- Home

- »

- Medical Devices

- »

-

Active Pharmaceutical Ingredient CDMO Market Report 2030GVR Report cover

![Active Pharmaceutical Ingredient CDMO Market Size, Share & Trends Report]()

Active Pharmaceutical Ingredient CDMO Market Size, Share & Trends Analysis Report By Product (Highly Potent API, Antibody Drug Conjugate), By Synthesis, By Drug, By Application, By Workflow, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68038-282-2

- Number of Pages: 150

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Healthcare

Report Overview

The global active pharmaceutical ingredient CDMO market size was estimated at USD 92.1 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 6.9% from 2023 to 2030. The growth can be attributed to factors such as increased drug R&D, the rising incidence of chronic diseases, the expanding importance of generics, and the increasing consumption of biopharmaceuticals. Moreover, the rising adoption of development and manufacturing outsourcing services as an effective cost-containment mechanism is further fueling market growth.

COVID-19 significantly impacted the supply chain of active pharmaceutical ingredients (API), causing some level of disruption in raw material supply and availability, shipping delays, and costs. However, the demand for new treatment options and an increase in the approval rates of new drugs supported the market growth during the pandemic. The growing burden of chronic diseases such as cancer, heart disease, and others is improving the demand for new treatment options. This is expected to drive demand for new API in the coming years and hence support the market in the post-pandemic period.

Pharmaceutical companies have been increasing the amount of discovery, development, and manufacturing work they outsource over the last couple of decades. However, the urge to outsource is not uniform in the biopharma industry. Small biotechnology companies frequently rely on a Contract Development and Manufacturing Organization (CDMO) to produce their development products as they go through the pipeline.

CDMOs are proving to be extremely beneficial to the pharmaceutical and biotech industries since they provide prospective capabilities and cost savings over in-house manufacturing. There is a substantial link between corporate size and outsourcing in general. Small and medium-sized businesses (SMEs) have fewer stakeholders and organizational hurdles in the decision-making process, allowing for more fluid decision-making. As per IQVIA, the market for medicines would expand at 3-6% CAGR by 2025, reaching a total value of about USD 1.6 trillion, excluding spending on COVID-19 vaccines. This is expected to create opportunities for market growth in the coming years.

Product Insights

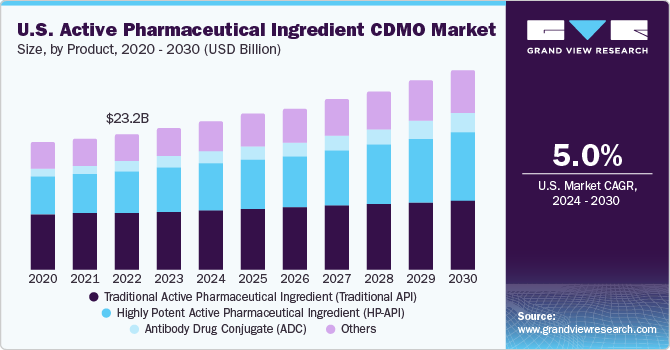

The traditional active pharmaceutical ingredient segment dominated the market and accounted for the largest revenue share of 39.8% in 2022. The market for traditional APIs is projected to expand at a promising CAGR of 4.1% during the forecast period, owing to rising pharmaceutical R&D, growing cases of chronic diseases, increasing adoption of generics, and rising uptake of biopharmaceuticals.

Furthermore, a rise in the adoption of high-tech therapeutics, the evolution of personalized medicines, and the emergence of innovative & novel delivery systems are factors likely to also boost market growth. The growing trend of outsourcing by large pharmaceutical firms will drive the demand for traditional API CDMO. Increasing investments in R&D pertaining to production processes for APIs is likely to propel segment advancement.

The antibody-drug conjugate segment is anticipated to register a lucrative growth rate of 13.9% over the forecast period. The efficacy of antibody-drug conjugates (ADC) and checkpoint inhibitors in the fight against cancer is having a significant impact on ADC R&D. Besides, new and intriguing use cases of antibody-drug conjugates are also being actively studied. The ADC biopharmaceuticals sector has experienced a significant increase in R&D into new uses of ADCs, both in terms of combination medications for cancer therapy and the application of the drug class to treat diseases other than cancer.

Synthesis Insights

The synthetic segment dominated the market for active pharmaceutical ingredients CDMO and held the largest revenue share of 73.1% in 2022. This is due to the increased availability of raw materials and the ease with which these molecules may be synthesized. Many synthetic molecules are also expected to go off-patent in the coming years, which is anticipated to boost growth.

