- Home

- »

- Medical Devices

- »

-

Africa Pharmaceutical Regulatory Affairs Market Report, 2030GVR Report cover

![Africa Pharmaceutical Regulatory Affairs Market Size, Share & Trends Report]()

Africa Pharmaceutical Regulatory Affairs Market Size, Share & Trends Analysis Report By Services, By Category, By Indication, By Product Stage, By Service Provider, By Company Size, By Country, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-121-3

- Number of Pages: 150

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Healthcare

Report Overview

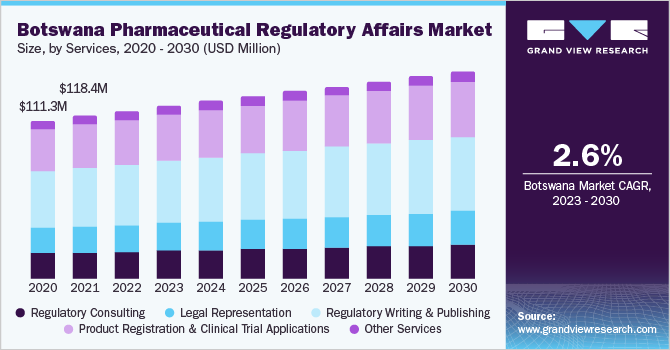

The Africa pharmaceutical regulatory affairs market size was valued at USD 126.04 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 6.81% from 2023 to 2030.The market is driven by several factors such as the increasing prevalence of chronic diseases, a growing elderly population, rising healthcare expenditure, and the demand for innovative and cost-effective medicines across the continent.Additionally, there has been an increasing focus on promoting local pharmaceutical manufacturing in Africa. The government and international organizations have been supporting domestic production to reduce dependence on imports and improve access to affordable medicines. This would further create opportunities for local pharmaceutical companies, leading to a positive impact on the market.

The COVID-19 pandemic of 2020-21 and the macroeconomic headwinds of 2022-23 had a notable impact on the market.The pandemic highlighted the need for robust regulatory systems to expedite the approval and distribution of vaccines, therapeutics, and medical devices. Regulatory agencies in various African countries had to adapt quickly to expedite emergency approvals while ensuring safety and efficacy. These factors have led to potential advancements in the regulatory framework and have brought about collaborative efforts between regulatory authorities and pharmaceutical companies.

Furthermore, there have been notable advancements in the regulatory landscape in Africa. Several countries have been strengthening their regulatory capabilities and implementing reforms to harmonize their processes with international standards. The African Medicines Agency (AMA), launched in 2019, is a notable development aimed at promoting access to safe, effective, and quality medicines across the continent. Such initiatives are expected to streamline the regulatory pathway, encourage innovation, and enhance healthcare outcomes.

The increasing focus on clinical research and development in Africa is also contributing to boosting the demand for a robust regulatory framework. Many countries in the region are participating in clinical trials for various diseases, including infectious diseases, oncology, and tropical illnesses. This shift towards clinical research is attributed to the availability of diverse patient populations, relatively lower costs, and increasing partnerships between global research organizations and African institutions.

Services Insights

By services, the regulatory writing & publishing segment dominated the market with a share of over 36% in 2022. The growth is attributed to factors such as increased outsourcing of these services by large- and mid-size biopharmaceutical and medical device companies.Regulatory writing and publishing services are offered from the early stages of development to the post-marketing authorization phase. Various functions performed under this segment include submission management services such as writing and publishing applications for various regulatory agencies across the globe. Some organizations also provide nonclinical writing and publishing services such as product labeling, aggregate reporting, patient narratives, & investigator brochures.

The legal representation segment is projected to witness the fastest growth rate in the coming years. These services are provided by CROs to biopharmaceutical companies that require regulatory support services for their medicinal products. Different countries require in-house representatives as regulations are very complex and ever-changing. CROs provide legal representatives who can handle regulatory requirements pertaining to the commercialization of their medicinal products. The demand for legal representatives has considerably increased over the years owing to complex and changing healthcare regulations.

Category Insights

By category, the drugs segment dominated the market in 2022 with a market share of 58%.Regulatory affairs play a very important role in the entire drug development, manufacturing, and commercialization continuum. This can be attributed to various regulations and related regulatory submissions/documentation at each of the steps involved in the process. A clear understanding of these regulations enables timely and cost-effective product launches in the market and can also help pharmaceutical companies gain the first-mover advantage.

The biologics segment is projected to witness considerable growth during the forecasted period. Increasing healthcare needs, coupled with increasing investments in healthcare infrastructure and improving regulatory frameworks, are driving the demand for biologics in the region. The region’s increasing middle-class population and expanding access to healthcare services contribute to the growing demand for advanced and innovative therapies.

