- Home

- »

- Animal Feed and Feed Additives

- »

-

Amino Acids Market Size, Share And Growth Report, 2030GVR Report cover

![Amino Acids Market Size, Share & Trends Report]()

Amino Acids Market Size, Share & Trends Analysis Report By Type, By Source (Plant Based, Animal Based), By Grade, By End-Use (Food & Beverages, Dietary Supplements), And Segment Forecasts, 2023 - 2030

- Report ID: 978-1-68038-453-6

- Number of Pages: 177

- Format: Electronic (PDF)

- Historical Range: 2018 - 2020

- Industry: Specialty & Chemicals

Report Overview

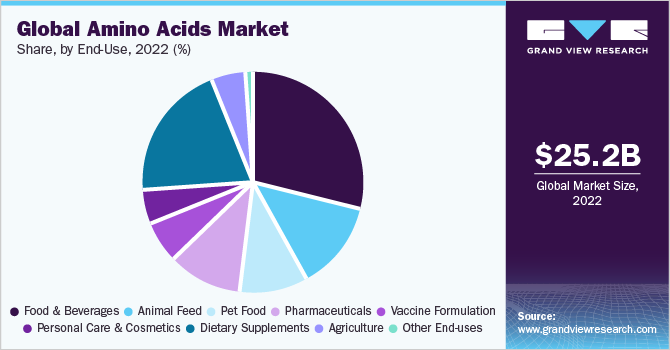

The global amino acids market size was valued at USD 25.19 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 8.5% from 2023 to 2030. This is attributable to increased consumer spending capacity and growing awareness among individuals regarding healthy lifestyles and preventive care. They are used in health supplements to reduce muscle pain, and fatigue, and lower the risk associated with cardiovascular diseases.

Currently, there is a rising need for plant-based protein sources due to the popularity of veganism and vegetarianism. To make sure that persons on plant-based diets get the right amount of nutrition, amino acid supplements are utilized because plant-based proteins frequently lack one or more important amino acids. In addition, they are also used in dietary supplements, which are becoming increasingly popular as people seek to improve their health and well-being. Amino acid supplements are marketed for their potential benefits in supporting muscle growth, improving athletic performance, and enhancing overall health. Such factors are driving market growth.

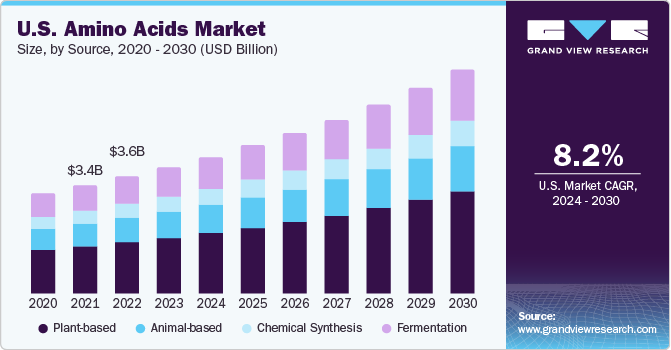

The U.S. is a major consumer of the product in North America with revenue share of 83.0% in 2022. The growth of the product market during the forecast period can be attributed to the rising consumer awareness regarding safety and hygiene related to animal products, coupled with the outbreak of animal diseases. In the animal feed industry, amino acids are used as bioactive supplements as they offer several health benefits to animals. They are also used as critical ingredients in pet food products and veterinary supplements to enhance food digestibility and thereby strengthen the immune system. Feed-grade amino acids are in demand as their consumption improves the activities & health of animals and offers better joint mobility. The animal feed industry is expected to witness a high demand for feed-grade amino acids owing to the increasing aging-pet population, unique dietary requirements, and specialized diets. The growing adoption of pets in households across U.S. is expected to drive the demand for pet food, in turn, driving the demand for the product in the pet food industry.

Raw materials used for amino acid production including soybean oilseeds, wheat, and corn have been witnessing price volatility over the past few years. This trend is expected to continue over the forecast period owing to increasing consumption of raw materials for other food production, resulting in limited supply for amino acid production. Short-term factors such as increasing energy prices are among the other hurdles leading to a shortage of raw materials for amino acids production. In developing economies, manufacturers are often forced to create amino acids from low-quality alternative ingredients such as cassava or sorghum. Such alternative ingredients are less digestible compared to corn and soybean.