The biotech segment is projected to register the fastest growth rate of 7.0% over the forecast period. Factors such as rising demand for biopharmaceuticals and higher molecular efficiency are propelling segment growth. Furthermore, large investments in the biotechnology and biopharmaceutical industries can be ascribed to segment advancement. Biotech active pharmaceutical ingredients cover a small portion of the active pharmaceutical ingredient market. However, given the explosive growth of the biopharmaceutical industry and the increasing use of biotech drugs, the biotech-active pharmaceutical ingredients space is expected to have a positive outlook.

Drug Insights

The innovative drugs segment dominated the active pharmaceutical ingredient CDMO market and accounted for the largest revenue share of 73.7% in 2022. Increased FDA approvals for new molecular entities, the high cost of innovative active pharmaceutical ingredients relative to generic pharmaceuticals, and the strengthening focus on R&D are all contributing to segment growth. Many unique molecules are present in the pipeline as a result of extensive research in this subject and are projected to be launched during the forecast period.

On the other hand, the generic drugs segment is anticipated to witness the fastest CAGR of 8.6% during the forecast period. This is largely due to the patent expiration of branded drugs and the cost-effectiveness of generics. The generic sector is expanding as a result of the growing number of patents that are scheduled to expire. According to the U.S. FDA, approximately 158 drug patents expired in 2021, presenting a large market opportunity for generic pharmaceuticals. Out of 156 patents, 44 would be readily available to generic manufacturers. All these factors are likely to propel segment growth.

Application Insights

The oncology segment dominated the market for active pharmaceutical ingredients CDMO and accounted for the largest revenue share of 35.5% in 2022. The market is growing due to the rising number of cancer cases globally. According to the WHO, cancer is a leading cause of mortality and accounted for 10 million deaths in 2021 across the globe. The rising demand for new cancer therapies is anticipated to increase as a result of the steady increase in cases. The growing presence of novel drugs in cancer is expected to create opportunities for the segment.

The glaucoma segment is expected to expand with a substantial CAGR of 7.3% across the forecast period. This is largely attributed to the rising prevalence of diabetes, the growing elderly population, and the increase in healthcare spending globally. According to the WHO, glaucoma is the world's second-largest cause of blindness. Thus, a rapidly growing need for lowering the disease burden of glaucoma is likely to support market growth of this segment in the near future.

Workflow Insights

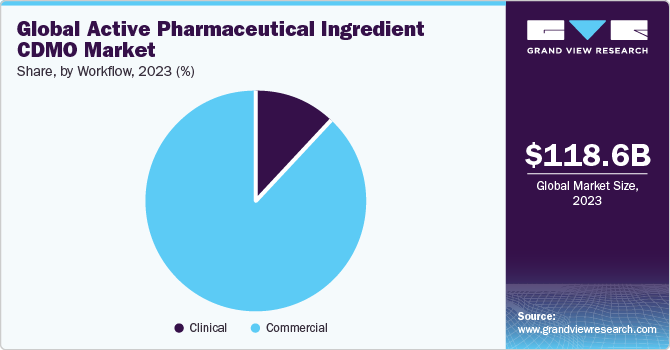

Based on workflow, the commercial segment dominated the market for active pharmaceutical ingredients CDMO with a revenue share of 87.9% in 2022. The segment growth is supported by the high disease burden globally, which promotes the demand for APIs. According to the CDC in 2021, 695,000 people died in the U.S. due to cardiovascular diseases. Thus, rising mortality rates are boosting CDMO operations for APIs worldwide. Global market players are expanding their presence to improve their API manufacturing capabilities. For instance, in June 2022, Merck opened an HP-API production facility in Wisconsin, U.S. to improve its manufacturing capability for producing cancer drugs.

The clinical segment is anticipated to witness the fastest CAGR of 7.3% in the market for active pharmaceutical ingredients CDMO during the forecast period. This is largely attributed to a record number of molecules being in the preclinical and clinical development pipelines of all sorts, as well as increased R&D spending. The growing demand for new treatment options worldwide is likely to improve the frequency of clinical research, hence promoting segment growth.

Regional Insights

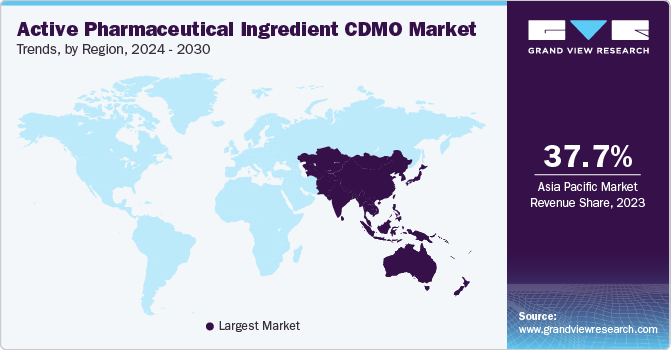

Asia Pacific dominated the active pharmaceutical ingredients CDMO market and accounted for a revenue share of 48.2% in 2022. Furthermore, the region is anticipated to register the fastest CAGR of 9.1% through the forecast period. Factors such as improved regulatory framework, high scope for cost savings, increased complexity, and robust drug pipelines are expected to drive the regional market. Furthermore, the availability of skilled workforce at a lower cost than in developed economies such as the U.S. is poised to propel the market. China holds the largest share in the Asia Pacific market, primarily due to the high pharmaceutical R&D investment.

