- Home

- »

- Advanced Interior Materials

- »

-

Aerospace Parts Manufacturing Market Size Report, 2030GVR Report cover

![Aerospace Parts Manufacturing Market Size, Share & Trends Report]()

Aerospace Parts Manufacturing Market Size, Share & Trends Analysis Report By Product (Engines, Aircraft Manufacturing, Cabin Interiors, Equipment, System, & Support, Avionics), By Aircraft Type, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-2-68038-678-3

- Number of Pages: 109

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Advanced Materials

Report Overview

The global aerospace parts manufacturing market size was estimated at USD 899.48 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 4% from 2023 to 2030. The market is growing on account of growing passenger traffic, especially in Asia Pacific and the Middle East & Africa, is expected to drive the demand and production of aerospace parts, over the coming years. Moreover, the increasing demand for light weighted and fuel-efficient aircrafts to reduce greenhouse gas emission is positively influencing the demand for aerospace parts manufacturing in the market.

The expansion in air passenger and air freight volume across the globe against the backdrop of economic growth in emerging countries and considerable developments in commercial aerospace are predicted to be key market drivers. The increase in air travel and transport is presumed to drive the demand for manufacturing of aerospace parts that are used in aircraft. The growing demand for transportation is expected to stimulate the production of aircraft, which, in turn, is expected to result in the extension of contracts between aerospace parts suppliers and aircraft manufacturing companies.

Additionally, increased defense spending to reduce the operational costs and improve the efficiency of aircraft is anticipated to create opportunities for innovation, which, in turn, is expected to boost the technological advancements in manufacturing of aerospace parts market. Aircraft are durable assets and typically remain in-service for two or three decades. As the cost to retain and operate the aircraft exceeds the profits generated, they must be replaced. New-generation aircraft and aerospace parts provides improved range and payload capability, thus enabling better fuel efficiency, significant cost savings, and profit margins compared to older aircraft. The annual replacement rate in airline industry is approximately 3%. Fleet replacement provides a strong base for long-term demand for manufacturing of new aerospace parts since it is much needed for fleet expansion.

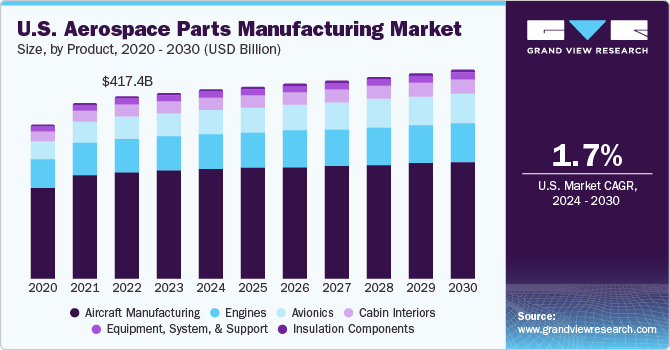

The U.S. aerospace parts manufacturing industry dominates the global market owing to the presence of established players such as Boeing, United Technologies, Lockheed Martin, etc. increased passenger transportation is expected to drive the manufacturing of aerospace parts in the US. The rising demand for aerospace parts sourced from the U.S. including wings, fasteners, fuselages on the account of assurance of airworthiness strong legacy and technological ability to produce high quality products which is expected to drive the demand for aerospace materials over the forecast period.

Product Insights

On the basis of product, the aircraft manufacturing accounted for the largest revenue share of 51.5% in the market in 2022. This segment comprises the manufacturing and assembly of a complete aircraft, including aero structure. Aero-structure mainly comprises fuselage, door pairings, wings, and airframe.

The segment also includes developing and making aircraft prototypes; aircraft conversion that includes significant modifications to the aircraft, and complete aircraft overhaul and rebuilding. Aircraft manufacturing consists of building and assembly of civil aircraft such as large commercial aircraft, business jets, and regional aircraft. The segment is led by Boeing, who also manufactures freighters for logistic air supply.

The equipment, safety and support segment is expected to be the fastest growing type segment at a CAGR of 5.9% over the forecast period. The equipment, system, and support segment comprise various parts including landing gear, opening and closing doors, air management system, actuation and control system, and others. The overall weight of an aircraft is a crucial factor in determining the efficiency and design of the equipment, system, and other support systems. The reduced weight has a significant impact on the overall performance of an aircraft.

The avionics segment is expected to expand at a significant CAGR in manufacturing of aerospace parts. Advanced avionics are generally used to incorporate screens allowing pictures of the flight routes as well as necessary flight instrument data. Avionics are designed to increase the safety and utility of an aircraft and aerospace parts. It encompasses electronic aircraft systems, such as fly-by-wire or fly-by-light flight controls, system monitoring, anti-collision system, and pilot interface systems including communication, flight management systems, navigation, and weather forecast. Avionics demand generally follows overall aerospace manufacturing sector and is expected to grow in line with increasing demand for aircrafts.