Indication Insights

By indication, the oncology segment held the highest share of the market in 2022. This can be attributed to the high prevalence of cancer, which is boosting the need for safe and effective treatment options. Africa is expected to experience the most significant increase in cancer cases and deaths compared to other regions. According to data published by GLOBOCAN, the number of cancer cases in Africa is estimated to increase from 1.1 million new cases in 2020 to 2.1 million cases in 2040. Furthermore, oncology is one of the most profitable markets for pharmaceutical & biotechnology companies, thereby increasing the R&D projects undertaken by these players.

The immunology segment is projected to witness considerable growth during the forecasted period. The robust immunology pipeline of pharmaceutical and biopharmaceutical companies is anticipated to further boost segment growth. For instance, as of 2022, Novartis had nearly 33 drugs in the pipeline for treating immunological conditions. The high number of drugs in the pipeline for immunological drugs is expected to support the demand for regulatory services during the forecast period.

Product Stage Insights

By product stage, the clinical studies segment held the highest share of the market in 2022. This can be attributed to the increasing number of clinical trial registrations over the past few years. The COVID-19 pandemic has increased the number of clinical trials in the region, due to the urgency to identify and commercialize an effective cure and/or vaccine for the disease. Furthermore, supportive regulatory actions, such as shortening trial approval time, waiving the waiting period, release of industry guidance documents, and funding clinical trials undertaken by regulatory authorities, are anticipated to boost this segment in the pharmaceutical regulatory affairs market.

The preclinical segment is projected to witness considerable growth during the forecasted period. This can be attributed to the increasing demand for novel disease treatments, such as COVID-19, the Zika virus, & Ebola, and the increasing prevalence of existing diseases such as CVDs, cancer, & neurological diseases. The main goals of preclinical studies are to determine a molecule’s safety profile, bioanalysis, pharmacodynamics, and ADME & DMPK analysis.

Service Provider Insights

By service provider, the outsourcing segment dominated the market in 2022. This can be attributed to the increasing popularity of these services as outsourcing enables healthcare companies to reduce costs, prioritize strategic projects, reduce staff training time, and improve overall efficiency as well as provide greater flexibility.The availability of various outsourcing models suitable for different company sizes is also anticipated to boost the outsourcing market.

The in-house segment is projected to witness slow growth during the forecasted period. The slow growth is due to an increasing number of small- and medium-scale pharma/biotech/medical device companies, which lack funds and infrastructure to support an in-house regulatory affairs department. Furthermore, these firms find it difficult to hire experienced and technically sound full-time employees as they are emerging companies & have budget constraints. Hence, in-house regulatory affairs department is not preferred by small-scale companies, and they outsource nearly 90% of their regulatory solutions.

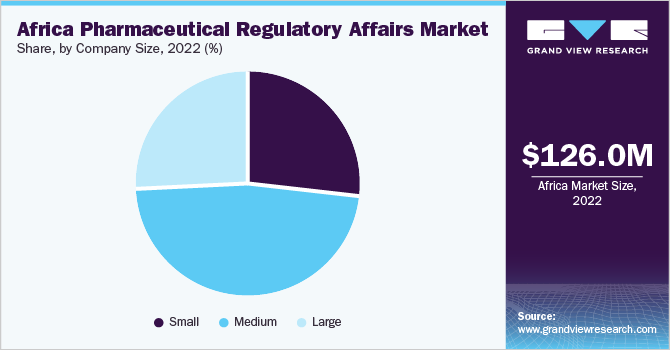

Company Size Insights

By company size, the medium segment dominated the market in 2022. These companies have a broader product portfolio and a wider geographic presence, allowing them to serve a larger customer base across different African countries. They can invest in R&D, clinical trials, and regulatory compliance, ensuring that their products meet the necessary standards and regulations. Moreover, medium-sized companies can establish strategic partnerships with local stakeholders, including regulatory authorities and healthcare providers, to streamline the regulatory process & enhance market access.

The large-size segment is projected to witness considerable growth during the forecasted period. Large companies have extensive resources, global presence, and expertise in navigating complex regulatory frameworks. These companies often have established relationships with regulatory authorities, enabling them to influence policy and shape regulatory standards. Large companies have the financial strength to invest in extensive clinical trials, advanced manufacturing facilities, and robust regulatory compliance systems. This allows them to bring innovative and high-quality pharmaceutical products to the African market while meeting stringent regulatory requirements.

Country Insights

By country, South Africa dominated the market with more than 42.24% from 2023 to 2030. The government of South Africa has shown a strong commitment to improving healthcare access and quality. Policies such as the National Health Insurance (NHI) aim to provide universal health coverage, leading to increased demand for pharmaceutical products and regulatory compliance services.With more people gaining access to healthcare services, there is a growing need for a wide range of medications to address various health conditions and diseases.

Uganda is projected to capture a considerable market share of about 8.82% of the Africa pharmaceutical regulatory affairs market in 2022. The promotion of generic medicines in Uganda's healthcare system has led to increased affordability and accessibility of essential drugs. Regulatory affairs professionals are active in evaluating and approving generic medicines, enabling faster market access. Generic medicines are cost-effective alternatives to brand-name drugs, as they are produced once the patent of the original drug has expired. This emphasis on generics aligns with the government's goal of providing cost-efficient healthcare options to its citizens, especially in low-income and underserved communities.

