- Home

- »

- Advanced Interior Materials

- »

-

Air Purifier Market Size, Share & Trends Analysis Report, 2030GVR Report cover

![Air Purifier Market Size, Share & Trends Report]()

Air Purifier Market Size, Share & Trends Analysis Report By Technology (HEPA, Activated Carbon), By Application (Commercial, Residential), By Region (APAC, Europe, MEA, North America), And Segment Forecasts, 2023 - 2030

- Report ID: GVR-3-68038-406-2

- Number of Pages: 152

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Advanced Materials

Report Overview

The global air purifier market size was estimated at USD 13.97 billion in 2022 and is anticipated to expand at a compound annual growth rate (CAGR) of 7.3% from 2023 to 2030. It is anticipated that the rising airborne infections and growing urban pollution levels will fuel industry growth. For instance, about 14% of the EU-28 population living in urban areas was exposed to ozone concentration above the threshold set by the European Union. Furthermore, 15% of the EU-28 urban population was exposed to Benzo pyrene, and over 4% was exposed to high concentrations of Nitrogen Dioxide, according to the EEA’s report on Air Quality in Europe published in 2020.

In addition, increased disposable income and rising standards of living, along with the growing health consciousness, are anticipated to drive the industry. Over the forecast period, it is expected that the increased prevalence of airborne diseases and rising levels of air pollution in the U.S. will have a favorable impact on the market. Furthermore, according to the State of the Air 2022 assessment, after decades of progress in cleaning up air pollution sources, more than 40% of Americans (over 137 million people) live in areas with failing grades for harmful levels of particle pollution or ozone. This equates to 2.1 million more individuals breathing polluted air than the previous year.

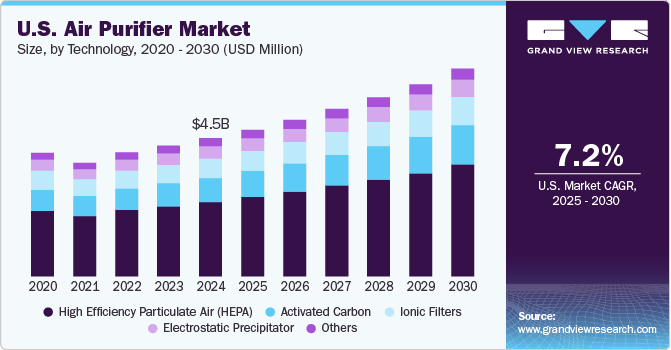

This factor is expected to increase public consciousness regarding the low quality of air and increased demand for air purifiers. Furthermore, given that HEPA technology is the most effective at capturing dangerous airborne particles, it is predicted to dominate the U.S. market over the coming years. For instance, the U.S. Department of Energy has established standards for quality assurance and specifications related to HEPA filters. Similarly, the Association of Home Appliance Manufacturers (AHAM) has established the Clean Air Delivery Rate (CADR), which is a standard used to measure the effectiveness of air purifiers, thereby enabling consumers to compare the performance of air purifiers in eliminating dust, pollen, and tobacco smoke.

The introduction of strict rules and standards for indoor air quality by various governments, which focus on controlling air pollution, is anticipated to boost industry growth. In addition, several air pollution reduction initiatives launched by governments and NGOs worldwide are anticipated to fuel industry expansion. For instance, the “Guide to Air Cleaners in the Home” by the U.S. Environmental Protection Agency (EPA) offers advice on choosing a furnace filter, HVAC filter, and portable air cleaner, as well as other details on air cleaners. The World Health Organization (WHO) has also released some recommendations on the quality of indoor air. Moreover, shifting lifestyle preferences, declining indoor air quality, rising health concerns, and growing consumer knowledge about the advantages of air purifiers will drive the industry. However, it is anticipated that the high cost of the product and its maintenance may restrict its adoption.

Technology Insights

The HEPA segment led the industry in 2022 and accounted for the maximum share of 40.3% of the global revenue. Smoke, dust, bio-contaminants, and pollen are airborne particles that HEPA filters are very effective at capturing. The worldwide air purifier industry is projected to see increased product penetration due to the high caliber and dependability of HEPA filters to remove airborne particles. Filters that contain activated carbon or charcoal are made of tiny bits of carbon that have been specifically treated with oxygen to open the pores of the carbon atoms. As a result, the carbon becomes more porous and has a larger surface area, which improves its capacity to capture airborne particles.