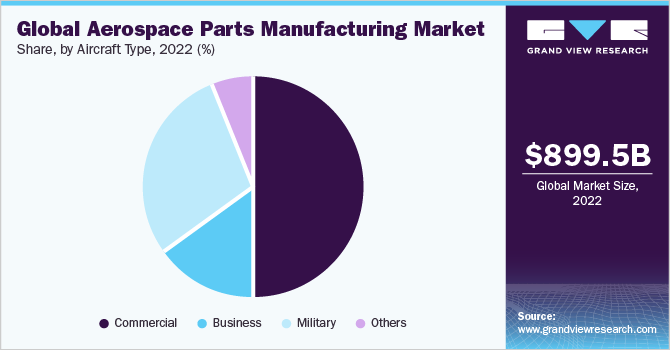

Aircraft Type Insights

Based on aircraft type, the commercial segment dominated the market with the highest revenue share of 51.5% in manufacturing of aerospace parts. The commercial aircraft segment is also expected to remain the fastest growing segment over the coming years. This is on account of rise in passenger and freight traffic around the world. With improved trade relations globally, there is an increase in the demand for cargo services, which is expected to drive the growth of the market for commercial aircrafts and its parts.

The commercial aircraft market is characterized by the presence of a limited number of manufacturing companies owing to the associated financial risks and technological requirements. Manufacturing engines for commercial aircraft entail the highest risk, thereby constricting the number of manufacturing companies competing in the market. Boeing and Airbus are the major commercial aircraft manufacturing companies, together accounts for majority of the overall revenue share.

The business and general aviation aircraft comprises light planes that are used for private leisure flying, personal transportation, corporate travel, and short-haul commercial transportation, such as air taxis and commuter airliners, with low takeoff weights. The growing demand for business aircraft can be attributed to its benefits such as increased mobility, enhanced productivity, and improved efficiency. Business aircraft is anticipated to boost productivity, as air travel requires less time compared to other modes of travel. This is expected to drive the demand for business aircraft along with demand for aerospace parts over the forecast period.

Military aircrafts are used to move troops and materials such as tanks, automotive vehicles, and helicopters. With modifications, they also serve as tankers for in-flight refueling. Military transporters have special features compared to commercial freight aircraft, which includes short-takeoff-and-landing capability, loading ramps, airdrop capability, and paratroop doors.

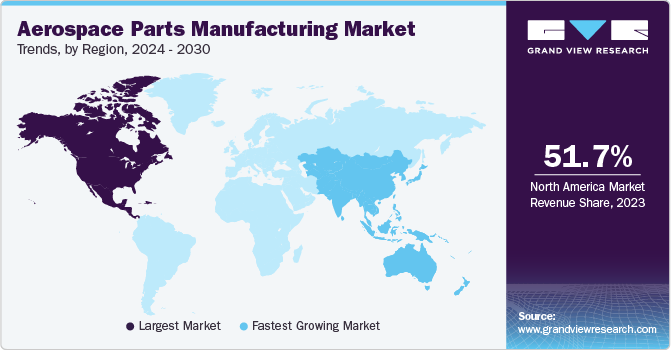

Regional Insights

The North America market for aerospace parts manufacturing dominated the regional market with the largest revenue share of 50.5% in 2022. North American economy is extremely favorable for the aircraft manufacturing owing to the increased number of aging fleets in the region. The replacement of the aging aircraft is contributed to the lower operating efficiency and revenue requirements for the operating airlines. Moreover, increase in per capita income is expected to boost the number of airway passengers, thereby boosting the demand for aircraft and its parts.

The Asia Pacific accounted for a significant share in 2022 and the market is projected to expand at a CAGR of 7.3% by 2030. This is due to growing development in the aviation industry in the region driven by the economic growth of Japan, China and other countries. There is a rise in the international air travel along with growing demand for international cargo which is expected to drive the demand for MRO activities, thereby boosting the demand for aerospace parts.

The Europe aerospace parts manufacturing market was valued at 273.95 billion in 2022. The growth of the European aerospace and defense industry is expected to surpass that of the industry in the U.S. over the forecast period, owing to a slight increase in defense spending by some European countries, such as Russia, Italy. The industry has experienced improved performance against the backdrop of economic slowdown and uncertainties in recent years. However, the European industry is highly concentrated in nature on account of the major players accounting for a significant revenue share.

Key Companies & Market Share Insights

The Global aerospace parts manufacturing market exhibits an increasingly competitive environment, owing to the rising demand from aircraft manufacturing industry. The aerospace parts market has observed a trend of major companies collaborating to start a joint venture for product development, due to the risks and increased costs associated with the development and manufacturing of new aerospace parts.