Type Insights

Non-essential type segment dominated the market with a revenue share of 52.6 % in 2022. This is attributed to the fact that they are commonly used in animal feed to provide a balanced amino acid profile for the animal. Animal nutritionists formulate diets to meet the animal's nutrient requirements, including their protein needs. Amino acids are the building blocks of proteins, so it is essential to provide a balanced mix of both essential and non-essential products in the animal's diet. This helps to ensure optimal growth, development, and health.

Glutamic Acid in non-essential segment dominated the market with a revenue share of 42.3% in 2022. It is involved in the synthesis of proteins and is a component of some enzymes. It is also involved in the production of energy and is an important neurotransmitter in the brain. Glutamic acid has potential benefits in supporting brain health and cognitive function. It plays a role in the regulation of neurotransmitters in the brain, and it also have neuroprotective effects.

The use of essential type segment is also witnessing steady growth across the world owing to surging demand for dietary supplements and sports nutrition products, increasing number of patients suffering from chronic diseases, aging population, and rising awareness among consumers about the benefits of essential amino acids.

Lysine in essential type segment is also anticipated to witness growth over the forecast period. The demand for lysine is mainly driven by the growth of dietary supplements market worldwide. Apart from human consumption, this is also a popular additive for animal feed. It is extensively used for the deposition of proteins in the body. The quantity of lysine consumed daily influences the growth of animals. The alteration in the concentration of dietary lysine used in animal feed enhances the growth of animals, and feed quality. The rising demand for lysine from animal feed manufacturers, coupled with the surging consumption of dietary supplements, is expected to augment the global demand for lysine over the forecast period.

Source Insights

Plant-based in source segment dominated the market with a revenue share of 43.7% in 2022. This growth is attributed to the growing consumer awareness regarding natural and organic products. The product is obtained from plant sources such as soybeans, wheat, corn, potatoes, and peas. Currently, soybeans are used for the commercial sourcing of amino acids owing to their large-scale global production and consumption. However, the processing of soybeans is known to alter the composition of the product that acts as a major concern during the sourcing of amino acids from them. However, the augmented social awareness related to animal slaughter is expected to positively impact the demand for plant-derived product worldwide.

Chemical synthesis is another segment anticipated to witness growth over the forecast period. It is a biochemical process through which most of the amino acids are produced. Most of the product is made through a synthetic process involving α-ketoacids, followed by transamination utilizing another amino acid, typically glutamate. This transformation is facilitated by a specific enzyme known as an aminotransferase. The formation of glutamate, in turn, occurs through the amination of α-ketoglutarate. Moreover, mutant bacteria are used in the commercial production of the product.

An alternate approach to obtain the α-amino acid involves the process of reductive amination of the α-keto acid. In amino acid synthesis, intricate techniques yielding high-purity compounds are frequently preferred. Additionally, the Gabriel synthesis presents an advantageous method for aminating bromomalonic esters. This technique mitigates the tendency of amines to undergo multiple substitutions, ensuring a single substitution reaction of primary and secondary alkyl halides.

Grade Insights

Pharma grade segment dominated the amino acids market with a revenue share of 39.1% in 2022. This growth is attributed to the fact that pharmaceutical-grade are among the most premium and high-cost grades of these acids. They are manufactured while adhering to strict quality control standards to ensure their purity and safety. They play a crucial role in various biological processes within the human body, including protein synthesizing, cell signalling, and neurotransmitter manufacturing.

Manufacturers of pharma grade must adhere to strict regulatory guidelines and pharmacopeial standards established by organizations such as the U.S. Pharmacopeia (USP), the European Pharmacopoeia (Ph. Eur.), and the European Medicines Agency (EMA). These guidelines ensure the quality, identity, strength, and purity of amino acids used in different medicines. They are commonly used in various therapeutic applications. They can support muscle growth and recovery, enhance athletic performance, manage certain medical conditions, and promote the overall wellbeing of consumers.

Food grade is another segment anticipated to witness growth over the forecast period. They are crucial for the food industry as they add protein content and functional and nutritional value to various products. Some products, such as glutamic acid, are known for enhancing the taste and flavor of food. They are often used as flavor enhancers in processed food, such as snacks. These acids are the building blocks of proteins and play a crucial role in the growth, repair, and maintenance of body tissues.

