- Home

- »

- Nutraceuticals & Functional Foods

- »

-

Alginate Market Size, Share & Growth Analysis Report, 2028GVR Report cover

![Alginate Market Size, Share & Trends Report]()

Alginate Market Size, Share & Trends Analysis Report By Type (High M, High G), By Product (Sodium, Propylene Glycol), By Application (Pharmaceutical, Industrial), By Region, And Segment Forecasts, 2021 - 2028

- Report ID: GVR-2-68038-244-0

- Number of Pages: 154

- Format: Electronic (PDF)

- Historical Range: 2017 - 2019

- Industry: Consumer Goods

Report Overview

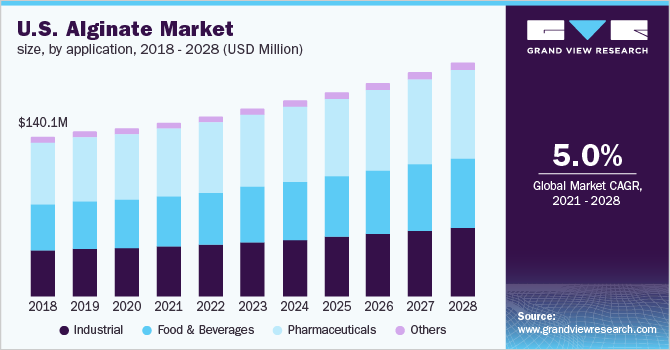

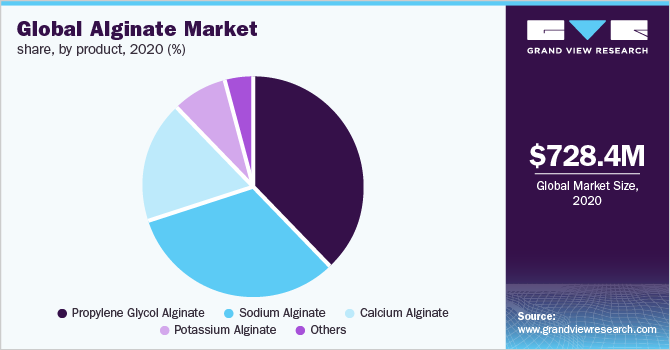

The global alginate market size was valued at USD 728.4 million in 2020 and is expected to grow at a compound annual growth rate (CAGR) of 5.0% from 2021 to 2028. The market is expected to witness significant growth owing to the increasing product demand in the food applications as a thickening agent, emulsifier, and gelling agent. Increased acceptance from the food industry and higher demand for natural ingredients are the key drivers for product demand. In addition, regulatory grants received from various organizations like the U.S. Food & Drug Administration (FDA) and the European Commission are expected to drive the growth of the global market. Globally, U.S. is one of the leading markets with high product penetration across the pharmaceutical application industry.

The wound care market in the country is considerably developed and uses alginate in several advanced wound care products. The use of calcium and sodium alginate fibers for wound care is also expected to augment the market over the forecast period. Brown seaweeds are the primary source of alginate. Durvillaea, Laminaria, Ascophyllum, Lessonia, Ecklonia, Sargassum, Turbinaria, and Macrocystis are the other commercial sources of the product. Ascophyllum, Laminaria, and Macrocystis are the most widely harvested species.

Countries like Norway, Chile, and China account for the high production of seaweed leading to the manufacturers setting the production units near the harvest areas. The higher cost involved in the drying of wet seaweed and the raw material supply-demand gap increases the procurement cost, which is reflected in the higher cost of finished products.

The product has a wide application scope in the pharmaceutical sector as it acts as a thickening agent, emulsion stabilizer, film-forming agent, and disintegrant for tablets. Growing product demand in the coating of tablets with low viscosity is expected to fuel the market growth. The market is constantly challenged by the volatile supply quantity of the seaweeds owing to unsustainable production techniques, which may hinder overall growth to some extent.

Type Insights

In terms of revenue, the high G type dominated the global market with a share of over 52% in 2020 and is expected to retain the leading position over the forecast period. High G is rich in guluronic acid blocks that have a wide range of applications in the cosmetics, food, and pharmaceutical industries. Superior gelling performance is responsible for the higher demand for these products in food applications.

Based on types, the market has been bifurcated into high G and high M. The amount of G and M blocks in the composition of the product is responsible for the performance characteristics of the products. The ratio of M and G in the product determines the gelling and thickening abilities of alginates.

A higher concentration of the G blocks in high G products leads to increased stabilization and thickness. They exhibit buckled chain structure and slower gel formation compared to the high M. Higher product flexibility offered by the high G type is drives its demand in the pharmaceutical industry.

The high M type segment is also expected to witness a steady growth rate of 4.7% over the forecast period. These products form gels quicker as compared to high G products leading to higher application in the cosmetic and food industries. Increasing usage of high M type products, such as beers, ice-creams, and yogurts, is expected to drive the segment growth.