An increased competition among the aerospace parts manufacturing companies aiming to establish secure contracts with aircraft manufacturers is being observed in the market. The players in the aerospace parts manufacturing market compete on the basis of differentiation in technology, design, product performance, and conformity to the customer specifications. Additional factors, such as timely delivery of the product, market goodwill, superior customer service & support, and price also affect the competition. Some of the prominent players in the global aerospace parts manufacturing market include:

-

JAMCO Corporation

-

Intrex Aerospace

-

Rolls Royce plc

-

CAMAR Aircraft Parts Company

-

Safran Group

-

Woodward, Inc.

-

Engineered Propulsion System

-

Eaton Corporation plc

-

Aequs

-

Aero Engineering & Manufacturing Co.

-

GE Aviation

-

Lycoming Engines

-

Pratt & Whitney

-

Superior Air Parts Inc.

-

MTU Aero Engines AG

-

Honeywell International, Inc.

-

Collins Aerospace

-

Composite Technology Research Malaysia Sdn. Bhd.

-

Mitsubishi Heavy Industries Ltd.

-

Kawasaki Heavy Industries Ltd.

-

Subaru Corporation

-

IHI Corporation

-

Lufthansa Technik AG

-

Diel Aviation Holding GmbH

-

Elektro-Metall Export GmbH

-

Liebherr International AG

-

Hexcel Corporation

-

DuCommun Incorporated

-

Rockwell Collins

-

Spirit Aerosystems, Inc.

-

Panasonic Avionics Corporation

-

Zodiac Aerospace

-

Thales S.A.

-

Dassault Systems SE

-

Parker-Hannifin Corporation

-

Chemetall GmbH

-

Premium AEROTECH GmbH

-

Daher Group

-

FACC AG

-

Triumph Group

-

Curtiss-Wright Corporation

-

Stelia Aerospace

-

Magellan Aerospace

-

Bridgestone Corporation

Recent Developments

-

In July 2023, Jamco Corporation announced the co-development of Venture – its premium class seats with reverse herringbone configuration under its collaboration with KLM Royal Dutch Airlines (KLM). These seats are implemented in KLM’s B777 Fleet’s World Business Class (WBC) and are curated with comfort and sustainability in mind while limiting the airline’s operational costs.

-

In July 2023, Safran entered into a general term agreement with Air France Industries KLM Engineering & Maintenance (AFI KLM E&M) for the maintenance of Auxiliary Power Unit Generators. This 5-year agreement also includes Power By the Hour contract. As per these contracts, Safran Electrical & Power will mend the Auxiliary Power Unit Generators in its facility in Pitstone, UK.

-

In July 2023, Thales announced its plans to acquire Cobham Aerospace (AeroComms) to strengthen its avionics portfolio. It is anticipated that through the integration of AeroComms’ exceptional portfolio of safety cockpit communication systems, Thales will be positioned to seize the chance of the transition toward connected cockpits.

-

In July 2023, Collins Aerospace announced the commencement of operational service of its MS-110 Airborne Multispectral Reconnaissance System. The company also unveiled its plans to deliver over 16 sensors to international Fast-Jet operators.

-

In June 2023, Rolls-Royce announced the development of its new small gas turbine for powering hybrid-electric flight The turbogenerator system was aimed at complementing the company’s Electrical Propulsion portfolio with ascendable power offerings in the range of 500kW to 1200kW, thereby enabling an additional range on sustainable aviation fuels and later, via hydrogen combustion.

-

In June 2023, GE Aerospace signed a Memorandum of Understanding (MOU) with Hindustan Aeronautics Limited to manufacture jet engines for fighter planes in the Indian Air Force. This initiative is considered a key parameter in strengthening the defense cooperation between the U.S. and India.

-

In December 2022, Woodward, Inc., a world leader in aerospace energy control & conversion, announced its plans to collaborate with Airbus to deliver the groundbreaking Fuel Cell Balance of Plant (BoP) solution designed for the ZEROe demonstrator. This development aims to put to service a zero-emission aircraft by 2035.

-

In July 2022, Mitsubishi Heavy Industries, Ltd signed an MoU with Boeing to collaborate on achieving the climate solution breakthroughs, under their long-built partnership. This collaboration is focused on co-studying and enabling sustainable technologies – comprising electrification, hydrogen, sustainable materials, aircraft design concepts, zero climate impact propulsion technologies, and the commercialization of sustainable aviation fuels.

