- Home

- »

- Advanced Interior Materials

- »

-

Abrasives Market Size, Share & Growth Analysis Report, 2030GVR Report cover

![Abrasives Market Size, Share & Trends Report]()

Abrasives Market Size, Share & Trends Analysis Report By Product (Coated, Bonded), By Application (Automotive & Transportation, Heavy Machinery, Metal Fabrication), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-2-68038-099-6

- Number of Pages: 115

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Advanced Materials

Report Overview

The global abrasives market size was valued at USD 36.40 billion in 2022 and is expected to exhibit a compound annual growth rate (CAGR) of 4.7% from 2023 to 2030. Growth in the metal fabrication industry on account of the rising demand for pre-engineered buildings & components and developments in the manufacturing sector is one of the key driving factors of the market. The growth of the metal fabrication industry is also driven by the rising demand from various end-use industries including medical, agriculture, automotive, and aerospace. Moreover, the market is continuously evolving because of the changing technologies and lack of skilled labor. The U.S. holds key importance in the global market. Although, the country has not witnessed any major growth in the manufacturing sector due to changing economic priorities affecting tariffs and internal investments, but emphasis towards domestic production is expected to prove fruitful for market growth in the country over the coming years.

Growth in the electric vehicles (EVs) industry is expected to be another driving factor for market growth. For instance, the Fremont factory by Tesla, Inc. in California is the largest automobile factory in North America. In August 2021, Rivian Automotive announced its plan to invest USD 5.0 billion to construct a car manufacturing factory in Fort Worth, Texas. The demand for EVs is increasing in the U.S. and so are their charging stations. This in return is anticipated to benefit abrasives consumption over the coming years.

Moreover, growth in the manufacturing sector in developing economies of Asia are boosting the demand for super abrasives. For instance, in April 2020, the Government of India announced production-linked incentives for large-scale electronic goods makers for the next five years to attract investments in mobile phone manufacturing and electronic component units. Such initiatives are contributing to industrial growth in the country, thereby boosting the market growth.

However, the market growth is expected to be restrained on account of volatile raw material prices. Mass production of abrasives requires large amounts of raw materials such as aluminum oxide. However, prices of bauxite and other source minerals fluctuate significantly, owing to factors such as varying transport costs impacted by fuel prices, thereby affecting the production cost and pricing of abrasives.

Product Insights

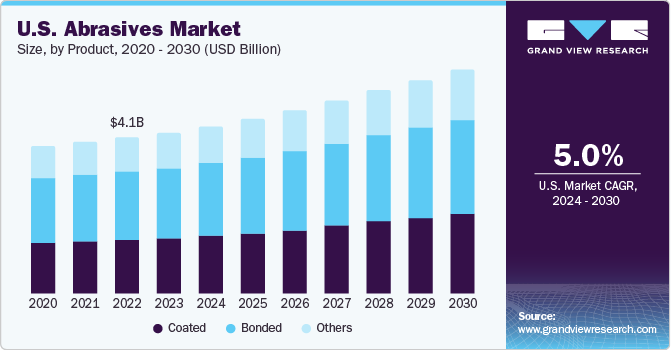

Based on product, bonded dominated the global market space in 2022 accounting for a revenue share of over 43.0%. Bonded abrasives include grinding wheels, snagging wheels, mounted wheels, and others, which are used for precision and rough grinding applications due to their high efficiency and enhanced operational capability.

Coated is expected to register the fastest growth rate over the forecast period. Coated abrasives include roll, sheet, disc, belt, and flap-wheel products. Rising demand for this product type has compelled companies to expand their production capacities. For example, in March 2020, Carborundum Universal Ltd. invested a sum of INR 48 crore (~USD 6.60 million) to double its installed capacity of coated abrasives for catering the growing demand for domestic and international markets.

The products in this segment find application in white goods, sanitaryware, furniture, automobile, fabrication, construction, and auto ancillaries. The developments in the stainless steel fabrication and wood working industries are expected to boost the growth of the product segment over the forecast period.