With the help of these filters, gases & odors from cooking, mold, chemicals, pets, and smoke can be absorbed. For instance, in January 2021, Energy Efficiency Services Ltd. (EESL), a joint venture between Power Finance Corporation Ltd., NTPC Ltd., Power Grid Corp. of India Ltd., and REC Ltd., developed an air purification system that filters out pathogens, including the novel coronavirus, from indoor spaces. Moreover, the company has applied for certification of this system from the Council of Scientific and Industrial Research (CSIR). The ionic filters segment is estimated to register a significant CAGR over the forecast period.

Since ionic filters do not need to be changed frequently, their market share is growing. However, the production of ionized air and ozone during the purification process may pose the risk of developing respiratory conditions like asthma, which is likely to restrict the use of this technology. UV radiation, Ozone generation, electrostatic precipitators, non-thermal plasma, and photocatalytic oxidation are other air purification techniques. Hazardous gases and tiny particles as small as 0.1 micrometers can be converted into safe chemicals using photocatalytic oxidation. This method eliminates microorganisms, active chemicals, and Volatile Organic Compounds (VOCs).

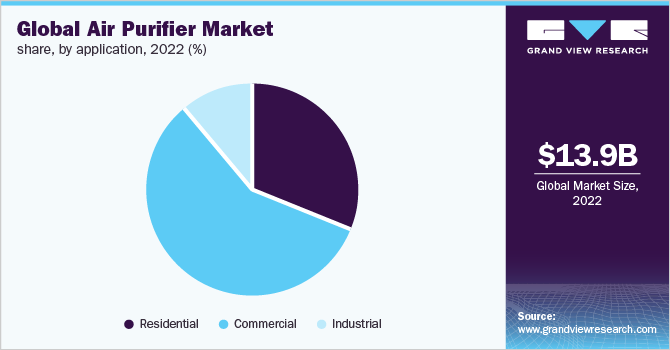

Application Insights

The commercial segment led the industry in 2022 and accounted for the largest share of 57.0% of the global revenue. Air purifiers are used in schools, malls, conference centers, workplaces, hospitals, hotels, theatres, and other business locations like recreation centers and amusement areas. Restaurants and hotels use air purifiers with activated carbon and HEPA to eliminate airborne, odor, and smoke particles from the air, improving the quality of the air in the spaces. To maintain indoor air quality for both staff and patients working in these facilities, odor airborne pathogens and allergens are removed, and in dental & medical offices, veterinary clinics, animal kennels, clinics, and hospitals, boarding kennels, contaminants are removed from the air using air purifiers. Due to air purifiers’ ability to reduce the spread of infectious diseases, there has been a rise in demand for them in various healthcare facilities around the globe since the COVID-19 pandemic.

The industrial application segment will likely expand at a steady CAGR over the forecast period. Air purifiers are used in several industries, including printing, petrochemical, power plants, food & beverage, chemical, and manufacturing. Air purifiers help eliminate construction dust, asbestos, weld smoke, and other particles that are harmful to employees and the environment if untreated. Air purifiers are used to remove contaminants from the air inside homes. The use of air purifiers in home settings has increased as people become more aware of the dangers that VOCs, smoking particles, and other particulate matter pose to human health. In addition, individuals have stayed at home due to the containment measures to stop the spread of COVID-19. As a result, the demand for air purifiers in residential applications has increased.

Regional Insights

Asia Pacific dominated the industry in 2022 and accounted for the maximum share of 42.6% of the overall revenue due to several variables, including a larger population with more disposable income and rapid urbanization & industrialization. For instance, according to the Clean Air Coalition report published in 2019, over 35% of the global premature deaths from air pollution occurred in East Asia, followed by South Asia. The lack of enforcement and regulations for industrial emissions, domestic heating, and oil-based road transportation is a common contributor to airborne particulates. Increasing smog and air pollution incidences, particularly in countries like China and India, are also anticipated to increase the use of air purifiers and promote regional market growth. Political decisions and rapid urbanization are a few elements that have harmed South Korea’s ecological balance and reduced air quality.

The country’s market is anticipated to benefit from growing public awareness about ailments and health concerns from exposure to hazardous particles at work or home. The North American region is anticipated to expand at a significant CAGR over the forecast period. Air quality legislation, such as the United States Environmental Protection Agency's (U.S. EPA’s) establishment of national ambient air quality standards, the U.S. Clean Air Act, and Environment Canada’s comprehensive emission reduction programs are projected to create new opportunities for air purifier manufacturers. The creation and execution of regulatory measures, the organization of air quality management programs to raise public awareness, and the rising number of installations of extensive ambient air quality monitoring systems will drive product demand in Mexico over the coming years.