End-use Insights

Food & beverages in end-use segment dominated the market with a revenue share of 29.0% in 2022. This is attributed to the fact that amino acids are used in the food processing industry as flavor enhancers, preservatives, and nutrition enhancers. Glycine and alanine are frequently employed as agents to enhance flavor and taste. Monosodium glutamate (MSG), a substance derived from glutamic acid, is extensively utilized as a flavor enhancer in a variety of food products, including canned vegetables, soups, processed meat, salad dressings, bread, carbohydrate-based snacks, and ice cream. It is subject to regulation by the U.S. Food and Drug Administration (FDA) and is deemed as Generally Recognized as Safe (GRAS). The product is popular among Asian countries and is widely used in several food preparations.

Functional beverages in food & beverage segment dominated the market with a revenue share of 23.7% in 2022. Amino acids are frequently used in sports and performance beverages to support muscle recovery, energy production, and endurance of consumers. BCAAs, such as leucine, isoleucine, and valine, are known for reducing exercise-induced muscle damage and promoting muscle protein synthesis in consumers. These acids enhance the performance of athletes and aid in their post-workout recovery.

Animal feed is another segment anticipated to witness growth over the forecast period. Growing awareness among consumers regarding nutritional requirements for animals coupled with augmented demand for enhanced feed quality and high feed production is expected to drive the segment over the forecast period. For instance, in calves, the most vital amino acids required are isoleucine, lysine, methionine, leucine, and threonine. A deficiency in any of these slows down animal growth and delays the onset of maturity. In the growth stage of poultry animals, arginine is an essential part of their diets as they do not contain a urea cycle, which is responsible for synthesizing protein. Arginine deficiency in chickens often results in feather deformation. In addition, lysine deficiency can have a similar effect on turkeys.

Regional Insights

Asia Pacific dominated the market with a revenue share of 46.1% in 2022. Rising pork consumption in China is expected to drive the market growth in the country. Growing health concerns and rising individual medical expenditure are expected to fuel the demand for dietary supplements in China, which, in turn, is expected to augment the demand for amino acids. The shift in trend toward ready-to-drink (RTD) beverages is projected to positively influence the demand for aspartame, in turn, augmenting the consumption of the product in the form of aspartic acids in the region over the forecast period.

Europe is the second-largest compound feed producer globally, with Germany and France being the major producing countries. Poultry feed accounts for a major share of the region’s compound feed market, representing approximately one-third of the total compound feed market. Key companies operating in the market have diversified businesses and broader product portfolios for animal feed. Rising production and consumption of animal feed are expected to drive growth for market in the region over the forecast period.

Due to the recent COVID-19 outbreak, the U.S. has witnessed a complete shutdown, of various manufacturing industries, which has resulted in panic buying of animal feed among several farmers owing to the potential shortage resulting due to reduced deliveries and logistics disruption. This has boosted the demand for animal feed additives including amino acids, thereby, expected to propel the growth of the market in North America over the projected years.

Key Companies & Market Share Insights

The global product market is considered fragmented as the number of players within the business operating in the market are high. Leaders and other emerging players in the country that include traders, small manufacturers, and players operating at local market levels capture the maximum market share. Companies are entering into expansions and new product launches so as to maintain their position in the market. Some prominent players in the amino acids market include:

-

Adisseo

-

ADM

-

Ajinomoto Co., Inc.

-

AMINO GmbH

-

Bill Barr & Company

-

BI Nutraceuticals

-

Blue Star Corp.

-

CJ CheilJedang Corp.

-

DAESANG

-

DSM

-

Donboo Amino Acid Co., Ltd.

-

Evonik Industries AG

-

Fermentis Life Sciences

-

Global Bio-chem Technology Group Company Limited

-

IRIS BIOTECH GmbH

-

KYOWA HAKKO BIO CO., LTD.

-

Novus International

-

PACIFIC RAINBOW INTERNATIONAL, INC.

-

Sichuan Tongsheng Amino Acid Co., Ltd.

-

Taiwan Amino Acid Co., Ltd.

-

Sigma-Aldrich

-

Wacker Chemie AG

-

Wuxi Jinghai Amino Acid Co., Ltd.

-

Wuhan Grand Hoyo Co., Ltd.

-

Hebei Huayang Group Co., Ltd.