Aerospace Parts Manufacturing Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 931.49 billion

Revenue forecast in 2030

USD 1,233.24 billion

Growth rate

CAGR of 4.0% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, aircraft type, region

Regional scope

North America, Europe, Asia Pacific, Middle East & Africa, Central & South America

Country scope

U.S., Canada, Mexico, Germany, France, Italy, U.K., Netherlands, Poland, China, Japan, Australia, Indonesia, Malaysia, Philippines, Brazil

Key companies profiled

JAMCO Corporation, Intrex Aerospace, Rolls Royce plc, CAMAR Aircraft Parts Company, Safran Group, Woodward, Inc., Engineered Propulsion System, Eaton Corporation plc, Aequs, Aero Engineering & Manufacturing Co., GE Aviation, Lycoming Engines, Pratt & Whitney, Superior Air Parts Inc., MTU Aero Engines AG, Honeywell International, Inc., Collins Aerospace, Composite Technology Research Malaysia Sdn. Bhd., Mitsubishi Heavy Industries Ltd., Kawasaki Heavy Industries Ltd., Subaru Corporation, IHI Corporation, Lufthansa Technik AG, Diel Aviation Holding GmbH, Elektro-Metall Export GmbH, Liebherr International AG, Hexcel Corporation, DuCommun Incorporated, Rockwell Collins, Spirit Aerosystems, Inc., Panasonic Avionics Corporation, Zodiac Aerospace, Thales S.A., Dassault Systems SE, Parker-Hannifin Corporation, Chemetall GmbH, Premium AEROTECH GmbH, Daher Group, FACC AG, Triumph Group, Curtiss-Wright Corporation, Stelia Aerospace, Magellan Aerospace, Bridgestone Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Aerospace Parts Manufacturing Market Report Segmentation

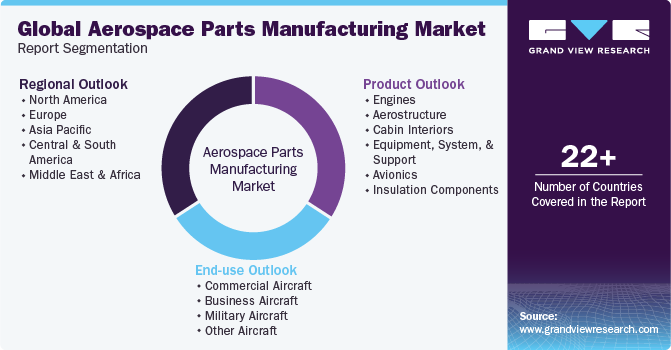

This report forecasts revenue growth at regional & country levels and provides an analysis of the industry trends in each of the segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global aerospace parts manufacturing market on the basis of product, aircraft type, and region:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Aircraft Manufacturing

-

Cabin Interiors

-

Equipment, Safety & Support

-

Avionics

-

Insulation Components

-

Engine

-

-

Aircraft Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Commercial

-

Business

-

Military

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Netherlands

-

-

Asia Pacific

-

China

-

Japan

-

Australia

-

Indonesia

-

Malaysia

-

Philippines

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. Some of the key players operating in the aerospace parts manufacturing market include JAMCO Corporation, Intrex Aerospace, Rolls Royce plc, Safran Group, Woodward, Hexcel, Eaton Corporation plc, GE Aviation, Textron Inc., Raytheon Technologies Corporation, MTU Aero Engines AG, Superior Aviation Beijing, Honeywell International Inc., Mitsubishi Heavy Industries, Ltd., Subaru Corporation, Spirit AeroSystems, Inc., Liebherr International AG, Diehl Aviation, Panasonic Avionics Corporation, Thales Group, Dassault Group, Parker Hannifin Corporation, Daher Group, Triumph Group, GKN Aerospace, Meggitt PLC, AVIC Aircraft Corporation Ltd., Senior plc, TransDigm Group Inc

b. The global aerospace parts manufacturing market size was estimated at USD 899.48 billion in 2022 and is expected to reach USD 931.49 billion in 2023.

b. The global aerospace parts manufacturing market is expected to grow at a compound annual growth rate a CAGR of 4.0% from 2023 to 2030 to reach USD 1,233.24 billion by 2030.

b. The U.S aerospace parts manufacturing market accounted for the largest revenue share in 2022 and this is due to the increasing air traffic and higher defense budgets in the country.

b. The expansion in air passenger and air freight volume across the globe against the backdrop of economic growth in emerging countries and considerable developments in commercial aviation is driving the market for aerospace parts manufacturing.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."

Important: Covid19 pandemic market impact

Suspension of manufacturing at plant locations coupled with supply chain disruption owing to raw material and component unavailability is expected to severely impact the market. Furthermore, the industry has pending aircraft deliveries which are expected to get released after the COVID impact blows over. We at GVR are trying to quantify the impact of this pandemic on the aerospace parts manufacturing market. Get your copy now to gain deeper insights on the same.