Key Companies & Market Share Insights

The global industry is highly competitive due to the presence of both multinational and regional or local manufacturers. Companies in the industry offer a wide range of air purifiers sold through various channels, including e-commerce websites, company-operated websites, retailers and their websites, and distributors. For instance, in December 2021, Secure Connection, a Hong Kong-based electronic products manufacturer, announced a new line of Honeywell Branded Air Purifiers. The new air purifier line is segmented into three categories: Value Series, Platinum Series, and Ultimate Series, with features such as UV LED, Ionizer, and Humidifier. They will be offered in various South Asian and Middle Eastern nations through all major shops and online e-commerce platforms.

Market participants compete based on several parameters, such as product performance, quality, technical competence, price, and corporate reputation. New product launches, licensing agreements, distribution network expansion, technological investments, and mergers & acquisitions are some of the key strategies adopted by the companies to strengthen their industry position and gain a higher market share. For instance, in December 2020, Rentokil Initial plc launched its VIRUSKILLER air purifier, which is proven to kill 99.99% of viruses with a single air pass, including coronavirus. The VIRUSKILLER technology utilizes patented UV reactor chambers and a series of filters to kill 99.99% of viruses with a single air pass. This product is available in different sizes to suit various sectors, including education, healthcare, offices, and hospitality & leisure venues. Some of the prominent players in the global air purifier market include:

-

Honeywell International, Inc.

-

IQAir

-

Koninklijke Philips N.V.

-

Unilever PLC

-

Sharp Electronics Corp.

-

Samsung Electronics Co., Ltd.

-

LG Electronics

-

Panasonic Corp.

-

Whirlpool Corp.

-

Dyson

-

Carrier

Air Purifier Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 15.83 billion

Revenue forecast in 2030

USD 25.97 billion

Growth rate

CAGR of 7.3% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Technology, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; France; U.K.; China; Japan; South Korea; Singapore; Malaysia; Brazil; Saudi Arabia

Key companies profiled

IQAir; Honeywell International, Inc.; LG Electronics, Inc.; Unilever PLC; Koninklijke Philips N.V.; Panasonic Corp.; Hamilton Beach Brands, Inc.; Whirlpool Corp.; Carrier; Camfil; Sharp Electronics Corp.; COWAY Co., Ltd.; Samsung Electronics Co., Ltd.; Dyson; Molekule

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Air Purifier Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global air purifier market report on the basis of technology, application, and region:

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

High Efficiency Particulate Air (HEPA)

-

Activated Carbon

-

Ionic Filters

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Commercial

-

Retail Shops

-

Offices

-

Healthcare Facilities

-

Hospitality

-

Schools & Educational Institutions

-

Laboratories

-

Transport

-

Others

-

-

Residential

-

Industrial

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

U.K.

-

-

Asia Pacific

-

China

-

Japan

-

South Korea

-

Singapore

-

Malaysia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global air purifier market size was estimated at USD 13.97 billion in 2022 and is expected to reach USD 15.83 billion in 2023

b. The air purifier market, in terms of revenue, is expected to grow at a compound annual growth rate of 7.3% from 2023 to 2030 to reach USD 25.97 billion by 2030

b. Asia Pacific dominated the air purifier market with a revenue share of 42.6% in 2022, on account of several factors including rising pollution levels coupled with rapid urbanization and industrialization especially in China and India is expected to drive the market growth over the forecast period.

b. Some of the key players operating in the air purifier market include IQAir, Honeywell International, Inc., LG Electronics, Inc., Unilever PLC, Koninklijke Philips N.V., Dyson, Sharp Electronics Corporation, Samsung Electronics Co., Ltd., Panasonic Corporation, Hamilton Beach Brands, Inc., Whirlpool Corporation, and Carrier among others

b. The key factors that are driving the air purifier market include increasing health problems associated with air pollution coupled with the improving standard of living, rising household spending, and the outbreak of the COVID-19 pandemic globally.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."

Important: Covid19 pandemic market impact

The enforcement of lockdown across the countries globally has led to the increased demand for air purifiers in the past couple of months. Moreover, as air purifiers are effective against various viruses, the demand in several countries is expected to witness significant growth owing to the outbreak of COVID-19. Few manufacturers are claiming that their air purifiers are an ideal option for neutralizing as well as effectively controlling the spread of coronavirus. In addition, consumers are buying air purifiers across the globe as a precautionary measure to mitigate indoor air pollution and to clean indoor air to avoid the novel coronavirus infection. These factors are expected to drive the demand for air purifiers across the globe. The updated report will account for COVID-19 as a key market contributor.