Product Insights

In terms of revenue, propylene glycol led the market with a revenue share of more than 38% in 2020. It is expected to maintain its dominance growing at the fastest CAGR over the forecast period. It is an ester of alginic acid with applications as stabilizers, thickeners, and emulsifiers in the pharmaceutical, food, personal care, and cosmetics industries. These products having approval from the FDA as a food additive adds up to the demand growth.

Sodium emerged as the second-largest product in the market with a revenue share of over 32% in 2020. It is a white-yellowish powder extracted from cell walls of brown algae and widely used as a gelling and thickening agent in the food industry. It is primarily used in the production of sauces, whipped cream, jellies, and other dressings. It also offers superior stability to dairy products leading to increased demand.

Calcium alginates are widely used in pharmaceutical applications like wound care and wound dressing products. The calcium-based fibers enable accelerated healing. Furthermore, in North America and Europe, calcium alginate is approved to be used as an anti-foaming agent in the food industry. It is used as a thickener to increase the viscosity of food products, which is expected to drive the segment growth over the forecast period.

Potassium alginate is a potassium salt of alginic acid and has extensive application in the pharmaceutical industry owing to superior thickening and stabilizing properties. It helps in the reduction of blood sugar and cholesterol levels in humans, which is expected to increase its application in the pharmaceutical industry, thereby supporting the segment growth.

Application Insights

In terms of revenue, industrial application dominated the industry with a share of 38.99% in 2020 and is expected to maintain a dominating position over the forecast period. Alginates have an industrial application in textile printing where they are used as a thickening agent as they combine cellulose in fibers. They are used as a substitute for starches as the latter react with reactive dyes, which leads to lower color yield.

They are also used in paper manufacturing for surface resizing. The product is used with starches providing smooth, continuous film and reduced paper fluffing. Alginate as an ingredient in wax papers helps to keep wax on the paper surface. It also acts as a film former and improves the printability of the paper.

The pharmaceutical segment is projected to register the fastest CAGR from 2021 to 2028 owing to high product demand due to its excellent healing capabilities in dry as well as wet conditions. The product also helps in the controlled release of medicines in drugs and can act as disintegrants, which also drive its demand in the pharmaceutical industry. The food and beverages segment is expected to witness a significant CAGR over the forecast period. Increasing demand for food products containing natural ingredients is expected to drive the segment growth.

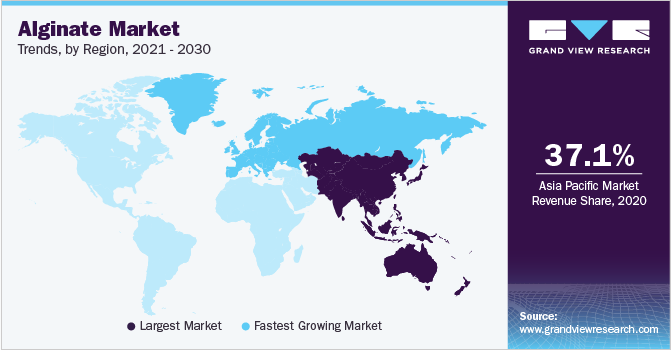

Regional Insights

In terms of volume, Asia Pacific region dominated the market with a share of 37.05% in 2020 and is expected to maintain the leading position over the forecast period. The presence of numerous manufacturers and the easy availability of raw materials are responsible for the region’s growth. The presence of a large consumer base in countries like China and India also drives the regional alginate market.

In terms of revenue, Europe is the leading regional market. Increasing expenditure on research and development in the pharmaceutical industry is expected to drive the product demand, thereby augmenting market growth over the forecast period.

Moreover, increasing consumption by other end-use industries in the leading economies like Germany, France, and the U.K. is supporting the regional market growth. The growing food processing industry in the region has fueled product consumption, which is supported by the approval for its usage in food items from the European Commission under EC 1333/2008.

The market in North American is primarily driven by the highly developed pharmaceutical and food and beverages industries in the region. Higher per capita health care spending in the North American countries is expected to boost product demand in pharmaceutical applications. In addition, the presence of multiple global giants in the food & beverages and pharmaceutical industries is expected to augment the market growth.

Key Companies & Market Share Insights

The industry is highly competitive with the presence of a large number of product manufacturers. A significant consumer base and abundant availability of raw material in the Asia Pacific region are responsible for the maximum number of manufacturers and higher product consumption in the region. Companies are continuously making efforts to locate the manufacturing plants near the seaweed harvest areas to reduce the cost of material and transports. Some of the prominent manufacturers in the global alginate market include:

-

Algaia

-

Marine Biopolymers Limited

-

DuPont de Nemours, Inc.

-

Ingredients Solutions, Inc.