Increasing regulatory focus on quality control for manufacturing is another key factor expected to drive the market over the forecast period. North America held a 23.2% share of the global market in 2022, aided by the presence of several established biotechnology and pharmaceutical companies. Furthermore, growing R&D investments by life sciences and pharmaceutical companies are anticipated to increase the demand for API contract manufacturing in the region. In addition, stringent regulations on manufacturing and quality of products are anticipated to create growth opportunities for domestic contract manufacturing services.

Key Companies & Market Share Insights

Market players are undertaking various strategic initiatives such as the launch of new product partnerships, collaborations, and mergers & acquisitions, with the aim to strengthen their service portfolio and provide a competitive advantage. For instance, in November 2022, Exelixis, Inc. signed a new license agreement with Catalent’s Redwood Bioscience. As per the agreement, Exelixis, Inc. paid USD 30 million to Catalent for developing 3 ADC programs for the former. Such initiatives are likely to support market growth. Some prominent players in the global Active Pharmaceutical Ingredient CDMO market are:

-

Cambrex Corporation

-

Recipharm AB

-

Thermo Fisher Scientific Inc. (Pantheon)

-

CordenPharma International

-

Samsung Biologics

-

Lonza

-

Catalent, Inc.

-

Siegfried Holding AG

-

Piramal Pharma Solutions

-

Boehringer Ingelheim International GmbH

Active Pharmaceutical Ingredient CDMO Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 98.1 billion

Revenue forecast in 2030

USD 156.3 billion

Growth rate

CAGR of 6.9% from 2023 to 2030

Base year for estimation

2022

Actual estimates/Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report Coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments Covered

Product, synthesis, drug, application, workflow, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Japan; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; Colombia; Chile; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Cambrex Corporation; Recipharm AB; Thermo Fisher Scientific Inc. (Pantheon); CordenPharma International; Samsung Biologics; Lonza; Catalent, Inc.; Siegfried Holding AG; Piramal Pharma Solutions; Boehringer Ingelheim International GmbH

15% free customization scope (equivalent to 5 analyst working days)

If you need specific market information, which is not currently within the scope of the report, we will provide it to you as a part of customization

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Active Pharmaceutical Ingredient CDMO Market Report Segmentation

This report forecasts revenue growth at the global, regional & country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global active pharmaceutical ingredient CDMO market report on the basis of product, synthesis, drug, application, workflow, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Traditional Active Pharmaceutical Ingredient (Traditional API)

-

Highly Potent Active Pharmaceutical Ingredient (HP-API)

-

Antibody Drug Conjugate (ADC)

-

Others

-

-

Synthesis Outlook (Revenue, USD Million, 2018 - 2030)

-

Synthetic

-

Biotech

-

-

Drug Outlook (Revenue, USD Million, 2018 - 2030)

-

Innovative

-

Generics

-

-

Workflow Outlook (Revenue, USD Million, 2018 - 2030)

-

Clinical

-

Commercial

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Oncology

-

Hormonal

-

Glaucoma

-

Cardiovascular

-

Diabetes

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

Colombia

-

Chile

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The synthetic segment dominated the API CDMO market and accounted for the largest revenue share of 73.1% in 2022.

b. The innovative drugs segment dominated the API CDMO market and accounted for the largest revenue share of 73.7% in 2022.

b. The oncology segment dominated the active pharmaceutical ingredient CDMO market and accounted for the largest revenue share of 35.5% in 2022.

b. Based on workflow, the commercial segment led the API CDMO market and accounted for the largest revenue share of 87.9% in 2022.

b. Asia Pacific dominated the API CDMO market and accounted for the largest revenue share of 48.2% in 2022.

b. The global active pharmaceutical ingredient CDMO market size was estimated at USD 92.1 billion in 2022 and is expected to reach USD 98.1 billion in 2023.

b. The global active pharmaceutical ingredient CDMO market is expected to grow at a compound annual growth rate of 6.9% from 2023 to 2030 to reach USD 156.3 billion by 2030.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."