Key Companies & Market Share Insights

The market is fragmented owing tothe presence of diverse players and increasing competition among market players.As the demand for innovative and affordable medicines rises across the region, companies are seeking faster approvals and market access for their products. In January 2023, PharmaLex Holding GmbH was acquired by AmerisourceBergen Corporation. The acquisition aimed to enhance its specialty services and expand its global platform of pharmaceutical manufacturer services capabilities. PharmaLex's expertise in development consulting, regulatory affairs, pharmacovigilance, quality management & compliance services, and scientific affairs will further strengthen AmerisourceBergen’s position as a preferred partner for biopharmaceutical companies throughout the pharmaceutical development and commercialization process. Some of the prominent players in the Africa pharmaceutical regulatory affairs market include:

-

Freyr

-

IQVIA Inc

-

ICON plc

-

WuXi AppTec

-

Charles River Laboratories

-

Labcorp Drug Development

-

Parexel International Corporation

-

Pharmalex GmbH

-

Pharmexon

-

Genpact

Africa Pharmaceutical Regulatory Affairs Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 134.30 million

Revenue forecast for 2030

USD 213.06 million

Growth Rate

CAGR of 6.81% from 2023 to 2030

Base year for estimation

2022

Actual estimates/Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Services, category, indication, product stage, service provider, company size, country

Country Scope

South Africa; Botswana; Namibia;Algeria; Zimbabwe; Zambia; Tanzania; Rwanda; Ghana; Nigeria; Uganda; Mauritius; Kenya; Rest of Africa

Key companies profiled

Freyr; IQVIA Inc; ICON plc; WuXi AppTec; Charles River Laboratories; Labcorp Drug Development; Parexel International Corporation; Pharmalex GmbH; Pharmexon; Genpact

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Africa Pharmaceutical Regulatory Affairs Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the Africa pharmaceutical regulatory affairs market on the basis of services, category, indication, product stage, service provider, company size, and country:

-

Services Outlook (Revenue, USD Million, 2018 - 2030)

-

Regulatory Consulting

-

Legal Representation

-

Regulatory Writing & Publishing

-

Writing

-

Publishing

-

-

Product Registration & Clinical Trial Applications

-

Other Services

-

-

Category Outlook (Revenue, USD Million, 2018 - 2030)

-

Drugs

-

Innovator

-

Preclinical

-

Clinical

-

Pre-Market Approval (PMA)

-

Generics

-

Preclinical

-

Clinical

-

Pre-Market Approval (PMA)

-

Biologics

-

Biotech

-

Preclinical

-

Clinical

-

Pre-Market Approval (PMA)

-

ATMP

-

Preclinical

-

Clinical

-

Pre-Market Approval (PMA)

-

Biosimilars

-

Preclinical

-

Clinical

-

Pre-Market Approval (PMA)

-

-

Indication Outlook (Revenue, USD Million, 2018 - 2030)

-

Oncology

-

Neurology

-

Cardiology

-

Immunology

-

Others

-

-

Product Stage Outlook (Revenue, USD Million, 2018 - 2030)

-

Preclinical

-

Clinical studies

-

PMA

-

-

Service Provider Outlook (Revenue, USD Million, 2018 - 2030)

-

In-house

-

Outsourcing

-

-

Company Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Small

-

Medium

-

Large

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

Africa

-

South Africa

-

Botswana

-

Namibia

-

Zimbabwe

-

Algeria

-

Zambia

-

Tanzania

-

Rwanda

-

Ghana

-

Nigeria

-

Uganda

-

Mauritius

-

Kenya

-

Rest of Africa

-

-

Frequently Asked Questions About This Report

b. The Africa pharmaceutical regulatory affairs market size was estimated at USD 126.04 million in 2022 and is expected to reach USD 134.30 million in 2023

b. The Africa pharmaceutical regulatory affairs market is expected to grow at a compound annual growth rate of 6.81% from 2023 to 2030 to reach USD 213.06 million by 2030.

b. South Africa dominated the Africa pharmaceutical regulatory affairs market with a share of 42.24% in 2022. The government of South Africa has shown a strong commitment to improving healthcare access and quality. Policies such as the National Health Insurance (NHI) aim to provide universal health coverage, leading to increased demand for pharmaceutical products and regulatory compliance services.

b. Some key players operating in the Africa pharmaceutical regulatory affairs market include Freyr, IQVIA Inc, ICON plc, WuXi AppTec, Charles River Laboratories, Labcorp Drug Development, Parexel International Corporation, Pharmalex GmbH, Pharmexon, Genpact

b. Key factors that are driving the Africa pharmaceutical regulatory affairs market growth include the increasing prevalence of chronic diseases, a growing elderly population, rising healthcare expenditure, and the demand for innovative and cost-effective medicines across the continent.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."