Application Insights

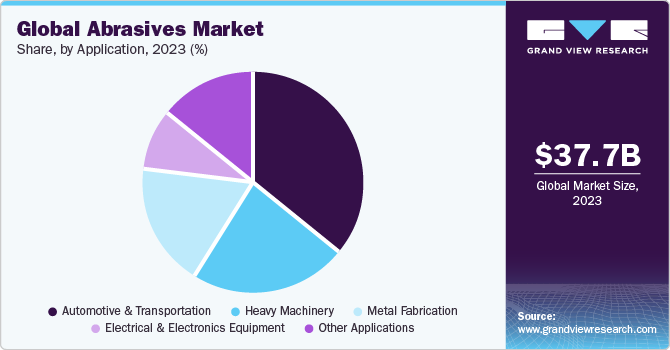

Based on application, automotive & transportation held largest revenue share of over 35.0% in 2022 of the global market. In automotive industry, abrasives are used for various applications such as coarse and lacquer sanding. Moreover, super abrasives, in the form of diamond discs, are preferred for grinding and polishing to enhance the surface finish of automotive components.

Heavy machinery is amongst the fastest growing application segments of the market. Abrasives find application in metal cutting applications, grinding & crushing of mining equipment, and others. Growth in the manufacturing sector of developing economies is expected to boost the demand for heavy machinery, thus, augment consumption of abrasives over the forecast period.

For instance, in June 2020, Mahanadi Coalfields Limited announced to invest ₹60,000 crore (~USD 9.35 billion) by 2025-26 for expanding its coal production capacity to 300 million tons. To increase capacity, the company would invest in purchasing heavy machinery as well. Such investments are anticipated to increase demand for heavy machinery and benefit market growth over the coming years.

Electrical & electronics equipment is another lucrative segment for abrasives, where these are used for slicing and grinding of electronic components and various hard materials such as glass, silicon, zirconia, and quartz to produce circuit components and compact discs. With ease in restrictions in the second half of 2020, nations are re-opening their electrical & electronics manufacturing sector. For instance, in May 2020, the electrical and electronics sector resumed its operations in Malaysia.

Regional Insights

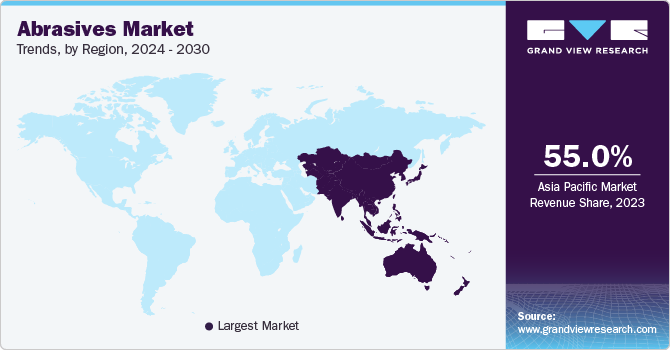

Asia Pacific dominated the global market space and accounted for a share of over 55.0% in 2022. Infrastructural developments, rising investments in manufacturing sector, and growth in EV production in developing economies of the region are expected to augment market growth across the forecast period.

Southeast Asian countries are potential markets for abrasives. For instance, as per the General Statistics Office of Vietnam, the industrial production (annual variation in %) of Vietnam increased to 15.5 in 2022 from 2.1 in 2021. Growth in the manufacturing and processing industries were the key drivers behind the boost of the industrial sector. Developments in the manufacturing sector of the country have augmented the need for machinery and hence, product demand.

North America is anticipated to witness steady growth over the coming years owing to the rising product demand from the automotive and aerospace & defense industries. Despite the decline in 2020, owing to the pandemic, rising emphasis on the production of EVs in the region, coupled with the resumption of aircraft manufacturing operations, is anticipated to prove beneficial for the market growth in the coming years.