-

KIMICA

-

Ceamsa

-

Algea

-

Shandong Jiejing Group Corporation

Recent Developments

-

In March 2023, Algaia SA was acquired by JRS Group, a leading hydrocolloid and fiber company that uses plant-based raw materials. The acquisition would enable the companies to jointly address the rising demand for alginate and seaweed-based solutions globally, catering to the feed, food, pharma, home & personal care, and agriculture sectors

-

In February 2023, Algaia announced the commencement of the expansion work of its R&D center premises in Saint Lô, France, with the aid of fundings obtained from Saint Lô Agglo. The project involves the building of new laboratories with advanced equipment, along with a workshop for producing seaweed extracts on a semi-industrial scale, before being manufactured at the company’s Lannilis plant on an industrial scale

-

In October 2022, KIMICA announced the opening of a new R&D facility, “KIMICA HONKAN”, in Futtsu-city, Chiba-Prefecture. The facility brings together quality control labs, R&D labs, office spaces, and welfare facilities; KIMICA also unveiled 2 warehouses for supporting this expansion. The lab area includes a “Food Application Laboratory” for the development of innovative alginate applications, while the quality control department has been developed to comply with pharmaceutical cGMP guidelines

-

In September 2021, Tilley Distribution announced the acquisition of Ingredients Solutions Inc., a blender and distributor of hydrocolloids based in Maine, U.S. The deal made Tilley the largest independent hydrocolloid distributor in North America and greatly expanded its portfolio of specialty ingredients. As per the deal, Tilley retained the R&D laboratory of Ingredients Solutions in Waldo, Maine, along with its employees

Alginate Market Report Scope

Report Attribute

Details

Market size value in 2021

USD 759.8 million

Market size volume in 2021

44,480.7 tons

Revenue forecast in 2028

USD 1,074.4 million

Volume forecast in 2028

59,139.2 tons

Growth Rate

CAGR of 5.0% from 2021 to 2028 (Revenue-based)

Base year for estimation

2020

Historical data

2017 - 2019

Forecast period

2021 - 2028

Quantitative units

Volume in tons, revenue in USD million, and CAGR from 2021 to 2028

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; MEA

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Saudi Arabia; South Africa

Key companies profiled

Algaia; Marine Biopolymers Ltd.; DuPont de Nemours, Inc.; Ingredients Solutions, Inc.; KIMICA; Ceamsa; Algea; Shandong Jiejing Group Corp.

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

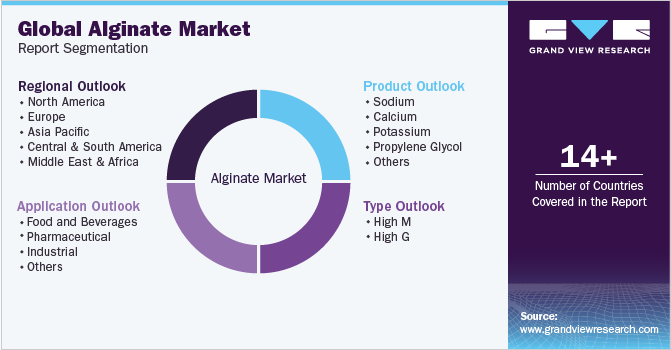

Global Alginate Market Report SegmentationThis report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2028. For the purpose of this study, Grand View Research has segmented the global alginate market report on the basis of type, product, application, and region:

-

Type Outlook (Volume, Tons; Revenue, USD Million, 2017 - 2028)

-

High M

-

High G

-

-

Product Outlook (Volume, Tons; Revenue, USD Million, 2017 - 2028)

-

Sodium

-

Calcium

-

Potassium

-

Propylene Glycol

-

Others

-

-

Application Outlook (Volume, Tons; Revenue, USD Million, 2017 - 2028)

-

Food and Beverages

-

Bakery

-

Confectionery

-

Meat Products

-

Dairy Products

-

Sauces & Dressings

-

Beverages

-

Others

-

-

Pharmaceutical

-

Industrial

-

Others

-

-

Regional Outlook (Volume, Tons; Revenue, USD Million, 2017 - 2028)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global alginate market was estimated at USD 728.4 million in 2020 and is expected to reach USD 759.8 million in 2021.

b. The global alginate market is expected to grow at a compound annual growth rate of 5% from 2021 to 2028 to reach USD 1,074.4 million by 2028.

b. The Asia Pacific emerged as a dominating region with a volume share of 37.05% in the year 2020 owing to the presence of several alginates manufactures, higher raw material availability, and a higher consumer base in the countries like India and China.

b. The key player in the global alginate market includes Algaia, Marine Biopolymers Limited, DuPont de Nemours, Inc, Ingredients Solutions, Inc., KIMICA, Ceamsa, Algae, SNAP Natural & Alginate Products Pvt. Ltd, Shandong Jiejing Group Corporation, IRO Alginate Industry Co., Ltd.

b. Increasing demand for natural ingredients from the food and beverage industry as well as the pharmaceutical industry owing to higher consumer awareness is expected to drive the alginate market growth.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."