expected to aid the market growth.

Europe held a dominant revenue share of 70.8% in 2022. In Europe, the directives are provided by the government for the possession of firearms, the supply of firearms in a single market, and a protocol against the manufacturing and trafficking of firearms. Also, the European defense system has faced challenges in dealing with refugees from the Middle East and Syria. Europe has also faced a threat of terrorism; owing to these factors, the market for ammunition in Europe is expected to strengthen over the forecast period.

Rising geopolitical disputes and the increasing threat of terrorist attacks are the primary reasons for the growth of defense industries in the Asia Pacific. Countries like China and India are spending on modernizing their armed forces to battle against violence. These countries procure ammunition for the armed forces and law enforcement agencies to minimize the rising crime rate. These factors are expected to drive the demand over the forecast period.

Key Companies & Market Share Insights

Key companies, such as General Dynamics Corporation, Northrop Grumman, and BAE Systems, generate most of their revenues through military and government channels. Their primary customers include the U.S. Department of Defense and The Intelligence Community. Moreover, they also deliver products to U.S. government customers, including the Department of Homeland Security.

These players are also involved in teaming and sub-contracting relationships with their competitors. Competition for significant defense programs often requires teams to collaborate on their broad capabilities to cater to customer requirements. Opportunities associated with these programs include roles as the provider of sub-system or component and programs integrator. Some prominent players in the global ammunition market include:

-

Northrop Grumman Corporation

-

FN Herstal

-

Olin Corporation

-

General Dynamics Corporation

-

BAE Systems, Inc.

-

Rheinmetall Defense

-

Nexter KNDS Group

-

Hanwha Corporation

-

ST Engineering

-

Remington Arms Company LLC

-

Vista Outdoor Operations LLC

Ammunition Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 68.57 billion

Revenue forecast in 2030

USD 36.75 billion

Growth rate

CAGR of -5.6% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Caliber, small ammunition product, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Turkey; Spain; Russia; Czech Republic; Poland; China; India; Japan; South Korea; Australia; Singapore; Brazil; Argentina; Saudi Arabia; UAE

Key companies profiled

Northrop Grumman Corporation; FN Herstal; Olin Corporation; General Dynamics Corporation; BAE Systems, Inc.; Rheinmetall Defense; Nexter KNDS Group; Hanwha Corporation; ST Engineering; Remington Arms Company LLC; Vista Outdoor Operations LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Ammunition Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global ammunition market report based on caliber, small ammunition product, end-use, and region:

-

Caliber Outlook (Revenue, USD Million, 2018 - 2030)

-

Small Caliber

-

5.56 mm

-

7.62 mm

-

7.62 x 51 mm

-

7.62 x 39 mm

-

Others

-

-

9 mm

-

9 x 18 mm

-

9 x 19 mm

-

Others

-

-

-

Medium Caliber

-

23 mm

-

30 mm

-

Others

-

-

Large Caliber

-

VSHORAD

-

122 mm

-

Others

-

-

Rockets, Missiles & Other

-

Tank Ammunition

-

Artillery Ammunition

-

-

-

Small Ammunition Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Rimfire

-

Centerfire

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Civil & Commercial

-

Sports

-

Hunting

-

Self Defense

-

-

Defense

-

Military

-

Law Enforcement

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Spain

-

Russia

-

Turkey

-

Czech Republic

-

Poland

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Singapore

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global ammunition market size was estimated at USD 58.28 billion in 2022 and is expected to reach USD 68.57 billion in 2023.

b. The ammunition market is expected to decline at a compound annual growth rate of -5.6% from 2023 to 2030 to reach USD 36.75 billion by 2030.

b. The large caliber ammunition segment dominated the market with a revenue share of 50.9% owing to the rising use of spin-stabilized large caliber cartridges in guns as it promotes flight stability using spinning.

b. Some of the key players operating in the ammunition market include Northrop Grumman Corporation, FN Herstal, Olin Corporation, General Dynamics Corporation, and BAE Systems, Inc. among others.

b. The key factors that are driving the ammunition market include rising global military expenditure. Rising terrorist activities and political violence across the globe are anticipated to ascend the demand for ammunition over the forecast period.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."

Important: Covid19 pandemic market impact

The mining industry accounts for a vital share of the global economy and is responsible for supplying key raw materials for several applications and end-use industries, thus being a key sector of focus amidst the ongoing pandemic outbreak. Mining industries in China are expected to return to normal operations by Q3 of 2020 as enterprises indicated towards the returning of their workers soon. Moreover, Iron ore producers are known to be the least impacted. Major players such as BHP and Vale reported experiencing no major influence on their operations due to the COVID-19 virus. The iron ore prices reached above USD 90 per ton amidst the pandemic situation which may negatively impact the end-use industries. The report will account for Covid19 as a key market contributor.