The growth in the metal fabrication and machining industries in North America is also expected to provide lucrative growth opportunities to the manufacturers. For instance, in July 2020, Sargent Metal Fabricators Inc., announced its plan to expand operations in South Carolina, U.S. with an investment of USD 9.5 million. The expansion aims at catering to the growing customer demand. Such investments are expected to augment the product demand in the region over the forecast period.

Key Companies & Market Share Insights

The global market is highly competitive and fragmented owing to the presence of several small- and large-scale players. The companies witnessed revenue losses in 2020 owing to the suspension of automotive operations, which led to a declined demand for abrasives. Thus, companies are adopting several strategic initiatives to overcome their losses and gain a competitive edge.

For example, in September 2020, RPM International Inc. acquired Ali Industries, Inc. a leading manufacturer of sandpaper and other products, through its Rust-Oleum business. With this acquisition, RPM International aims at broadening its Consumer Group segment’s surface preparation capability through addition of abrasives to the company’s lineup of repair, cleaning, and patch products. Some prominent players in the global abrasives market include:

-

3M

-

Asahi Diamond Industrial Co., Ltd.

-

Bosch Limited

-

Deerfos

-

CUMI

-

Henkel AG & Co, KGaA

-

sia Abrasives Industries AG

-

Saint-Gobain

-

SAK ABRASIVES LIMITED

-

TYROLIT Group

Abrasives Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 37.71 billion

Revenue forecast in 2030

USD 52.59 billion

Growth rate

CAGR of 4.7% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative Units

Revenue in USD million, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South Africa; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Italy; Russia; China; India; Japan; Australia; Brazil

Key companies profiled

3M; Asahi Diamond Industrial Co., Ltd.; Bosch Limited; CUMI; Henkel AG & Co, KGaA; sia Abrasives Industries AG; Saint-Gobain; SAK ABRASIVES LIMITED; TYROLIT Group; Deerfos

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Abrasives Market Report Segmentation

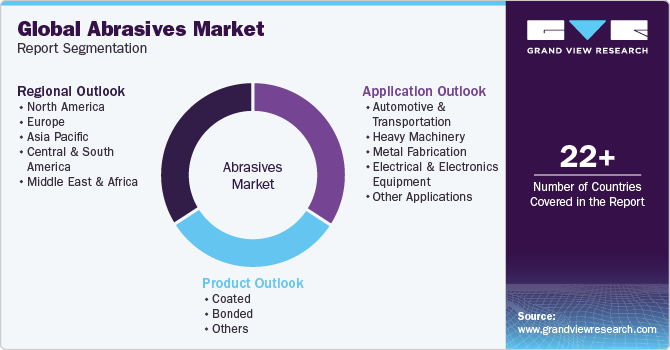

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis on the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global abrasives market report based on product, application, and region:

-

Product Outlook (Revenue, USD Million; 2018 - 2030)

-

Coated

-

Bonded

-

Others

-

-

Application Outlook (Revenue, USD Million; 2018 - 2030)

-

Automotive & Transportation

-

Heavy Machinery

-

Metal Fabrication

-

Electrical & Electronics Equipment

-

Others

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global abrasives market size was estimated at USD 36.40 billion in 2022 and is expected to reach USD 37.70 billion in 2023.

b. The global abrasives market is expected to grow at a compound annual growth rate of 4.7% from 2023 to 2030 to reach USD 52.59 billion by 2030.

b. The automotive & transportation segment dominated the market with a revenue share of over 35.6% in 2022. The segment is witnessing significant growth owing to increasing demand from end-use industries such as automotive and transportation.

b. Some of the key vendors of the global abrasives market are Saint-Gobain, 3M, Bosch Limited, sia Abrasives, SAK ABRASIVES, among others.

b. The key factor that is driving the growth of the global abrasives market is the increasing demand for metal fabrication on account of growth in the manufacturing sector is anticipated to augment market growth over the forecast period.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."