Amino Acids Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 27.22 billion

Revenue forecast in 2030

USD 48.30 billion

Growth Rate

CAGR of 8.5% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2020

Forecast period

2023 - 2030

Report updated

September 2023

Quantitative units

Volume in kilotons, revenue in USD million, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, source, grade, end-use, region

Regional scope

North America, Europe, Asia Pacific, Central & South America, Middle East & Africa

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, Russia, Turkey, Netherlands, China, India, Japan, South Korea, Indonesia, Thailand, Brazil, Argentina, South Africa, Saudi Arabia

Key companies profiled

Adisseo, ADM, Ajinomoto Co., Inc., AMINO GmbH, Bill Barr & Company, BI Nutraceuticals, Blue Star Corp., CJ CheilJedang Corp., DAESANG, DSM, Donboo Amino Acid Co., Ltd., Evonik Industries AG, Fermentis Life Sciences, Global Bio-chem Technology Group Company Limited, IRIS BIOTECH GmbH, KYOWA HAKKO BIO CO., LTD., Novus International, PACIFIC RAINBOW INTERNATIONAL, INC., Sichuan Tongsheng Amino Acid Co., Ltd., Taiwan Amino Acid Co., Ltd., Sigma-Aldrich, Wacker Chemie AG, Wuxi Jinghai Amino Acid Co., Ltd., Wuhan Grand Hoyo Co., Ltd., Hebei Huayang Group Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Amino Acids Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis on the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global amino acids market report on the basis of type, source, grade, end-use, and region:

-

Type Outlook (Volume, Kilotons; Revenue, USD Million; 2018 - 2030)

-

Essential

-

Histidine

-

Isoleucine

-

Leucine

-

Lysine

-

Methionine

-

Phenylalanine

-

Threonine

-

Tryptophan

-

Valine

-

-

Non-essential

-

Alanine

-

Arginine

-

Asparagine

-

Aspartic Acid

-

Cysteine

-

Glutamic Acid

-

Glutamine

-

Glycine

-

Proline

-

Serine

-

Tyrosine

-

Ornithine

-

Citrulline

-

Creatine

-

Selenocysteine

-

Taurine

-

Others

-

-

-

Source Outlook (Volume, Kilotons; Revenue, USD Million; 2018 - 2030)

-

Plant-based

-

Animal-based

-

Chemical Synthesis

-

Fermentation

-

-

Grade Outlook (Volume, Kilotons; Revenue, USD Million; 2018 - 2030)

-

Food Grade

-

Feed Grade

-

Pharma Grade

-

Other Grades

-

-

End-Use Outlook (Volume, Kilotons; Revenue, USD Million; 2018 - 2030)

-

Food & Beverages

-

Bakery

-

Dairy

-

Confectionery

-

Convenience Foods

-

Functional Beverages

-

Meat Processing

-

Infant Formulation

-

Others

-

-

Animal Feed

-

Pet Food

-

Pharmaceuticals

-

Vaccine Formulation

-

Personal Care & Cosmetics

-

Dietary Supplements

-

Agriculture

-

Other End-uses

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Russia

-

Turkey

-

Netherlands

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Indonesia

-

Thailand

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. Some key players operating in the amino acid market include Ajinomoto Co., Inc. Bill Barr & Company, Wacker Chemie AG, Evonik Industries AG, Kyowa Hakko Bio Co., Ltd., and AMINO GmbH.

b. Key factors that are driving the amino acid market growth include increasing demand from food, pharmaceutical, and nutraceutical industries. Amino acids are extensively used as an active ingredient in the animal feed industry to improve feed quality and animal health by enhancing feed efficiency,

b. The global amino acids market size was estimated at USD 25.19 billion in 2022 and is expected to reach USD 27.22 billion in 2023.

b. The global amino acids market is expected to grow at a compound annual growth rate of 8.5% from 2023 to 2030 to reach USD 48.3 billion by 2030.

b. Food & beverages end-use accounted for the largest revenue share of 29.0% in 2022. This is attributable to the rising usage of amino acids as flavor enhancers, preservatives, and nutrition enhancers.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."

Important: Covid19 pandemic market impact

Restrictions on manufacturing activities due to the advent of the COVID-19 pandemic shall cause a slump in the supply of feed, as well as its additives. The current stagnation in supply is, in turn, detrimental against the backdrop of ever-increasing demand for essential food products such as dairy and meat. The report will account for Covid19 as a key market contributor.